Nvidia Stock Is Slowly Moving Higher - Short Put Plays Could Work Here

/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)

BING-JHEN_HONG via iStock

Nvidia, Inc. (NVDA) stock is moving higher from a trading plateau, as analysts have raised their price targets. This might be a good time for existing investors to sell short out-of-the-money put options. This sets a lower buy-in and makes extra income.

NVDA is at $183.37 in midday trading on Monday, Sept. 22. That is still below where NVDA stood when I last wrote about Nvidia over three weeks ago on Aug. 29 (i.e., $180.17).

(Click on image to enlarge)

In that article ("Nvidia's Free Cash Flow Falters From Higher Capex - Is NVDA Stock Fully Valued?), I suggested that NVDA was worth just $207 per share. It could be worth more now.

New Price Targets

That was based on analysts' revenue estimate, an estimated 43% free cash flow (FCF) margin, as well as a 2.0% FCF yield metric.

Since then, however, analysts have raised their revenue estimates. As a result, its price target could be higher.

For example, analysts now see revenue for this year (ending Jan. 31) rising to $206.45 billion, up from $204.33 billion in my Aug. 29 article. That is a 1% gain in just 3 weeks. In addition, FY 2026 estimates are now $273.81 billion, up from $266.33 billion (up +1.66%).

That implies, using a 43% FCF margin estimate, that FCF could rise to between $88.77 billion and $117.74 billion next year, or just over $100 billion ($103.3 billion).

That's potentially +43.4% higher than the $72.023 billion in FCF over the last 12 months, according to Stock Analysis.

And using a 2% FCF yield metric, that implies its market cap could rise to $5,165 billion (i.e., $103.3/0.02). Today's Nvidia's market value is $4.455 trillion, according to Yahoo! Finance:

$5,165 billion/$4,455 / $4,455 billion = 1.159 - 1 = +16% upside

In other words, NVDA stock is potentially worth $212.40 target price per share (i.e., $183.10 x 1.16). That is 2.6% higher than my prior target price of $207.

Analysts have also raised their targets. Yahoo! Finance says 63 analysts have an average price of $211.93, up from $201.98 in my last article three weeks ago.

The bottom line is that NVDA stock is worth much more than its present price. NVDA is slowly rising as analysts continue to raise their revenue and FCF estimates.

One way to play this, especially for existing investors, is to sell short out-of-the-money (OTM) puts.

Shorting OTM NVDA Puts

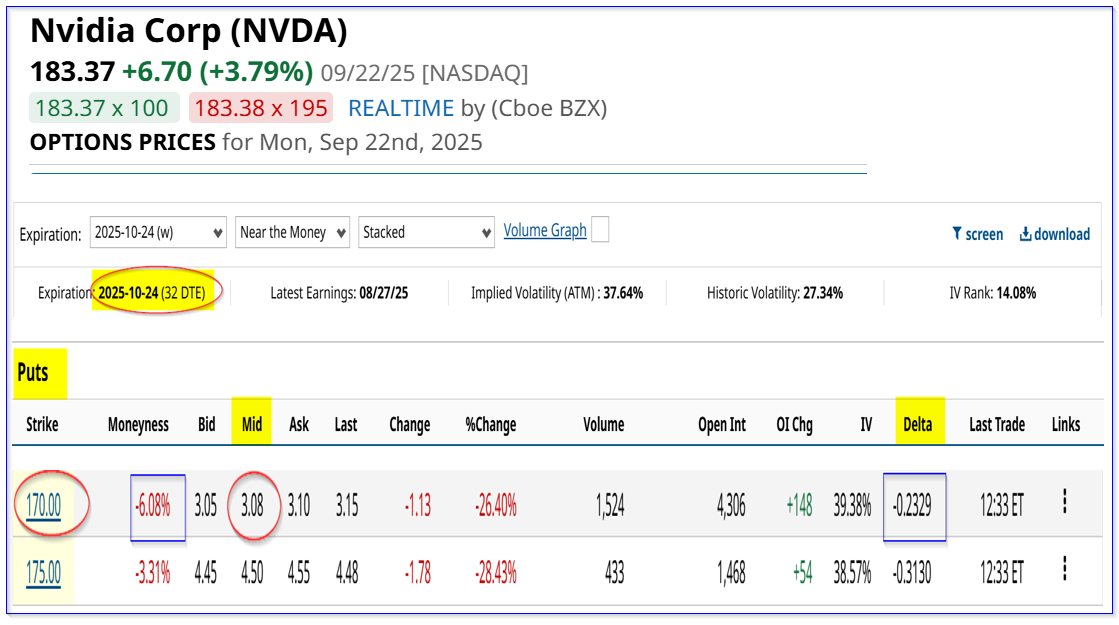

For example, NVDA put options expiring on Oct. 24, 2025, 32 days from now, have attractive yields.

The $170.00 strike price put contract trades for $3.08 at the midpoint. This strike price is over 7.2% below today's price. However, it also provides a short-seller an immediate yield of almost 2.0% (i.e., $3.08/$170.00 = 0.01811 = 1.811%).

(Click on image to enlarge)

The point is that $170 provides a potential buy-in point for the investor if NVDA falls to that point on or before Oct. 24. The breakeven point, after deducting the income already received, is $308 on an investment of $17,000:

$17,000-$308 = $16,692 for 100 shares, i.e., $166.92 per share breakeven

That is 8.9% below today's price of $183.37.

Moreover, if the investor can keep making 1.811% every month for the next 3 months, the expected return (ER) is 5.433%. That is the same as holding NVDA stock now and seeing it rise to $193.33 over the next 3 months.

Moreover, the potential upside, even if NVDA falls to $170.00 and the investor's account is assigned to buy 100 shares at $170, is substantial:

$212.40 target price / $166.92 = 1.273 -1 = +27.3% upside

However, the downside of this play is that the investor could end up with an unrealized loss. That occurs if NVDA falls below the breakeven point and stays there.

But, even in that case, the worst that happens is that the investor owns more shares. They can then sell out-of-the-money (OTM) calls to mitigate that unrealized loss. They can also continue to short OTM puts to reduce the loss.

The point is that NVDA is undervalued, and shorting OTM puts is a good potential play here.

More By This Author:

Analysts Push Cisco's Target Price Higher - Shorting CSCO Puts Works HereMeta Platforms Stock Options - A Follow-Up On Three Ways To Play META

Heavy Out-Of-The-Money Put Options Activity In Amazon - Setting A Lower AMZN Buy-In Point