Option Strategies For Low Volatility Environments

Today, we’re going to look at which options strategies are best for low volatility environments.

Option investors take advantage of high implied volatility (IV) by selling options as in credit spreads and iron condors. But what are options for investors to do when IV is low?

Do the opposite. Buy options.

Buy long-dated options, LEAPS, straddles, strangles, calendars, and protective puts.

However, buying options has a couple of disadvantages.

We cannot just picking random calls and puts to buy.

We have to combine our long options in structures that will overcome those inherent disadvantages.

In addition, we have to look at other criteria and wait for conditions to line up.

Implied Volatility And Option Prices

When IV is low, the price of options is less expensive.

Therefore, it is a good time to buy options.

If we own puts and calls as IV increases, our options will increase in value.

Increasing IV will pump up the extrinsic value of the option.

Disadvantages Of Buying Single Options

However, long calls and long puts have two disadvantages:

- Time decay — the value of the option loses value with time. They have negative theta.

- Strong directionality — we need to get the direction correct in order to make money.

Poor Man’s Covered Call

To over-come theta decay, we buy long-dated options that are six months, nine months, or even a year out in time.

Options with expiry a year away or more are called LEAPS.

They have slower time decay than short-dated options.

To further reduce the time decay, sell short-dated options against the long-dated one.

The short option has positive theta to offset some of the negative theta of our long option.

They also have the effect of reducing the directionality of the long option.

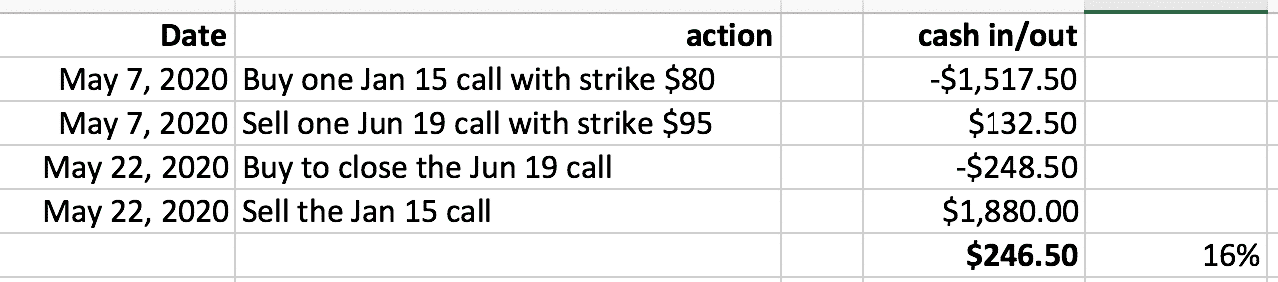

On May 7th, 2020, the VIX (S&P volatility index) and RVX (Russell volatility index) are both under their 50-day moving average and 20-day moving average.

General market volatility is low.

But we also have to check the IV of the underlying stock itself.

Nike (NKE) implied volatility is within the low end of its range.

Its stock price is above both its 20-day average and its 50-day average. RSI is above 50, but not overbought.

We will look at bullish, bearish, and neutral strategies.

Let’s start with a bullish strategy.

Because NKE is a bullish stock in a low IV environment.

An investor puts on a Poor Man’s Covered Call strategy by buying the 67-delta call that with expiry January 15, 2021 (253 days away).

The call is an in-the-money call and acts as a stock replacement.

NKE @ $88.56

Normally, the investor would sell multiple call cycles against the long LEAP call.

But the NKE long call went up so much so quickly, that the investor decides to take a 16% profit in less than a month, and then repeat the strategy in another underlying.

Poor Man’s Covered Put

If we have a bearish assumption on the underlying, we can do the same with long puts, known as Poor Man’s Covered Put.

Here we are buying nine months’ worth of put options at low IV prices, and then selling it back a month at a time.

If IV goes up during that time, it means we are buying low vol and selling high vol.

In addition, if the underlying goes down in price, the put would increase in value.

