Microsoft Stock Is Trading In A Range - Shorting Out-Of-The-Money Puts Works

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

by VDB Photos via Shutterstock

Microsoft Corp. (MSFT) stock has been trading in a range for the last 2 months. Shorting out-of-the-money (OTM) put options has been one of the best plays. Right now, a one-month 4% OTM put provides a 1.5% income yield.

MSFT is trading at $475.35 in morning trading on Friday, Jan. 9. This represents a decrease from $492.02 one month ago, on Dec. 9, and from $496.82 on Nov. 7.

(Click on image to enlarge)

MSFT stock - last 3 months - Barchart - As of Jan. 9, 2026

I've been recommending shorting out-of-the-money (OTM) put options in MSFT stock. For example, a month ago, on Dec. 9, I wrote a Barchart article, “How to Make a 1.1% Yield Shorting One-Month Microsoft Puts.”

I suggested selling short the $475.00 put option expiring today. At the time, MSFT was at $491.00, so this strike price was over 3% below the trading price.

However, the investor received $5.63 for each contract (multiplied by 100 shares, or $563 for an investment of $47,500). That worked out to a one-month 1.185% income yield.

Today, that put option could expire worthless. It makes sense for the investor to do a new one-month short-put play.

High Price Targets

I showed in my Nov. 4, 2025, Barchart article that MSFT stock could be worth as much as $682.55 per share over the next 12 months (NTM). That was based on its strong FY 26 Q1 results with 33% FCF margins.

Since then, analysts have raised their revenue forecasts for the next two years. So, theoretically, I should hike my FCF-based price target (PT), which was based on a 30% FCF margin assumption.

Moreover, analysts have been maintaining their high price targets (PTs). For example, Yahoo! Finance reports that 57 analysts have hiked their PTs to $622.51. That is close to where it was two months ago ($626.71).

Similarly, Barchart's mean PT is $630.07, compared to $632.77 two months ago.

The bottom line is that analysts still see MSFT stock as undervalued.

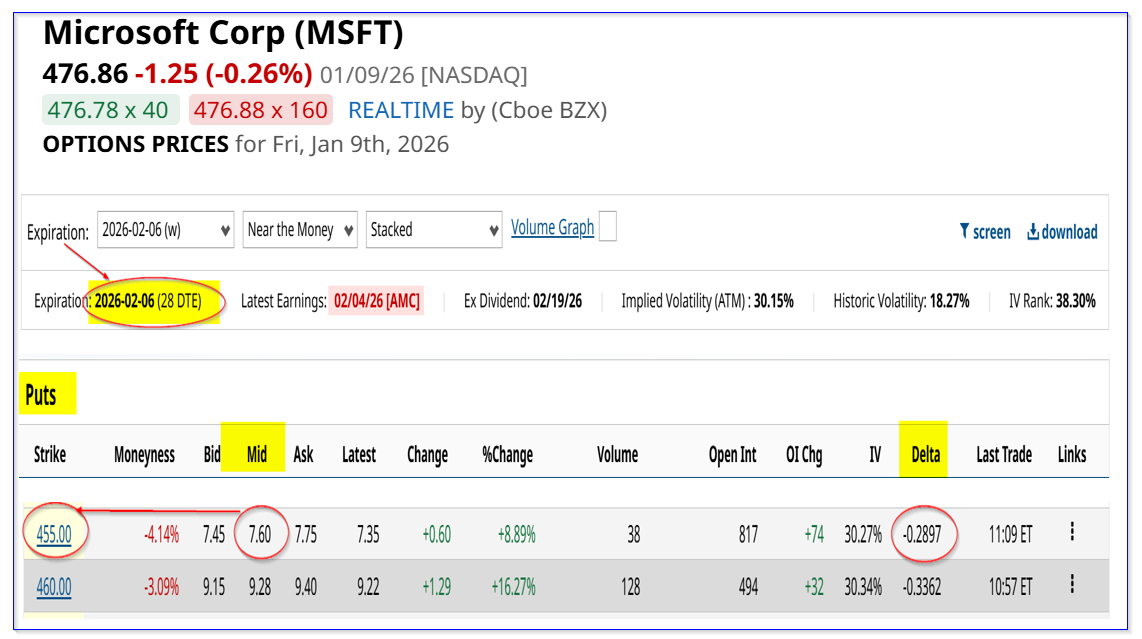

Shorting One-Month MSFT Puts

Today, the Feb. 6, 2026, expiry period shows that the $455.00 strike price put contract has a $7.60 midpoint premium. That provides an immediate yield of 1.67% for a put exercise price that is 4% below today's trading price.

(Click on image to enlarge)

MSFT puts expiring on Feb. 6, 2026 - Barchart - Jan. 9, 2026

This means that an investor who secures $45,500 in cash or buying power with their brokerage firm can enter an order to “Sell to Open” 1 put contract.

Their account will immediately receive $760.00, or 1.67% of the cash secured as collateral to buy 100 shares at $455.00.

The point is that if MSFT stays flat or rises closer to its higher PT over the next month, the investor has no obligation to buy 100 shares at $455.00.

Moreover, don't forget that the cumulative income over the past two months from these two short-put plays has been $13.23, or $1,323 for an average investment of $46,500, or 2.845%.

That works out to an annualized return of 17% if this type of income play can be repeated.

In other words, this is a great way to both set a potential lower buy-in point and also gain extra income.

Moreover, some less risk-averse investors can use that income to buy in-the-money (ITM) call options further out. That way, they can benefit from any upside in MSFT stock with less risk.

More By This Author:

Unusual Volume In Marvell Technology Put Options - Is MRVL Stock Undervalued?Nasdaq Stock Keeps Rising - Is It Worth Buying NDAQ Now?

Analysts Love Salesforce Stock And Are Raising Their Price Targets - How To Play CRM

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more