Microsoft Stock Is Off Its Highs, But Target Prices For MSFT Are Higher

/Microsoft%20logo%20on%20building%20by%20trazika%20via%20Pixabay.jpg)

trazika via Pixabay

Microsoft Corp (MSFT) stock has drifted off its highs, presenting an opportunity for value investors. Moreover, analysts' surveys show significantly higher target prices for MSFT stock. One way to play it is to short out-of-the-money (OTM) MSFT put options.

MSFT is below $500 on Tuesday, Sept. 9, at $499.28 in midday trading. This is well off its recent peak of $535.65 on Aug. 4.

(Click on image to enlarge)

MSFT stock - last 3 months - Barchart - as of Sept. 9

Free Cash Flow-Based Price Target

Meanwhile, the value of Microsoft stock is much higher. I discussed this based on the company's strong free cash flow (FCF) margins in an August 10 Barchart article ("Microsoft's Impressive Free Cash Flow - MSFT Stock Could Be Worth 28% More").

For example, based on analysts' revenue forecasts of $322.15 billion for the year ending June 30, 2026, and using a 53% operating cash flow (OCF) margin:

$322.15 billion FY 26 revenue est. x 53% margin = $170.74 billion OCF

Assuming the company spends $71 billion in capex this year, its free cash flow (FCF) will be about $100 billion:

$170.74b OCF = $71 billion capex = $99.74 billion FCF

Moreover, estimating the market will give the stock a 2% FCF yield (i.e., the same as 50x FCF), its market value could approach $5 trillion:

$99.74b / 0.02 = $4,987 billion mkt value

This is +34.4% higher than today's market cap of $3,711 billion, according to Yahoo! Finance. So, that means the target price is 34% higher:

$499.28 x 1.344 = $671.03 per share

Analysts' Target Prices

That coincides with other analysts' surveys' target prices. For example, Yahoo! Finance reports that 56 analysts covering MSFT have an average price target of $613.89.

Similarly, Barchart's mean price survey target price is $622.85. In addition, AnaChart's survey shows that 37 analysts have an average price of $565.35, and Stock Analysis shows that 31 analysts have an average of $617.38.

The bottom line is that analysts agree that MSFT stock looks undervalued here.

One way to play this, to set a lower buy-in point and get paid while waiting, is to sell short out-of-the-money (OTM) put options in one-month out expiry periods.

Shorting OTM MSFT Puts

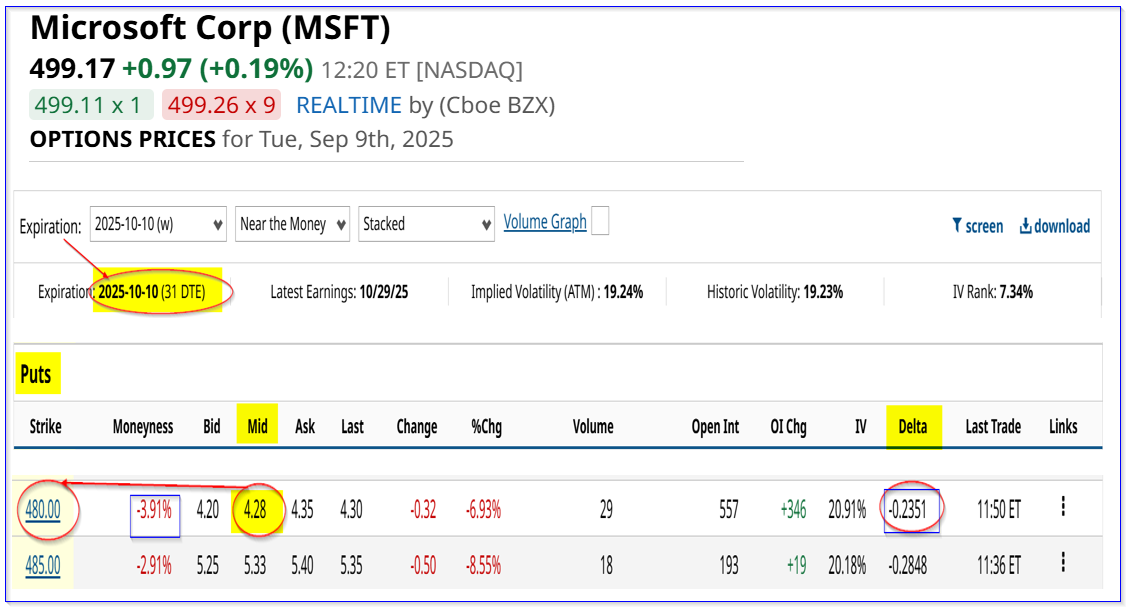

For example, the Oct. 10 expiry period, one month away, shows that the $480.00 put option contract, 4% below today's price, has a midpoint premium of $4.28 per contract.

That means that a short-seller of these put options makes an immediate yield of 0.891% (i.e., $4.28 /$480.00).

(Click on image to enlarge)

MSFT puts expiring Oct. 10 - Barchart - As of Sept. 9, 2025

In other words, an investor who secures $48,000 with their brokerage firm can enter an order to “Sell to Open” 1 put contract at $480.00. The account will then immediately receive $428 in the account, hence the 0.891% yield (i.e., $428/$48,000).

The point is that the investor can set a lower buy-in point and get paid while waiting to see if MSFT falls to $480.00. The breakeven point is $480-$4.28, or $475.72, or over 4.7% below today's trading price.

The bottom line is that this is a good way to earn extra income, especially for existing shareholders, while also providing a disciplined way to buy in at a lower price.

Note that there is a low chance that the stock will hit this strike price, as the delta ratio is only 23.5%.

Downside Risks

However, if MSFT falls to $480 or lower, the account's collateral will be assigned to buy 100 shares at $480.00. If MSFT falls below the breakeven point of $475.72, this may result in an unrealized capital loss for the new owner of 100 MSFT shares.

Nevertheless, not all is lost. The investor can continue to hold these MSFT shares. After all, the upside based on our price target is attractive:

$671.03 target / $475.72 breakeven = 1.41 -1 = +41% upside

Moreover, in this case, an investor can choose to sell out-of-the-money (OTM) call options with strike prices above the breakeven point. That way, the investor can recoup all or some of the unrealized loss.

The point is that there are ways to manage this situation. Investors can study Barchart's Options Education webinars to learn how to manage these downside risks.

The bottom line is the MSFT stock could be undervalued here. One way to play it is to sell short out-of-the-money put options in one-month out expiry periods.

More By This Author:

Is Bitcoin Set To Rebound? Ways To Play A BTC Cryptocurrency TurnaroundAnalysts Keep Raising Shopify's Targets - Make A 3.0% Yield In One-Month SHOP OTM Puts

Strategy, Inc. Shows Huge, Unusual Call Options Activity - Speculators Abound In This Bitcoin Play