Most Liquid Options

Liquidity is crucial when placing options trades. This article will explore the importance of trading the most liquid options.

I will provide some tips to assure that you are trading the most liquid options.

As lower liquidity equates to higher transaction costs it is important to always be mindful of these costs and how they add up over time.

Liquidity Overview

Liquidity in the options space is broadly defined as the price we pay to enter and exit a position.

Even if you are with a commission-free brokerage, trades are not free.

As retail investors, more often than not, we are liquidity takers.

That means we are placing trades interacting with a market maker, who is a liquidity provider.

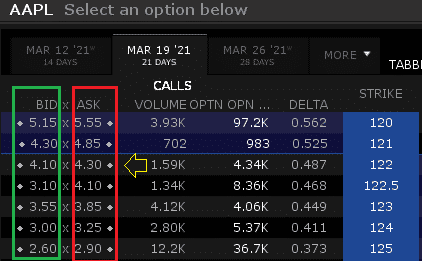

While there are various ways of measuring liquidity one simple way is the bid/ask spread, as shown below.

The bid price (shown in green) is the highest price someone is willing to pay to buy the option.

The ask price (shown in red) is the lowest price someone is willing to receive to sell that option.

The distance between the bid-ask price is known as the spread.

The larger the spread, the larger transaction costs and thus less liquidity.

Let’s look at the 122 strike shown in yellow.

We have a bid of $4.10 and an ask of $4.30 for a spread of 20 cents.

So, if we were to buy and sell the option immediately the most we would pay is 20 cents. Often the true cost is even less.

This is because there is frequently hidden liquidity within the bid-ask spread.

As we can see with the AAPL options chain the options are very liquid. Below is an example of an illiquid options chain.

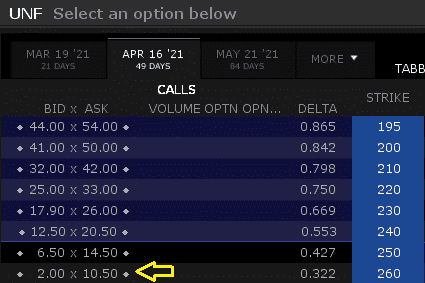

Here are the options for Unifirst, a workplace uniform company.

While being a 4 Billion dollar company we can see that there is no volume on the options and virtually no liquidity.

Looking at the bid-ask on the 260 calls we can see the spread is an astonishing $8.50.

These are the options we want to avoid.

If we still want to trade the underlying and have a directional view it would be better off buying the stock.

The Importance of Liquidity When Trading

The most important thing a trader needs to have is a positive expected value on the trades they take.

Without it, we are simply at a roulette table betting on red.

Despite this even if we have a positive expected value without liquidity there is no way to take advantage of it.

After all the less liquidity the more of our edge is eaten up in transaction costs.

Liquidity is always there when you want it but never when you need it.

Sometimes stocks may appear liquid and have tight bid to ask spreads.

Yet during times of market crises that liquidity starts to evaporate.

Markets become fast-moving and the bid-ask spread widens substantially.

More common than not, that is precisely the same time we need the liquidity the most. As others are forced to get out of a position.

By focusing on the most liquid options, we reduce this risk of having our liquidity taken away when we need it the most.

These semi-liquid options can be traded, but need to be handled with care.

Liquidity and Market Depth

Another metric important in determining liquidity is market depth. Imagine that the bid-ask has only one contract on either side but I need to sell 100 contracts.

For most retail traders with smaller investments (myself included), market depth is not a big issue.

But if you start managing millions it becomes a lot more important.

If you listen to a podcast from any fund manager, who has billions of assets under management, they will often spend half the time talking about liquidity.

This is because of the size of their orders and positions.

For them the importance of having market depth and liquidity cannot be overstated.

Tips on Finding the Most Liquid Options

So how does one go about finding the most liquid options? Here are 5 tips that I use.

Focus on tickers that have a high average options volume.

This means, rain or shine, there are a lot of options being traded on the ticker.

I would screen out all the stocks that have under 10,000 daily contracts traded right away.

Look at the option strikes that have a higher open interest.

Certain strikes are more popular, as they are close to the money or are at round numbers.

Think Tesla 990 calls vs. Tesla 1000 calls.

These strikes will often have greater liquidity and a narrower bid-ask spread.

Monthlies have more liquidity than weeklies.

As a general rule if there are weekly contracts available the monthlies will still have more liquidity.

The monthlies are the options expiring on the 3rd Friday of every month.

Consider executing trades around midday.

Options market makers compete against each other to have the bid-ask price as tight as possible.

When the market first opens prices are more volatile and spreads will be wider.

Yet as volatility settles after the open spreads will often tighten as market makers are not as worried about being picked off by price jumps.

Find hidden liquidity for yourself.

Place a limit order slightly below the ask and see if you can find hidden liquidity.

If not move the order down a few pennies or let it rest and see if you get picked off.

Simply by using these five tips you can guarantee that you will be not paying much in transaction costs and make sure you are trading a liquid underlying.

If we are not satisfied with the liquidity of the options we can trade the underlying.

Buying the stock itself will always be more liquid and should be considered if we have a directional view.

Most Liquid Stock Options

Below you will find a list of some of the most liquid options on individual stocks.

Some of these names may be a little surprising, but this data is from March 2021, right around the time of the Gamestop / short squeeze craziness.

Pretty funny to see names like NOK< AMC and GME as the most liquid options.

Summary

Liquidity is the cost of doing business in the options space.

When placing trades it is always important to focus on the liquidity of the underlying.

By trading the most liquid options we guarantee we are paying the lowest transaction costs.

Furthermore, we have greater confidence that if we need liquidity, in the event of market turmoil, it will be there for us.

Ultimately this leaves us keeping more of our edge and money in our pockets.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more