Netflix Is Below 1-Year Lows With Heavy Call And Put Option Activity - Bullish Signals For NFLX

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

by freestocks via Unsplash

Netflix Inc. (NFLX) stock is trading below its one-year low prices, along with heavy out-of-the-money call and put option activity. This is a major bullish signal, especially given Netflix's strong free cash flow results released yesterday.

NFLX is at $83.29 in midday trading on Wednesday, January 21, 2026, down over 4.6%. This price is well below its one-year low prices of $85.59 on April 4, 2025, and $86.67 on March 10, 2025.

(Click on image to enlarge)

NFLX stock - over the last year - Barchart

The New Warner Bros. Deal

Netflix also announced yesterday that it changed the terms of its bid for Warner Bros. Discovery (WBD) to an all-cash bid of $27.75 per share. The announcement did not specify the cost to Netflix. But, based on its enterprise value, it would value Warner Bros. at $82.7 billion.

This offer includes an increased debt component of $42.2 billion, according to a Variety report, up from $34.0 billion as of December 19, 2025 (although down from $59 billion in the original deal).

Nevertheless, this is still lower than the $30.00 per share all-cash offer from Paramount Skydance. The company said that its bid valued Warner Bros. at $108 billion, according to Forbes.

Their deal would not include a spin-off of Discovery Global, as the Netflix deal entails. This division includes cable TV networks like CNN, TNT, TBS, HGTV, TNT Sports, and Discovery+, according to Variety.

WBD is trading higher at $28.55, implying that some investors may be expecting a higher offer for the company from Netflix. WBD shareholders are now set to vote on the deal by April in a special shareholder meeting.

Paramount may decide to challenge that meeting as it is planning a proxy fight for WBD's board. Therefore, the fight goes on between these two bidders. That uncertainty may be causing the huge volatility in NFLX stock.

Strong Results from Netflix

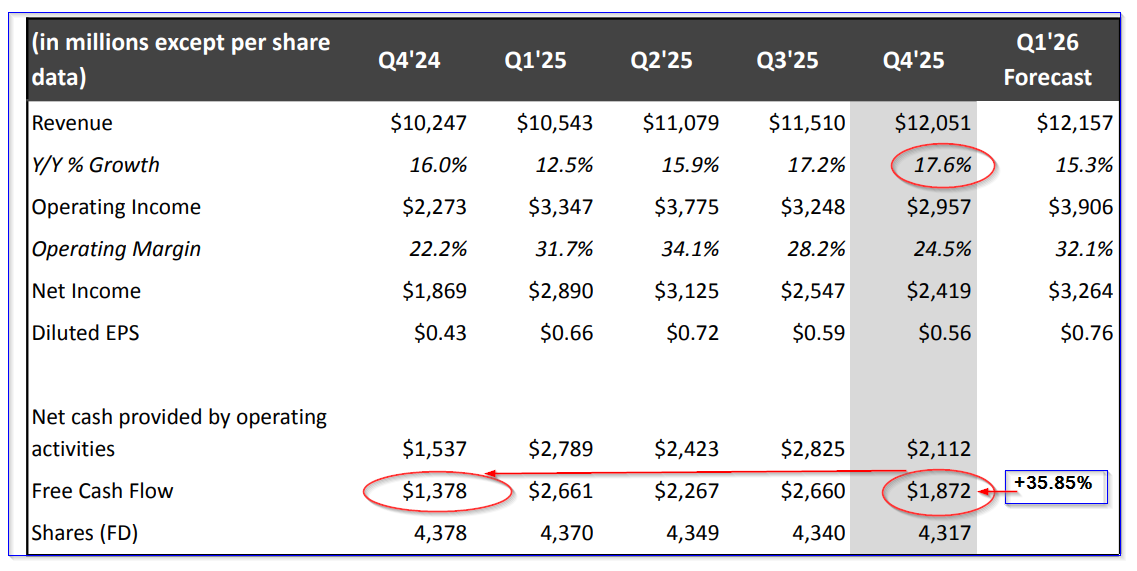

Nevertheless, Netflix reported strong Q4 results yesterday. For example, revenue rose 17.5% in Q4 over last year, and free cash flow (FCF) was up +35.9%.

