Is McDonald's A Buy? Its Strong FCF Margins Imply MCD Could Be 23% Undervalued

/McDonald's%20Corp%20location%20by-%20M_Suhail%20via%20iStock.jpg)

by- M_Suhail via iStock

McDonald's Corporation (MCD) generated strong free cash flow (FCF) and a high FCF margin in Q3, over 34% of sales. That implies MCD stock could be very undervalued here—at least 23% over the next year. Shorting OTM puts is one way to play it.

MCD is at $300.74 on Friday morning, up since its Nov. 5 earnings and cash flow statement release. This article will show why the stock could be worth at least $370 per share over the next year.

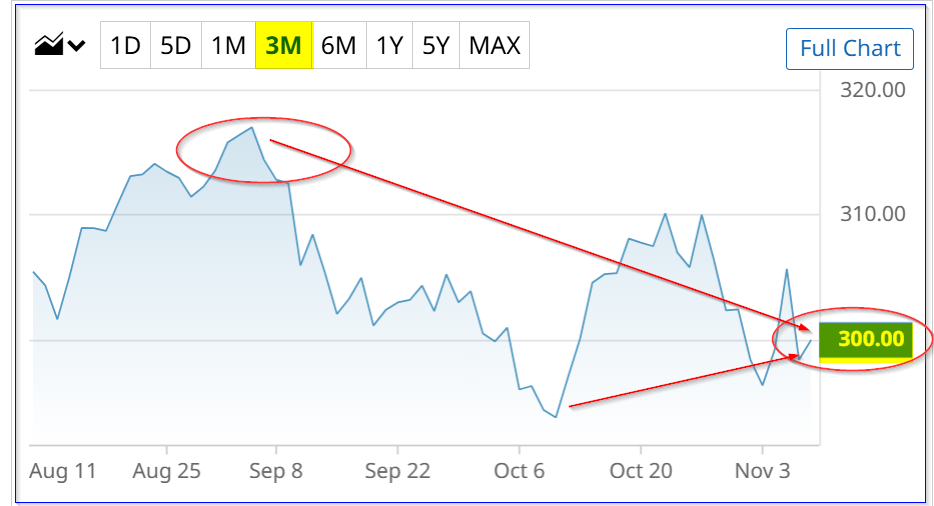

(Click on image to enlarge)

MCD stock - last 3 months - Barchart - As of Friday, Nov. 7, 2025

Strong Results

The fast-food restaurant company said its comparable Q3 sales rose by +3.6% globally, and total revenue was up +3.0%. In addition, for the nine months to Sept. 30, revenue was up +2%, with operating income up +4.4% YoY, and net income rose by +3.1%.

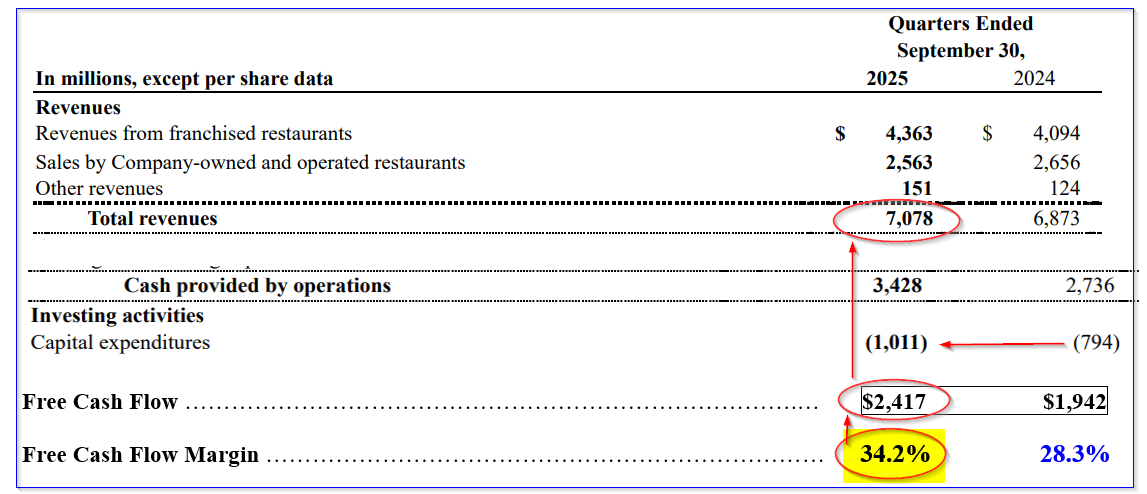

More importantly, its operating cash flow rose to $3.428 billion in Q3, up from $$2.736 billion (i.e., +25.3% YoY, as can be seen on page 6 of its 10-Q release. That represents 48% of its $7.078 billion in Q3 revenue. That is almost half of its revenue.

