LYFT Stock Has Been Flat For 3 Months - But 1-Month Puts Have Yields Over 5%

/Lyft%20logo%20on%20phone%20by%20Thought%20Catalog%20via%20Unsplash.jpg)

by Thought Catalog via Unsplash

LYFT, Inc. (LYFT) stock has been volatile, especially around earnings releases, but flat over the last three months. However, put option premiums are high. For example, 8% lower strike prices (i.e., out-of-the-money) have yields exceeding 5% for the next month.

LYFT is up on Monday, Jan. 12, 2026, morning trading at $19.61. However, three months ago, it closed at $19.99 on Oct. 13.

LYFT stock - last 3 months - Barchart - Monday, Jan. 12, 2026

However, Lyft stock has reached as high as $24.57 on November 12, 2025. However, it hasn't fallen below $19.00 in the last 3 months. However, 9 months ago, it hit a low of $9.97 on April 7, 2025.

Is that volatility why its put option premiums are so high now? Maybe, but value investors are entralled with the stock, given its strong free cash flow (FCF) generation.

Strong Free Cash Flow (FCF)

For example, on Nov. 5, 2025, Lyft reported that its trailing 12-month (TTM) FCF rose over $1 billion for the first time. Moreover, based on its guidance for adjusted EBITDA margins between 2.7% and 3.0%, compared to 2.9% in Q3, FCF could be expected to be strong in Q4.

As a result, it's not unreasonable to expect that Lyft, Inc. could at least a 16.4% FCF margin going forward (i.e., compared to its Q3 LTM 16.38% according to Stock Analysis).

Here's how that works out, estimating Lyft's free cash flow using Seeking Alpha revenue estimates from analysts:

$6.38 billion revenue est. 2025 x 0.164 = $1.05 billion FCF 2025

$7.38 billion revenue est. 2026 x 0.164 = $1.21 billion FCF 2026

So, over the next 12 months (NTM), Lyft should generate at least $1.13 billion on average in free cash flow (FCF).

We can use that estimate to derive a price target (PT) for LYFT stock.

Price Targets (PT) for LYFT Stock

Right now, Lyft has a market capitalization of about $8 billion, according to Yahoo! Finance. That implies that its FCF yield (i.e., FCF/Mkt Cap) is about 12.5%.

$1 billion LTM FCF / $8.00 billion mkt cap = 0.125 = 12.5%

This is the same as multiplying its FCF by 8.0x (i.e., 1/0.125 = 8.0).

So, if we multiply our NTM estimate of $1.13 billion in FCF by 8:

$1.13 billion x 8 = $9.04 billion mkt cap

In other words, the price target is 13% higher:

$9.04b / $8b today = 1.13-1 = +13% upside

Moreover, this means that the LYFT stock price target (PT) is 13% higher than today:

$19.61 x 1.13 = $22.16 per share PT

That is close to other analysts' PTs. For example, Yahoo! Finance reports that 46 analysts have an average PT of $24.21. Moreover, Barchart's mean survey PT is $24.31, and AnaChart's survey of 24 analysts is $24.18.

These analyst PTs average $24.23, or +23.6% higher than today's price.

The bottom line is that LYFT stock looks very undervalued here.

As a result, the high out-of-the-money (OTM)put option premiums I mentioned earlier are very attractive to short-sellers.

Shorting OTM LYFT Put Options

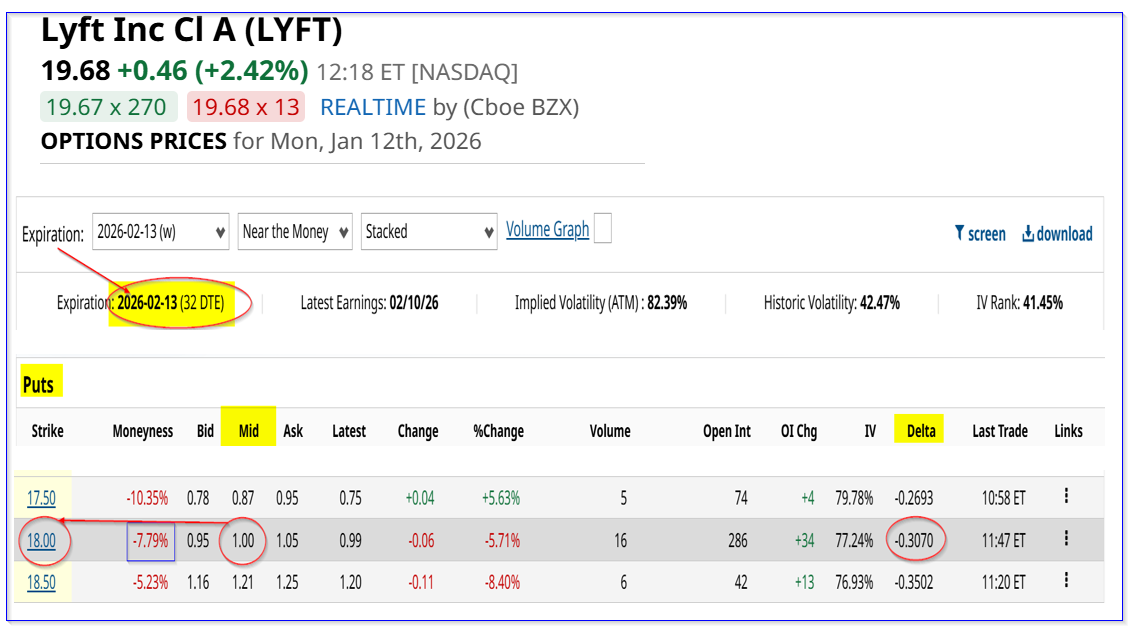

For example, look at the Feb. 13, 2026, expiry period, 32 days from today. It shows that an $18.00 strike price put option, over 7% below today's price, has a midpoint premium of $1.00.

That represents a one-month income yield of 5.55% ($1.00 / $18.00 = 0.055 = 5.55%)to a short-seller of this put contract.

(Click on image to enlarge)

LYFT puts expiring Feb. 13, 2026 - Barchart - As of Jan. 12, 2026

This means that an investor who secures $1,800 in cash or buying power with their brokerage firm can enter an order to “Sell to Open” this contract. Their account will immediately receive $100.

So, $100 for an investment of $1,800 equals a 5.55% one-month yield. As long as LYFT stock stays over $18.00 over the next month, the secured collateral will not be assigned to buy 100 shares at $18.00.

Moreover, more risk-averse investors can sell short the $17.50 strike price put. That is over 10% lower than today's price. The premium is lower at $0.87 at the midpoint, but that still provides a one-month yield of almost 5%:

$0.87 / $17.50 = 0.0497 = 4.97% for one month

In addition, the breakeven point (B/E) is even lower:

$17.50 - $0.87 = $16.63 per share

That means that an investor who shorts this put contract would not have an unrealized loss unless LYFT stock fell 15.5% from today's price of $19.68.

The bottom line here is that this is a great way for existing LYFT investors to pick up extra income while also setting a potentially lower buy-in point.

This allows a LYFT investor to generate income, along with the possibility of lowering their average cost. Moreover, new investors can produce a 5% one-month income yield while waiting to potentially buy LYFT at a much lower price.

More By This Author:

Netflix Stock Is Beaten Down - But Short Put Plays Are AttractiveMicrosoft Stock Is Trading In A Range - Shorting Out-Of-The-Money Puts Works

Unusual Volume In Marvell Technology Put Options - Is MRVL Stock Undervalued?

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more