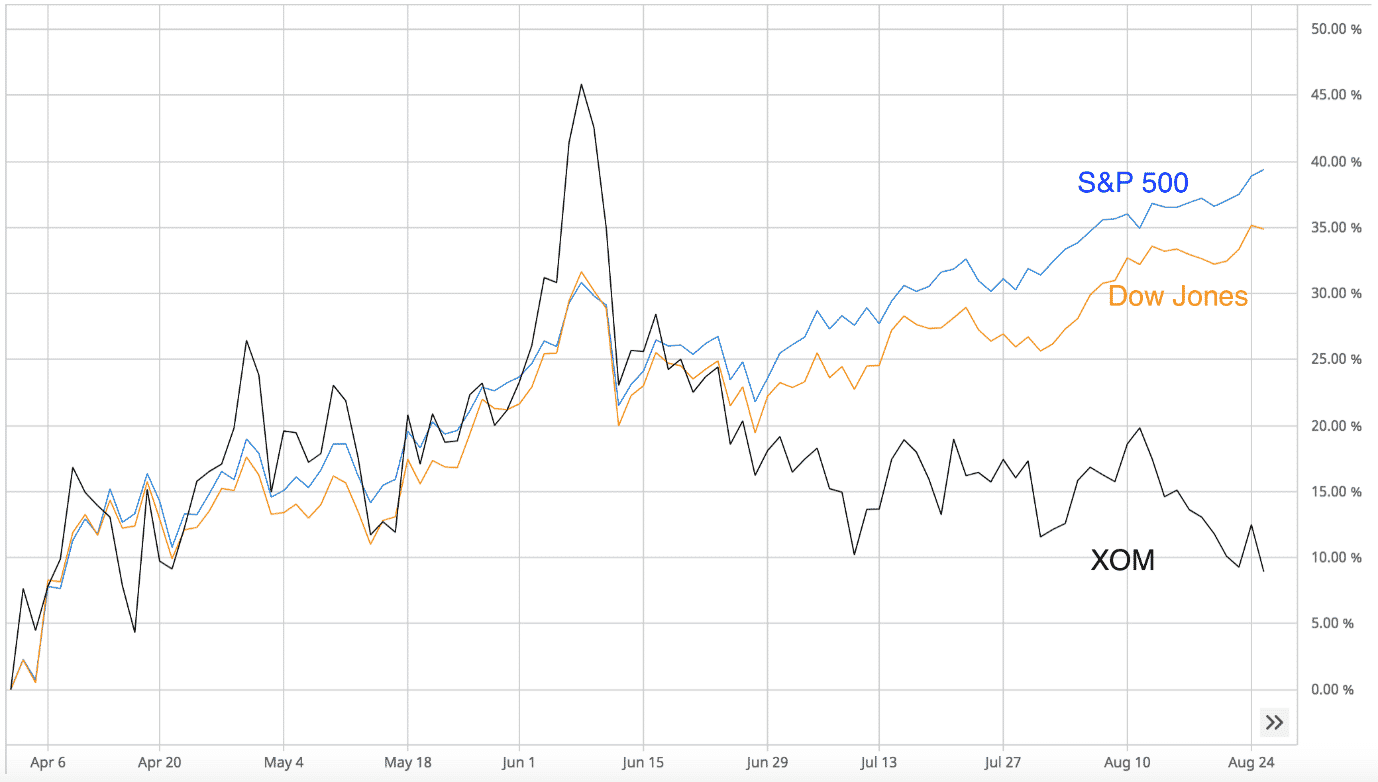

Exxon Mobile (XOM) has been underperforming the S&P 500 and the Dow Jones Index (of which it is a part) for months.