This can be seen in the company's summary table on the first page of its shareholder letter.

(Click on image to enlarge)

Netflix Q4 results - Shareholder Letter Jan. 20, 2026

In addition, the trailing 12-month (TTM) FCF results were higher. Stock Analysis reports that its TTM FCF was $9.461 billion, up 36.7% from a year earlier. That was also up +5.5% from the prior quarter's TTM FCF of $8.967 billion.

Moreover, the Stock Analysis site shows that the TTM FCF margin rose to 20.94% of revenue, up from 17.75% of revenue a year earlier, and even up from the prior quarter's 20.57% FCF margin.

The point is that the company is continuing its strong performance. In addition, Netflix reported over $9 billion in cash on its balance, along with a slightly lower $13.5 billion in long-term debt.

The point is that the company should be able to afford the new $42.2 billion in debt from the proposed WBD acquisition. However, that is still making investors nervous.

That explains why NFLX has fallen so far.

Unusual Stock Options Activity Shows Bullish Sentiment

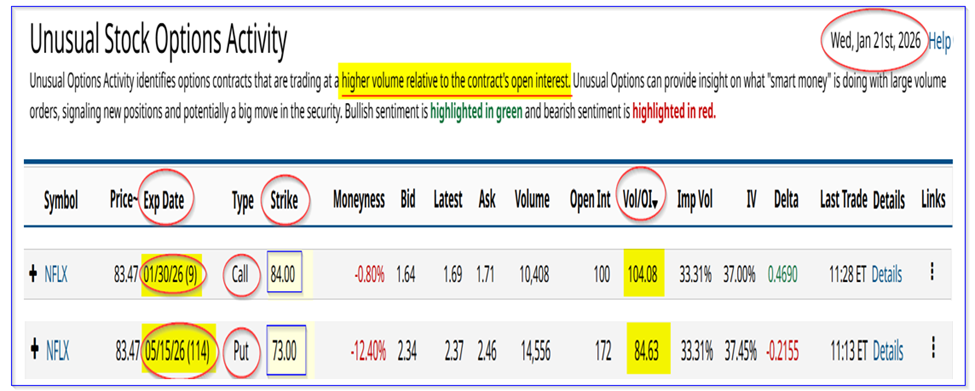

Nevertheless, this provides some opportunities for some investors. This can be seen in Barchart's Unusual Stock Options Activity Report today.

(Click on image to enlarge)

NFLX calls and puts - Barchart Unusual Stock Options Activity Report - Jan. 21, 2026

It shows that some large call options activity at the $84.00 strike price expiring Jan. 30, 2026. It shows that over 10,400 call options have traded, or over 104 times the prior number of calls outstanding at the strike price and expiry period.

That implies that a large number of buyers, willing to pay $1.69 at the midpoint, believe that NFLX could rise over $85.69 by the end of the month.

Moreover, sellers of the calls are willing to sell shares at $84.00, making a yield of over 2.0% (i.e., $1.69/$83.47 spot price), plus a potential total return of +2.659% (i.e., $85.69/$83.47-1).

Also, short-sellers of the May 15, 2026, put options at the $73.00 strike price, which is over 12.5% lower than today's price, are able to receive $2.37, or a yield 3.25% over the next 3.8 months (114 days).

That also means that they would be happy to buy NFLX stock at a net breakeven price of $69.63 (i.e., $72-$2.37), or -16.6% below today's price. That is another bullish signal at today's depressed NFLX stock price.

The bottom line is that this heavy out-of-the-money put and call option activity implies that some investors are now willing to invest in today's depressed NFLX stock price.

More By This Author:

Is Amazon Too Cheap Ahead Of Earnings? Put Yields Are High, Implying AMZN Stock Could RallyIf Occidental Petroleum Hikes Its Dividend As Expected, OXY Stock Could Rally

ConocoPhillips Has A 3.42% Annual Yield, But Short-Put Investors Can Make 1.5% Monthly

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more