However, its capex spending rose by +27.3% to $1.011 billion for the quarter. That means its free cash flow (FCF) margin was $2.417 billion, or 34.17% of sales.

(Click on image to enlarge)

McDonald's Corp - Free Cash flow - Hake analysis - Taken from Q3 10-Q, page 6

That is still a very high FCF margin, despite the higher capex spending, which represented 14.3% of sales vs. 11.6% a year ago. Moreover, this spending growth will likely slow, improving the FCF margin over the next year.

Here's why. The company stated, in its outlook section (page 32 of its 10-Q), that it expects its full-year 2025 capex spending to be between $3.0 billion and $3.2 billion. However, as of Q3, it had already spent $2.308 billion (seen on page 6).

That implies the Q4 capex spend will be just $792 million:

$3.1 billion mid-range 2025 est. - $2.308 billion YTD capex = $0.792 billion

That works out to approximately 11.3% of estimated Q4 sales, similar to what it was a year ago in Q3. This can be estimated by taking analysts' estimates of $26.69 billion in 2025 sales:

$26,690 2025 sales - $19,876 YTD sales = $7,044 billion Q4 sales

$792m Q4 capex est. / $7,044 b Q4 sales = 11.3%

Projecting FCF Next Year's FCF

The point here is that next year's FCF margin will be much higher as capex spending growth slows. Here's how that works out.

First, let's use analysts' 2026 revenue estimate ($28.15 billion from Seeking Alpha) and apply a 44% operating cash flow margin (OCF), as in Q3 (see above).

That's the midpoint between its 48% Q3 OCF margin and the trailing 12 months (TTM)OCF margin of 40%, according to data from Stock Analysis (i.e., $10.485 billion OCF/$26.264 billion in TTM revenue):

$28.15b x 0.44 OCF margin = $12.386 billion operating cash flow

Next, let's assume that capex spending will remain flat at about $800 million per quarter:

$12.15 billion OCF - $3.2 billion (i.e., $800m x 4) = $8.95 billion free cash flow

In other words, we can project about $9 billion in FCF next year. That would be +22% higher than its trailing 12-month (TTM) FCF of $7.392 billion, according to Stock Analysis.

It could also lead to a significantly higher stock price. Here's why.

MCD Stock Price Targets

One way to value a stock is to assume it pays out 100% of its free cash flow to shareholders. What would the dividend yield be?

For example, Yahoo! Finance reports that its market cap today is $215.15 billion. That means its TTM FCF represents a FCF yield, if it were to be 100% paid out to shareholders, of 3.4%:

$7.392b TTM FCF / $215.15 b mkt cap today = 0.03436 = 3.34% FCF Yield

We can apply this to the 2026 FCF forecast:

$9 billion 2026 FCF / 0.034 = $264.71 billion mkt cap

In other words, the target valuation is 23% higher:

$264.71b mkt cap forecast / $215.15 billion today -1 = 1.23 -1 = +23%

This implies a target price for MCD stock of $370 per share:

1.23 x $301 = $370.23

Analysts tend to agree that its price target is significantly higher. For example, Yahoo! Finance reports that its survey of 37 analysts shows an average price target of $330.10. Similarly, Barchart's mean survey price is $336.43.

Moreover, AnaChart, which tracks recent analyst write-ups, reports that 23 analysts have an average price of $338.35.

The bottom line is that price targets range from $330 to $370, implying that MCD stock is between 10% to 23% undervalued.

One way to play MCD is to set a lower price target and get paid while waiting for this to happen. That is done by selling short out-of-the-money (OTM) put options in nearby expiry periods.

