Intuit's Strong Free Cash Flow Results Could Push INTU Stock Higher

Golden Dayz via Shutterstock

Intuit, Inc. (INTU) produced strong free cash flow (FCF) for its fiscal year ending July 31, in its Aug. 21 earnings release. Based on its 32.3% FCF margin, INTU stock could be worth over 19% more at $734 per share in the next 12 months. That makes the stock attractive to value investors.

INTU stock is down over 4.6% today to $662.52. That is well off its recent high of $807.39 on July 30.

(Click on image to enlarge)

INTU stock - last 6 months - Barchart - As of Aug. 22, 2025

This dip presents a good buying opportunity today for investors who look closely at the company's cash flow. This article will delve into this.

Strong Free Cash Flow (FCF) Results and Operating Leverage

Intuit, which produces accounting and tax solutions for consumers and small businesses with its TurboTax and QuickBooks products, as well as consumer products like CreditKarma and MailChimp, had revenue rise 20% Y/Y to $in its fiscal Q4 ending July 31.

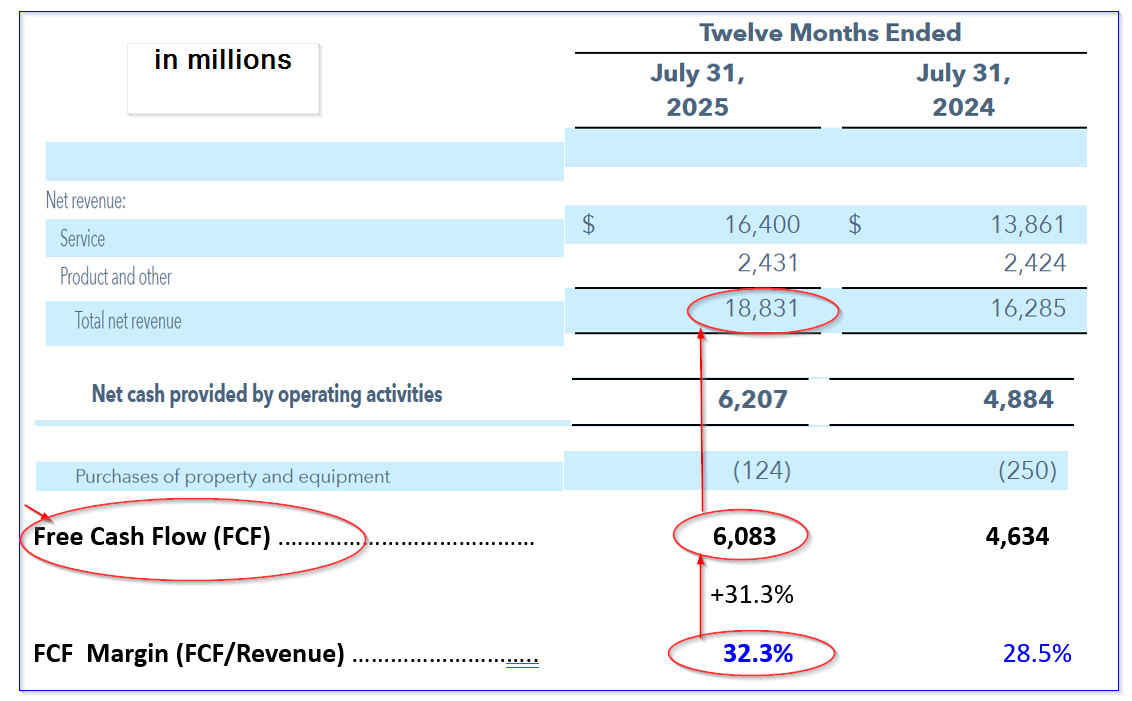

In addition, its full FY 2025 sales were up 15.6% to $18.831 billion for the trailing 12 months (TTM). Moreover, Intuit said it expects to see revenue rise in the double digits again this coming fiscal year.

However, the company's full-year free cash flow (FCF), which comes mostly in its fiscal Q3 ending April 3, was up almost 30% to $6.08 billion.

That represents a huge FCF margin of 32.3% of its $18.83 billion TTM revenue. That was significantly higher than last year's 28.8% FCF margin, and in line with prior quarters' LTM data, according to data from Stock Analysis.com.

(Click on image to enlarge)

Intuit - Free Cash Flow - Aug. 21 earnings releaseand Hake analysis

The point is that Intuit is squeezing out more cash from its operations even as revenue rises. That is what operating leverage is all about. This is also a sign of a very profitable company. That also means INTU stock could be worth more in the next 12 months (NTM).

Forecasting Next 12 Months (NTM) FCF

For example, analysts now project that revenue next fiscal year ending July 31, 2026, will rise +12% to $21.1 billion and $26.42 billion in the following fiscal year.

So, if we assume that FCF margins will average 32.3% over the next two years:

$21.1 billion x 0.323 = $6.815 billion FCF FY 2026

$26.42 billion x 0.323 = $8.534 billion FCF FY 2027

So, on average over the next 12 months (i.e., taking 3/4ths of the FY 2026 FCF figure and ¼ of the FY 2027), the NTM FCF can be estimated to be $7.24 billion (i.e., $5.11 billion +$2.13 billion).

That is 19% higher than the past FY FCF of $6.083 billion. This may push the stock's value significantly higher.

Price Targets for INTU Stock

For example, right now INTU stock has a market capitalization of $185.74 billion, according to Yahoo! Finance.

