Most-Shorted Stocks Are Excelling Beyond Reason

Market manias sure are intoxicating to watch, aren’t they? Right now almost everybody’s making money in the markets (except bears). All the major indexes are basically at all-time highs. The Nasdaq-100 is up 48% over the past 12 months and 552% over the last 10 years. Energy, crypto, emerging markets, metals, and pot stocks have all joined the party too.

But what’s really interesting is how the most-shorted stocks (MSS) are outperforming the rest of the market. The MSS in the U.S. have increased 245% since their March 2020 lows, according to research by Deutsche Bank. And they’ve outperformed the Russell 3000 by a whopping 147% in that same time period.

Typically the MSS underperform the market significantly. Here’s a chart from Deutsche Bank showing the trend since 1985.

As you can see, the previous periods of MSS outperforming the Russell 3000 were mild — 19% in 2000, 9% in 2014. Then in 2020… 147%. This move is highly unusual.

The most-shorted stocks are typically lower in quality, and they historically underperform the overall market by -6.9% per year. But recently they’ve been on an absolute tear.

It’s not just GameStop. We’re witnessing a market-wide short squeeze of epic proportions. And almost every financial asset is quickly rising in value. What’s going on here?

Easy Fed Policies Fueling Speculation

Interest rates have never been anywhere near this low for this long. The yield on bonds, CDs, and even stocks are all near all-time lows. You can’t earn 5% a year risk-free from government bonds anymore. To make any money these days, you have to take risks. And most people do that by buying stocks.

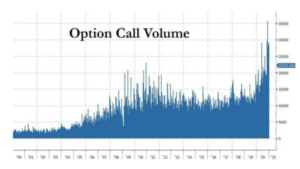

For the last 10 years, risk-taking has been very well rewarded. But now we’re reaching new levels of bullishness. Take a look at this chart of total call option volume since 2000.

Source: Zerohedge

Investors are piling into call options. Many investors — notably WallStreetBets users — have discovered that you can really move a company’s shares by buying calls en masse. They buy far out-of-the-money call options, which are a leveraged bet on the price going up.

When a lot of people buy call options on the same company, the dealers who sold those options are forced to buy shares to hedge their position. It’s called a gamma squeeze, and it can really juice a stock higher in the short-term. This is a piece of what’s driving the overall market and MSS higher.

But I think the ultimate driver of all this bullish momentum is the Federal Reserve. We saw what happened when the Fed tried to raise interest rates in 2018. Stock prices tanked. And the Fed reversed course and lowered rates again (and restarted quantitative easing). As soon as they started “easing” again, stocks moved up. Central bank support is ongoing, and the Fed is now even buying corporate bonds now (that’s new).

The Fed is extremely unlikely to raise interest rates anytime soon. And I suspect they’ll be ramping up quantitative easing soon to pay for what is essentially MMT.

How long can financial markets stay elevated? I suspect it’ll be much longer than seems rational. That tends to be the way of these things. I’m certainly not going to short in this market.

I’m sticking to my plan. I’m investing in emerging markets, precious metals, startups, bitcoin, and cannabis for the most part. I think these bull markets are a lot more sustainable than others. And they have more upside over the long-term. And that’s ultimately what it comes down to for me in this unprecedentedly crazy environment.

Disclaimer: Read our full disclaimer here.

@[Rick Ristov](user:5151), you'll enjoy this article.

Great read.

As matter of fact, the fed SHOULD HAVE increased and let the stock prices fall, which would have been only a fairly short term correction, really. The big change would be folks having to put their own money on the line, instead of borrowed money. Of course it has seemed to me that all speculation should be done with cash, not with credit. That would instantly reduce the wild rides that we see on occasion. And in a buying rush stampede it would avoid having the agents stopping the buying because of being afraid of getting stuck. They would get their cash with orders to buy and the cash-in-hand to do it.