Nasdaq Stock Keeps Rising - Is It Worth Buying NDAQ Now?

/Nasdaq%20Inc%20Times%20Square-by%20lucky-photographer%20via%20iStock.jpg)

by lucky-photographer via iStock

Nasdaq, Inc. (NDAQ) stock is up over 16.4% in the last two months, and up +2.6% this year. So, is it worth buying NDAQ now?

It's near analysts' price targets who may be waiting for upcoming results expected on Jan. 30. One attractive play is to sell short out-of-the-money puts in nearby expiry periods.

(Click on image to enlarge)

NFLX stock - last 3 months - Barchart - Jan. 6, 2026

Higher Price Targets (PTs)

NDAQ is trading at $99.69 in morning trading on January 6. That's up 16.4% from its recent low of $85.56 on November 5.

I discussed how NDAQ stock could be worth $100 per share in an Oct. 21, 2025, Barchart article after its Q3 results that day. That was based on its strong free cash flow (FCF) and FCF margins.

Moreover, analysts at the time had an average price target (PT) of $101.89 (Yahoo! Finance). Today, those 17 analysts have an average PT of $104.20.

Similarly, Barchart's mean analyst survey PT has risen from $104.50 to $107.00.

Moreover, AnaChart.com, which covers recent analyst write-ups, reports that 12 analysts have an average PT of $108.72. So, on average, analysts now expect around a 7% upside (PT of $106.64) from today.

But, does that make it worth buying? Possibly, but I highly suspect that analysts are waiting for its upcoming results.

Just in case the stock retreats, it makes sense to set a lower buy-in price point. One way to do that, as well as getting paid to wait, is to sell short out-of-the-money (OTM) put options.

Shorting OTM NDAQ Puts

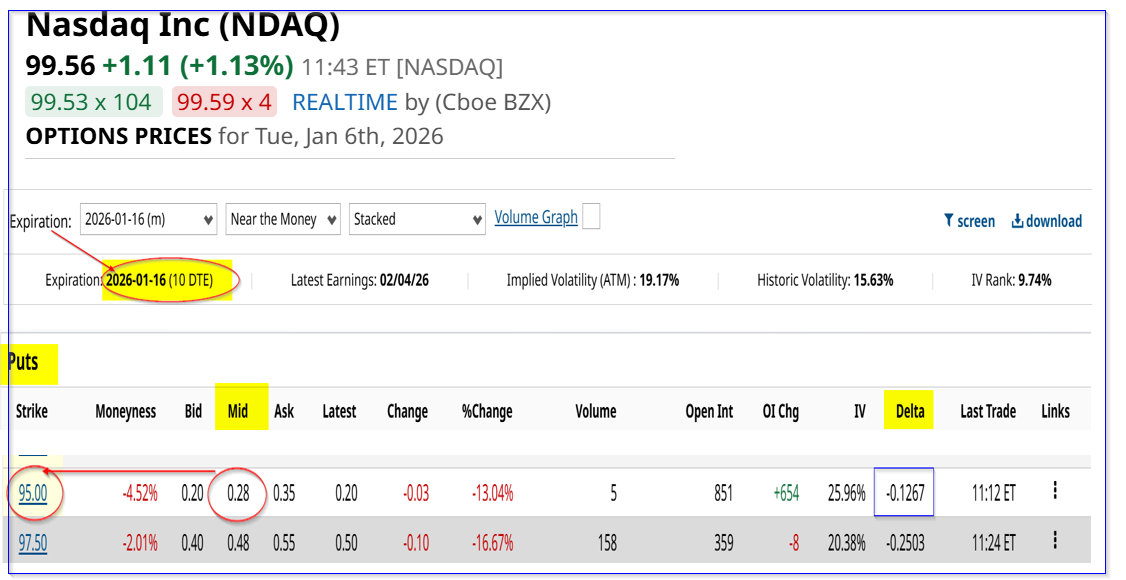

NDAQ stock has options only available once per month. So, the upcoming Jan. 16, 2026, expiration period (10 days to expiry or DTE) shows that the $95.00 strike price put option has a $0.28 midpoint premium.

That means that an investor who secures $9,500 with their brokerage firm can make $28 by entering an order to “Sell to Open” this contract. That represents a 10-day yield of 0.295%.

(Click on image to enlarge)

NDAQ puts expiring Jan. 16, 2026 - Barchart - As of Jan. 6, 2026

Monthly, assuming this could be repeated every 10 days (which it can't), it represents a one-month yield of 0.88%.