That means that Intuit's $6.083 billion in TTM FCF represents almost 3.3% of its market value:

$6.083 billion FCF / $185.74 billion mkt cap = 0.03273 = 3.275% FCF yield

Therefore, using our forecast of $7.24 billion in NTM FCF:

$7.24b FCF / 0.03275 = $221.07 billion NTM market cap

That is +19% higher than today's market cap. In other words, INTU stock could be worth 19% more than today's stock price of $667.35:

$662.52 *1.19 = $788.40 per share price target

Note that just a slight improvement in the market's FCF yield could push the target price much higher. For example, using a 3.0% FCF yield metric:

$7.24b NTM FCF / 0.03 = $241.3 billion = 1.299 x $185.74 billion mkt cap = price target of $860.61 price target.

So, assuming Intuit's FCF stays high at 32.3% and using a 3.3% and 3.0% FCF yield metric, INTU stock's value ranges between $788 and $861 per share over the next 12 months.

Analysts Agree. Analysts believe it looks undervalued. For example, Yahoo! Finance shows that 31 analysts have an average price target of $826.27. That is within the range we have delineated above.

Similarly, Barchart's mean survey price target is $817.96, and Stock Analysis says 19 analysts have an average of $802.16.

The bottom line is that INTU stock looks deeply undervalued here, based on its strong revenue growth and FCF margin prospects.

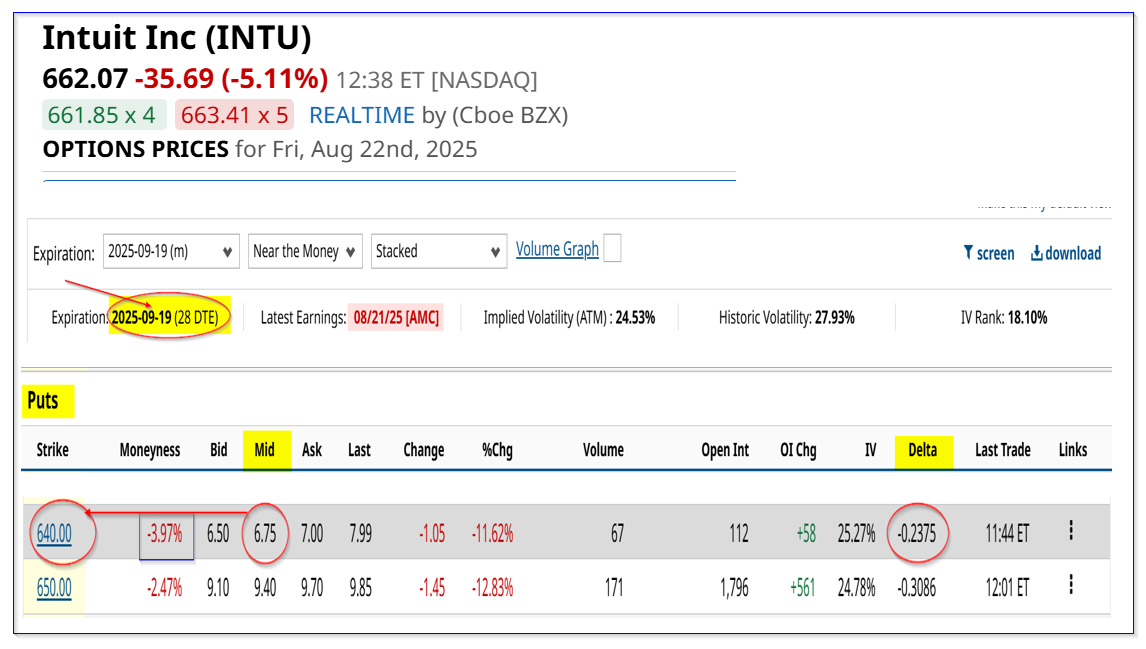

One way to play this, by setting a lower buy-in point and making income while waiting, is to short out-of-the-money (OTM) puts in nearby expiry periods.

Shorting OTM INTU Puts

For example, look at the Sept. 19, 2025, expiry period for $640 put option strike price, which is 4% below today's price (i.e., is out-of-the-money or OTM). It shows that the midpoint premium is $6.75.

(Click on image to enlarge)

That means that a short-seller of these premiums (by entering an order to “Sell to Open” these puts after securing $64,000 in collateral with the brokerage firm), can make immediate income of $675.

That provides an immediate yield of 1.05% over the next 28 days (i.e., $675/$64,000).

Moreover, there is a low delta ratio of just 23.75%. That implies a less than 24% chance of INTU stock falling to $640 in the next month based on past trading patterns.

But even if that happens, the investor's collateral will be used to buy 100 shares. But the breakeven point will be $640-$6.75, or $633.25, which is 4.35% below today's price.

That breakeven point provides an even better potential upside. For example, if INTU eventually rises to $734.09, the lowest price target we forecasted above, the potential upside is:

$788/$633.25 = +24.4%

The bottom line here is that this is a cheap way to play INTU stock and get paid waiting for a lower potential buy-in point.

More By This Author:

Coinbase Has Heavy Options Trading As Bitcoin Falls - Unusual Call Option Activity

Palo Alto Networks Stock Is A Favorite Of Value Investors After Its Latest Results

Cisco's Strong Free Cash Flow Could Make CSCO Stock Worth 14% More