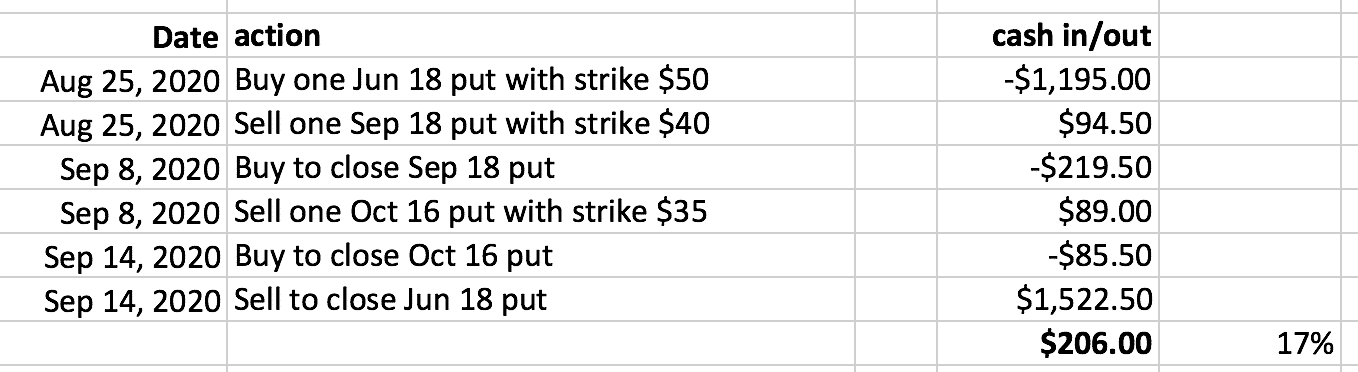

On Aug 25, 2020, VIX is in the low 20’s.

While some may say that this is not that low, it is low for that year comparing to VIX being in the ’80s during March of that year.

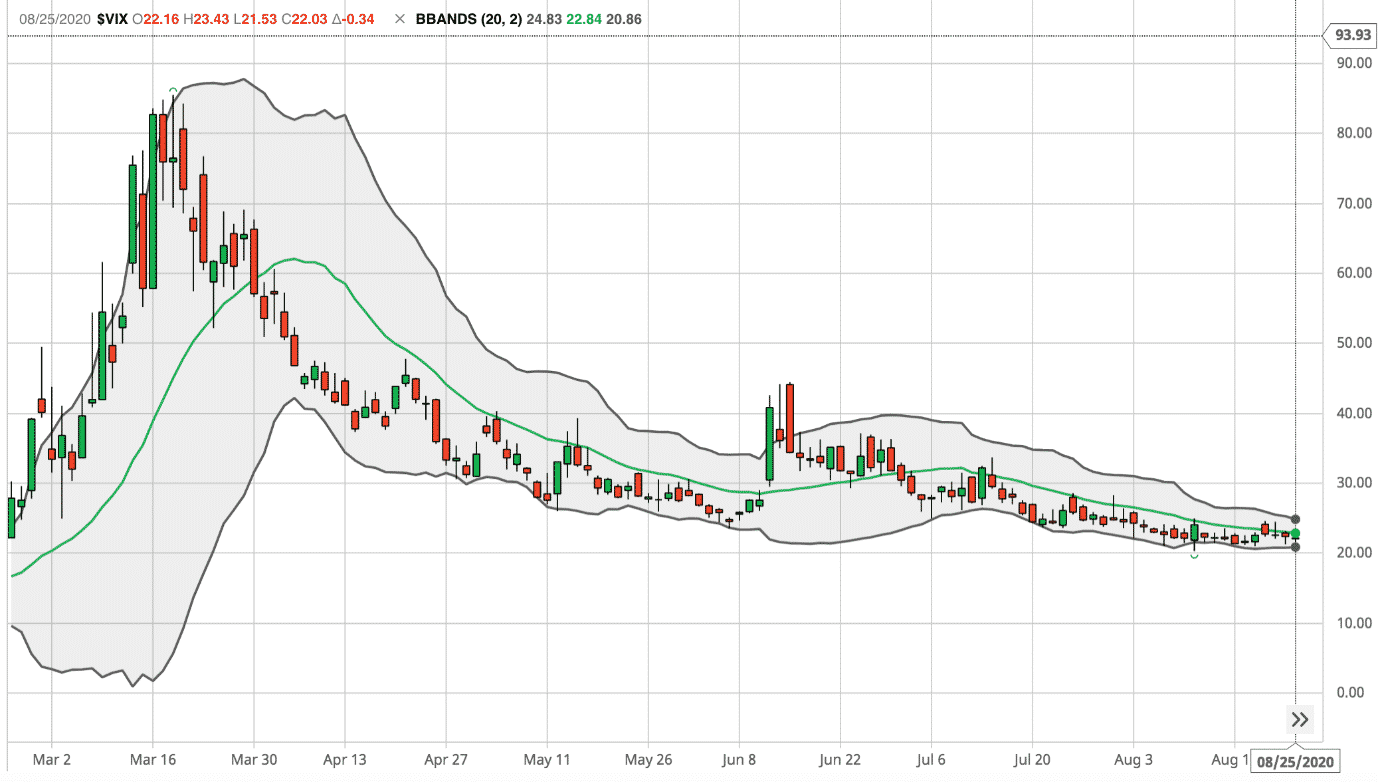

After checking XOM’s IV to be on the low end, an investor puts on a Poor Man’s Cover Put by buying a XOM long put that is 297 days away from expiry.

