How To Stop Getting Whipsawed On Volatile Sessions

Image Source: Pexels

Friday was quite the mess; triple witching, three Fed speakers, and a long weekend ahead of it. It was the kind of session that chews up futures traders and spits them out.

Gold dropped 85 points in minutes. The Nasdaq whipped 20 points in both directions before most traders finished their coffee. Every breakout reversed, and every signal faked out. And yet there's a way to trade days like these without getting destroyed.

The Problem With Futures on Choppy Days

You know the pattern. You get a clean breakout signal. You enter. The trade moves against you immediately. You get stopped out. Then the market reverses and runs to your original target without you. Wash, rinse, and repeat.

On Friday, gold gave a bearish divergence signal. It never confirmed. Instead it reversed into a hidden bullish divergence. Then that signal triggered a breakout. Then that breakout failed and whipped back down.

Three signals, three reversals, and three potential stop-outs if you were trading futures the normal way. This is where most traders lose money. Not on trending days, but on the choppy sessions where nothing follows through.

The Zero DTE Alternative

Instead of taking futures trades with tight stops that get hunted, I use a different approach on volatile days.

I buy zero DTE options on XSP for about 40 to 45 cents per contract. That's my entire risk. No matter how wild the swings get, I cannot lose more than what I paid. No stop hunts. No margin calls. No watching my P&L swing wildly with every tick.

Then I wait for a 10-point move in the ES. That 10-point move in ES futures translates to roughly a one dollar move in XSP. When that happens, the option I bought for 40 cents is now worth around 60 cents. Here's where it gets interesting.

Turning Winners Into Free Trades

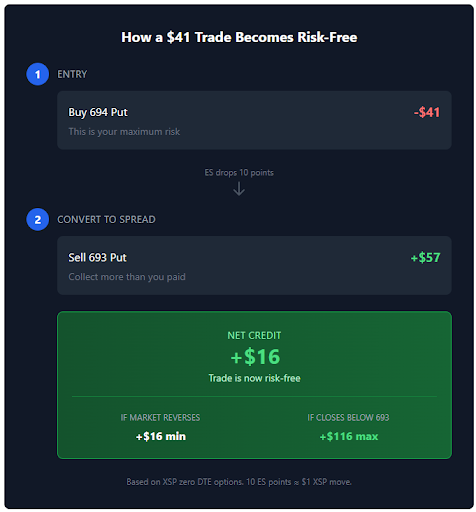

Once I have that 10-point move, I sell the next strike out for 50 to 60 cents. If I bought the 694 put for 40 cents and the market drops 10 points, I sell the 693 put for 57 cents. I just collected more than I paid. The trade is now risk-free.

If the market reverses after that, I don't care. I'm already guaranteed a small profit or I break even at worst. But if the market keeps moving in my direction and closes past my short strike, that $1 wide spread becomes worth $100.

I paid 40 cents and collected 57 cents, with a potential payout of $100 or more per contract.

The Real Numbers

I've been tracking this approach for a while now. The results break down roughly into thirds. About one-third of the time, the trade never gets the 10-point move I need. I lose my 40 to 45 dollars per contract. It's a full loss.

About one-third of the time, I get the move, convert it to a risk-free trade, but the market reverses before hitting my target. I make somewhere between zero and 20 dollars.

About one-third of the time, the market follows through and I capture the full spread value. That's 100 dollars or more per contract. Lose 45, make 10, or make 100. The math works even with a low win rate.

Why This Works on Volatile Days

Friday was a perfect example of how this works.

The ES bounced off the VWAP and the zero line on the monkey bars. I saw bullish divergence stacking up on the charts. The setup suggested at least a 10-point bounce was possible. I bought two contracts of the 693 put for 41 cents each. The total risk was 82 dollars.

The market cooperated. It dropped toward my target zone. I had a working order to sell the 692 put for 57 cents. Even while waiting for the fill, the trade was already profitable. The swings that would have stopped me out of a futures position three or four times didn't matter. My risk was defined from the start.

The Setup Criteria

Not every moment works for this approach. You need specific conditions.

- First, you need a clear directional signal. Divergence at a key level. A one-candle reversal at the VWAP. Something that suggests at least a 10-point move is probable.

- Second, you need options priced around 40 to 50 cents. This gives you enough room to sell the next strike for more than you paid once the move happens.

- Third, you need the move to happen relatively quickly. Zero DTE options decay fast. You don't want to be holding these for hours hoping something happens.

The best setups come after extended moves when the market is due for a bounce or reversal. Oversold conditions at support, and overbought conditions at resistance. Places where a 10-point snap-back is almost expected.

Stacking Multiple Trades

Here's where this approach really shines on volatile days.

If the market bounces 10 points and I convert my put to a risk-free trade, I can then look for a call setup on the other side. If the market drops 10 points from there, I convert that call to risk-free as well. Now I have two positions. Both are guaranteed to pay something. One might hit its full target.

On a day like Friday with three or four major swings, you could potentially stack three or four of these risk-free positions. Not all will hit their max payout. But you're playing a game where the downside is capped and the upside keeps accumulating.

What This Requires

This approach demands patience. You're not trading every five-minute signal. You're waiting for setups at key levels where a 10-point move is likely.

It also demands discipline. You have to let the trade work. You can't panic out when the market swings against you temporarily. Your risk is already defined. Let the structure do its job.

And it requires understanding the relationship between ES futures and XSP options. A 10-point move in ES equals roughly one dollar in XSP. That math is the foundation of the entire strategy.

The Bigger Picture

Days like Friday used to frustrate me. All that movement, all that opportunity, and nothing to show for it because every entry got stopped out.

Now those sessions are some of my favorites. The volatility that kills normal futures trades is exactly what makes this zero DTE approach work. Big swings mean faster moves to my 10-point threshold. More setups, more chances to convert trades to risk-free positions.

The key is having a framework that matches the market conditions. Trending days reward different approaches than choppy days. Using the same strategy regardless of conditions is how accounts get drained.

More By This Author:

If It Comes Back, Do You Want It?Why I'm Only Buying Stocks That Move Less Than The Market

Long Tesla? What You Don’t Know Can Hurt You