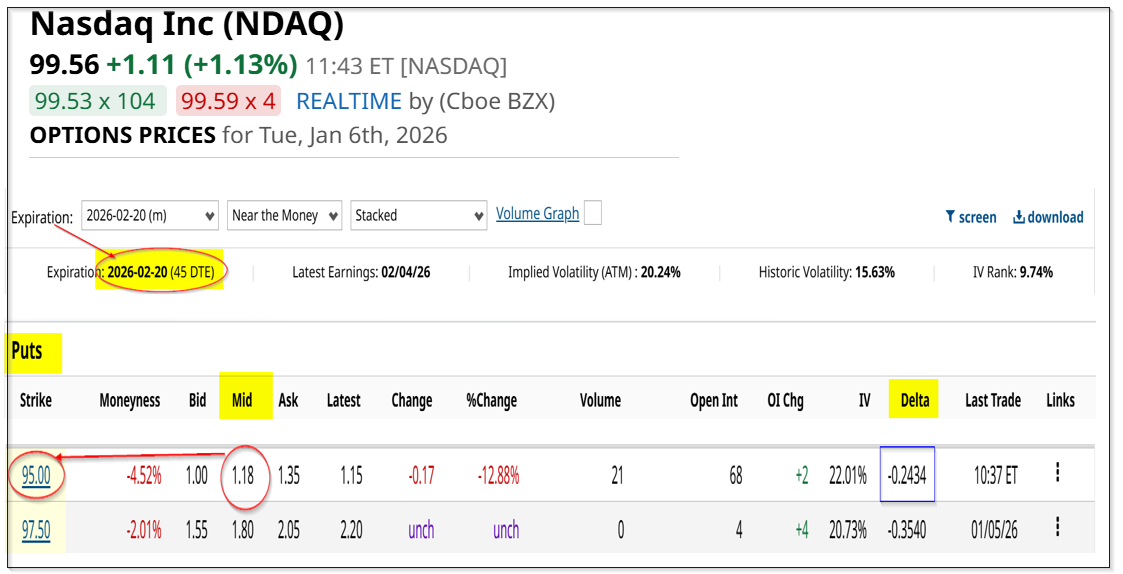

However, the next month expiry period ending Feb. 20, 2026, shows that the same $95.00 put option has a midpoint premium of $1.18 per put contract.

That represents income of $118 for a $9,500 investment over the next 45 days. This represents an income yield of 1.24% (i.e., $118/$9,500) for 45 days.

(Click on image to enlarge)

NDAQ puts expiring Feb. 20, 2026 - Barchart - As of Jan. 6, 2026

Moreover, the breakeven point, in case NDAQ falls to $95.00, is $93.82 (i.e., $95.00-1.18), or 5.7% below today's price. So, that represents a lower potential buy-in point.

In addition, since the delta ratio is -0.2434, it implies that there is less than a 25% chance that NDAQ will fall to $95.00 on or before Feb. 20. So, that means the investor could expect not to have their collateral assigned to buy 100 shares at $95.00.

For existing investors, it also might make sense to sell short covered calls.

Selling OTM Covered Calls

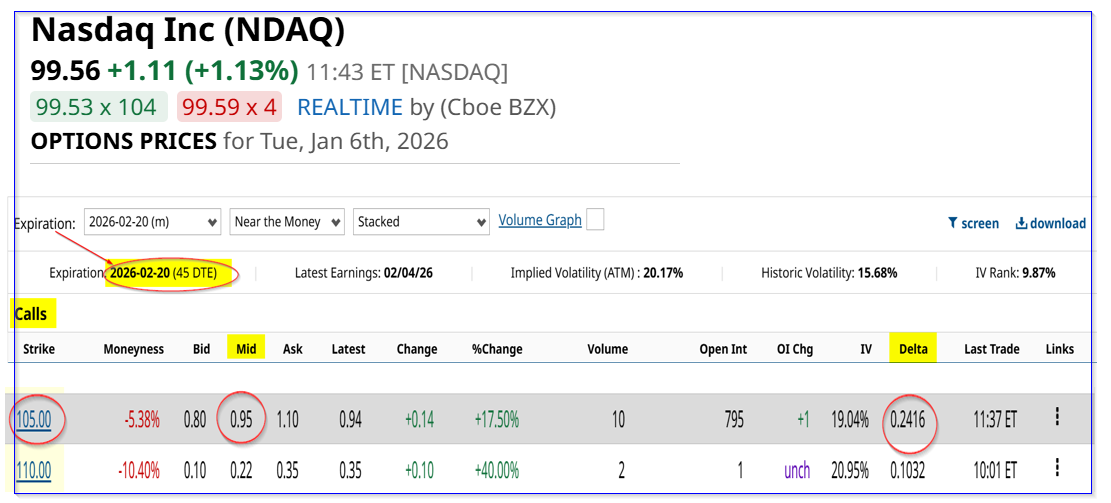

This strategy works for investor who already have shares and may be willing to potentially sell their investment or a portion of it at a higher price.

For example, the Jan. 16, 2026, call option period shows that the $105.00 call option has a midpoint premium of $0.15. That is effectively the same as a potential sale at $105.15 if NDAQ rises to $105.00 in the next 10 days.

But, if the stock stays lower than $105 by Jan. 16 close, the extra $15 gained from this covered call represents an income of 0.15%.

For the Feb. 20, 2026, period, the $105.00 call option has a $0.95 midpoint premium. That represents an income of almost 1% from today's price.

(Click on image to enlarge)

Moreover, there is a similar, less than 25% chance this will occur based on the delta ratio. However, in this situation, the investor's existing shares (i.e., 100 shares per call contract shorted) will be sold at $105.00 if NDAQ rises to $105 or higher on or before Feb. 20.

The bottom line is that there are ways to make extra income for existing Nasdaq stock shareholders or investors in case NDAQ stock remains in a trading range in the next two option periods.

More By This Author:

Analysts Love Salesforce Stock And Are Raising Their Price Targets - How To Play CRMTesla Stock Has Been Flat For Two Months - How To Make A 3.2% Yield In One-Month Puts

How To Make A 2.0% Income Yield In GOOGL Stock Over The Next Month

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more