Shorting OTM MCD Puts

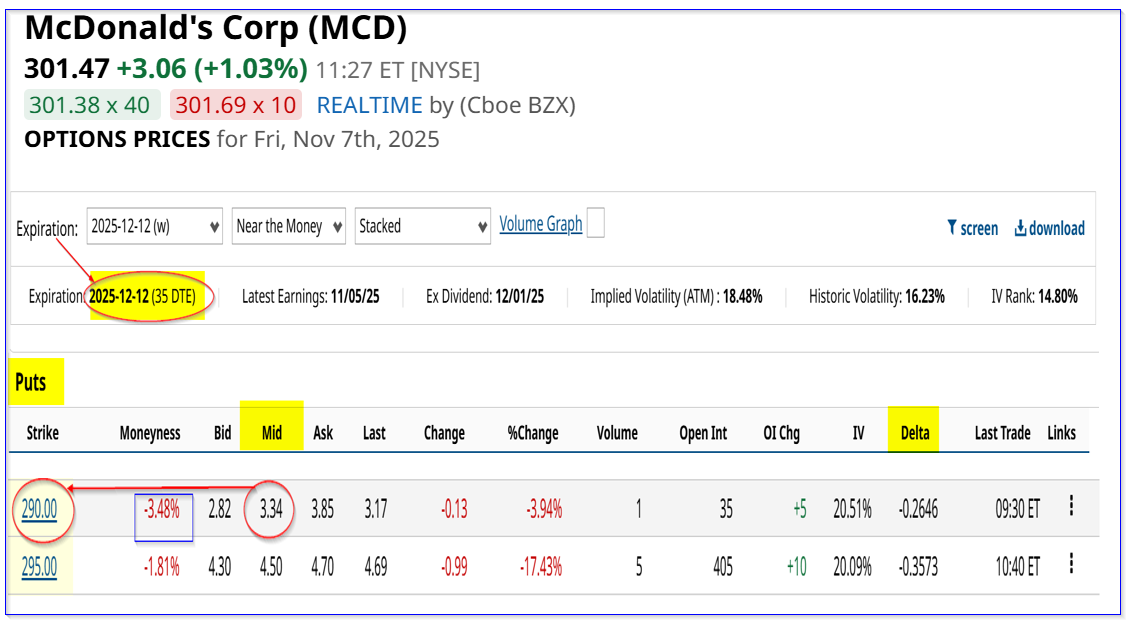

For example, the Dec. 12, 2025, expiry period shows that the $290 put option contract has a midpoint premium of $3.34. This strike price is $11 below today's price, or -3.65% out-of-the-money (OTM) for one month to expiry.

That provides a short-seller an immediate yield of 1.15% (i.e., $3.34/$290.00 = 0.0115 = 1.15% yield).

(Click on image to enlarge)

MCD puts expiring Dec. 12, 2025 - Barchart - As of Nov. 7, 2025

The reason is that an investor must first secure cash or buying power of $2,900 for every put shorted this way. The account will then immediately receive $334, when an order to “Sell to Open” this put contract is entered.

That is why the investment yields 1.15% (i.e., $334/$2,900).

Downside Risks

If MCD falls below $290.00, the account will be assigned to buy 100 shares at $290.00. That might end up with an unrealized loss, at least for a period of time until the investor sells the shares.

Note that this trade has a low delta ratio of just -0.26, implying just a 26% chance that MCD will fall to $290.00 before Dec. 12. But even if it does, the investor has a lower breakeven point:

$290.00 - $3.34 = $286.66 breakeven price

That is about 4.9% below today's price, providing good downside protection.

Moreover, the investor can always sell short covered calls, instead of selling the unrealized loss position. That could help mitigate any unrealized loss.

And, of course, the investor could always repeat the short-put play on a lower strike price put contract that is deeper out-of-the-money.

The bottom line is that, given the upside in MCD stock, this is a good way for a conservative investor to invest in McDonald's stock.

More By This Author:

Heavy Tesla Call Options Volume Highlights TSLA Stock's ValueMicrosoft Produces Strong FCF As Expected - Shorting OTM Puts Is An Attractive Play

Chevron's Free Cash Flow Rises - An Expected Dividend Hike Could Push CVX 14% Higher