XOM @ $40.88

The investor closes the trade on Sept 14 for a profit of 17% after two monthly sell cycles.

The trade ended with VIX slightly higher at 26.4.

But more importantly, XOM went down in price during that timeframe.

Buying Straddle

On Aug 25, 2020, the Bollinger Bands on VIX are getting very narrow while the VIX is at 22 which close to the lowest level for the past six months.

If the Bollinger Band expands and VIX increases on the upside, long calls, and long puts will profit.

Looking for stocks with a high beta that have a tendency to move more than the market, we find AMD has a 60-month beta of above 2.

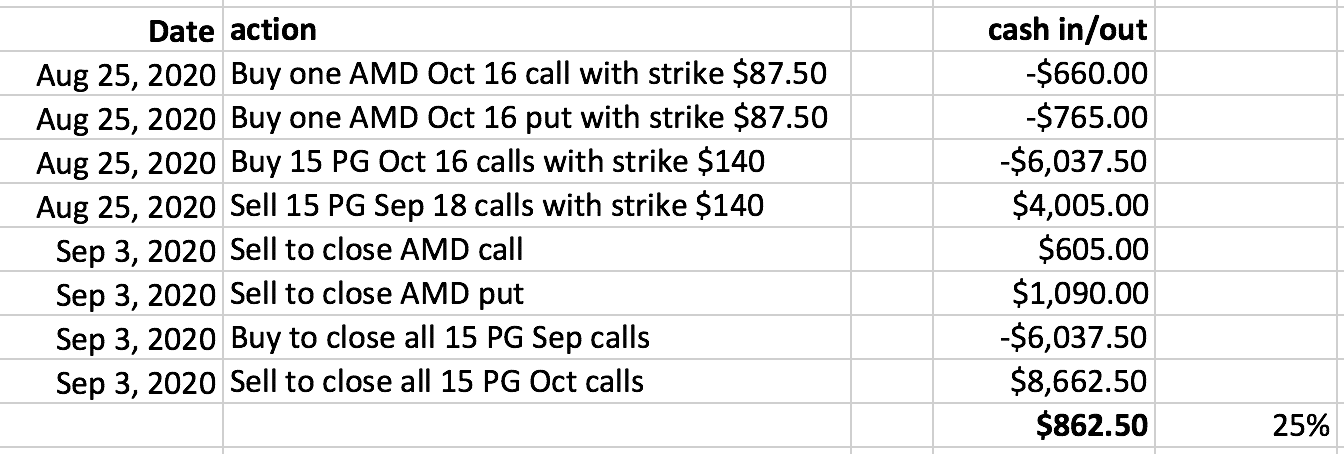

After checking the IV of AMD to make sure it is relatively low, the investor buys an AMD straddle with 52 days till expiration.

Never buy a straddle or a strangle when the IV of the underlying is high (like right before an earnings announcement).

Any drop in IV would hurt the profitability of the straddle/strangle — twice as much as a single long option.

This particular straddle position has a theta decay of -13.37.

The investor buys 15 calendars on a low-beta stock like PG with beta of 0.38.

The 15 calendars have positive theta of 13.80, enough to offset the theta decay of the straddle.

With a total net debit of $3457.50, that’s a lot of buying.

Good thing they are being purchased during moderate to low IV.

AMD @ $86.35 and PG @ $139.06

The investor monitors the VIX, the calendar, the straddle, and their respective IV and P&L on a daily basis.

If the price of the calendar moves out of its range, the investor needs to delta hedge or add additional calendars.

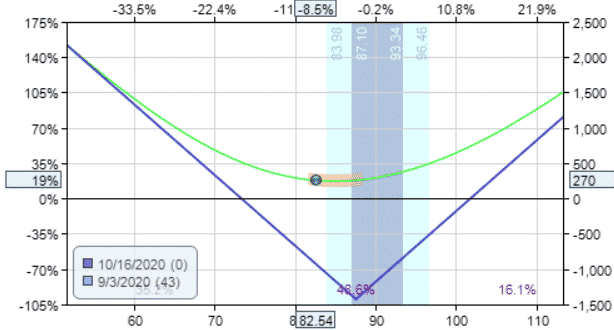

Fortunately, that action was not needed because VIX spiked up to 33.6 on Sept 3 and its RSI reached above 70.

Because both the straddle and the calendar are positive vega, the rise in IV increased the value of both.

Selling the calendar gave $592.50 in profits.

And selling the straddle gave $270 profit.

In total that was a 25% return on initial debit.

Note how the T+0 line of the straddle jumped up from the horizontal zero profit line on IV spikes.

Since the entire T+0 line is above zero, the price did not have to make such a big move to be profitable.

Buying Strangles

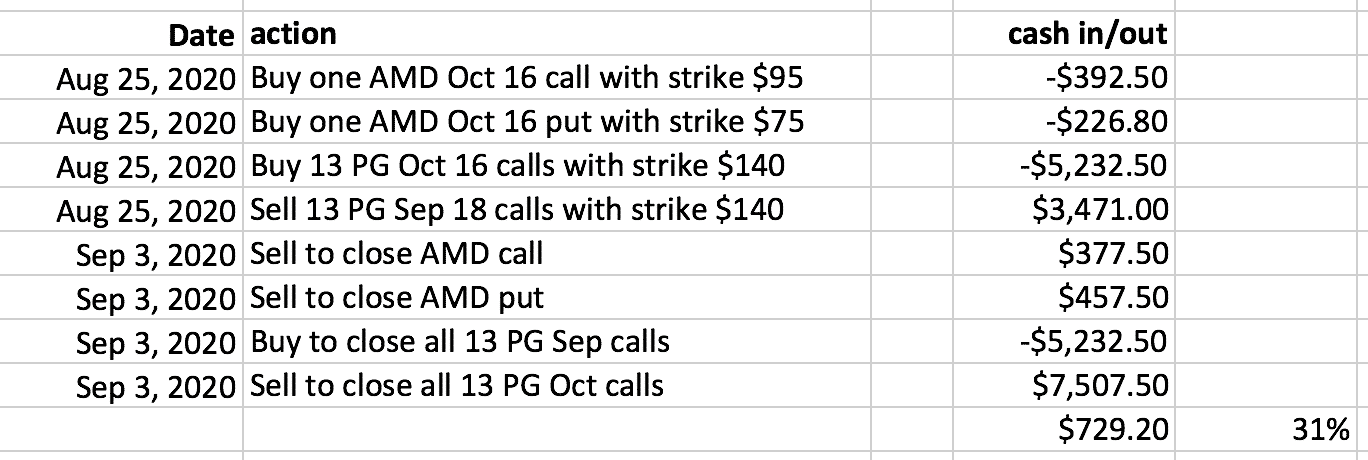

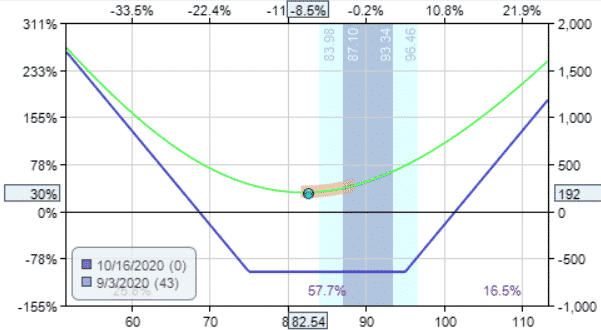

To slow down time decay, a strangle can be purchased instead of the straddle.

The strangle with a theta of -11.81 experiences less time decay.

Hence, we only need to buy 13 calendars instead of 15.

This reduces the initial debit to $2380.80.

AMD @ $86.35 and PG @ $139.06

Watch for any volatility spikes that causes the T+0 line to jump off the zero horizontal profit line like on September 3rd.

And then take the profit.

Buying a Protective Put

Suppose that an investor already owns 100 shares of Facebook (FB) which happens to have earnings on July 30, 2020.

Stocks like these can move 8% in either direction on earnings.

To protect against this possible loss, the investor watches the price of at-the-money put options the whole month of July.

The investor finds a price drop on July 21 that is acceptable — knowing that waiting any longer may find that the IV of options start to increase as earnings approaches.

On July 21, FB's price is $241.75 and it costs $917.50 to buy a $240 strike put expiring the day after earnings on July 31.

The investor buys the protection, knowing that the max loss would be $1,092.50, or 4.5% of the FB stock position — which is within the investor’s risk tolerance.

On July 31, FB gapped up on the open and closed at $253.67, producing an 8% move from the previous day’s close.

This move more than paid for the protective put.

The protective put was never needed and expired worthless.

The protective put acts as insurance that you hope you don’t need to use.

Buying Put Collars

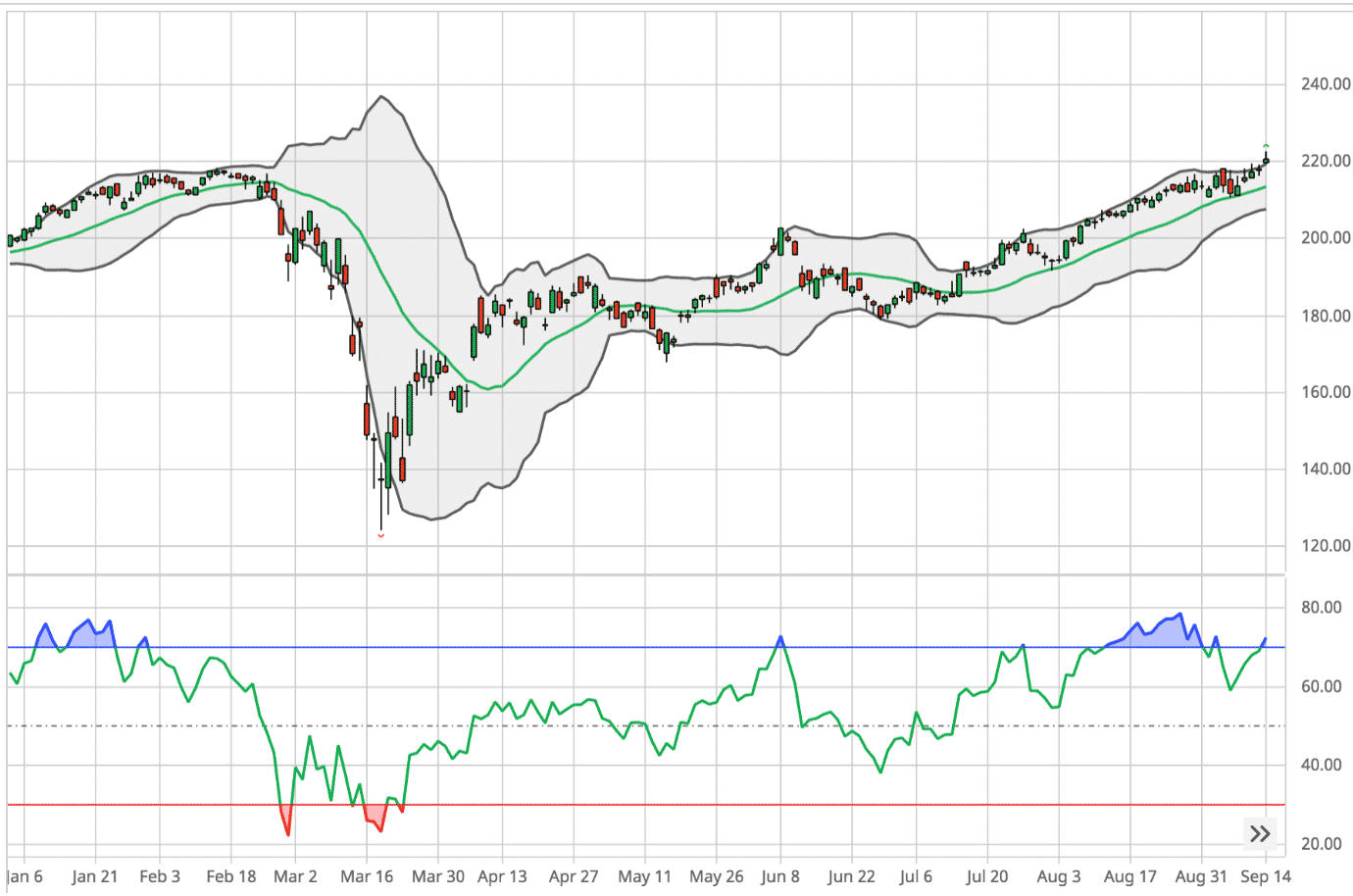

On September 14, 2020, McDonald’s (MCD) has recovered all its loss from the March sell-off and is now at its 52-week high closing above its upper Bollinger Band.

RSI is over-bought at 70.

While VIX is not at its lowest, it has just come back down to its 20-day moving average after a temporary spike.

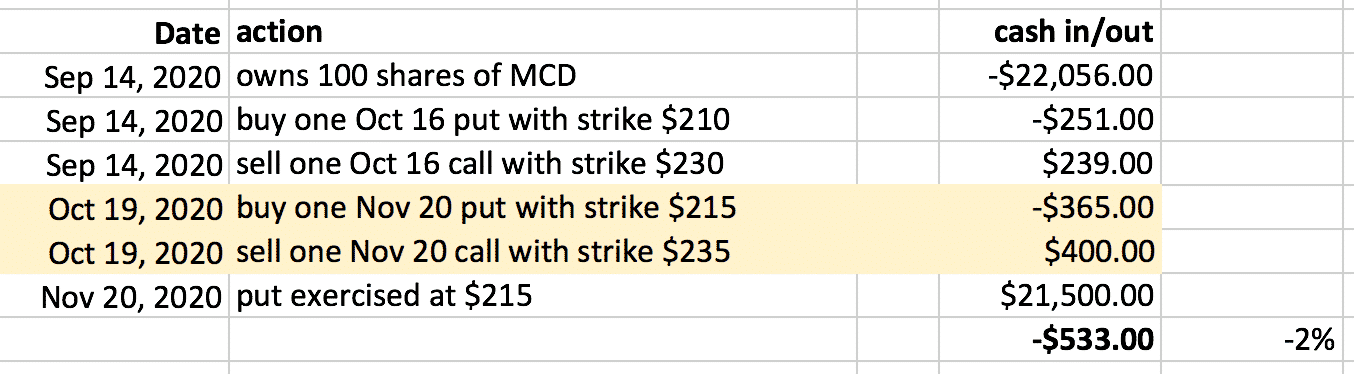

Knowing that buying put insurance will cost money, a long-term stock investor who has 100 shares of MCD, puts on a collar to protect gains so that he or she can sleep better at night.

The investor purchases a put 10 points below the current price of $220.56 and sells a call 10 points above to help finance the cost.

The put with a strike at $210 will kick in its protection after MCD drops 4.8%.

We can lose at most $1056 on the MCD position.

Depending on how much protection the investor would like, this strike can be set anywhere from 5% to 20%.

The cost of this insurance is about 1% of the MCD stock position value.

However, the sale of the covered call nearly pays for all of this cost.

On Oct 16, 2020, both the call and the put expired worthless.

MCD had gone up in price; there was no market sell-off.

The put insurance was not needed.

On Oct 19 (the next trading day), the investor repeats the purchase of a new collar with a price of MCD at $226. (See above table with a yellow highlight.)

The collar expires on November 20 at which time MCD closed at $214.09 (below the put strike of the collar).

The put was automatically exercised, selling the 100 shares of MCD back to the market at $215.

The investor lost $533, or 2% on the MCD position.

Without the purchase of the collars, the investor would have lost $647, or about 3%.

Loss without collar: ($214.09 – $220.56) x 100 = –$647

Conclusion

In order to explain the concepts, we have shown examples of how the trade should have worked.

What we did not show are trades that did not work (even if all the variables lined up properly).

While we saw winning trades that make 15% in a month’s time, we cannot extrapolate that to annual returns, because we cannot get this performance consistently every month.

And because we did not account for the draw-downs on the losing trades.

We also did not account for the cost of buying protective puts.

Nevertheless, it is possible to still make money in a low VIX environment — as longs as we keep our eyes on multiple factors and make sure that our winning trades outpace our losing trades.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more