How To Make A 2.0% Income Yield In GOOGL Stock Over The Next Month

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

by Markus Mainka via Shutterstock

Alphabet, Inc. (GOOGL) is set to announce earnings early next month. Whether GOOGL stock rises or stays flat, investors can make a 2.0% income yield by shorting one-month out-of-the-money put options.

GOOGL is at $313.02 in morning trading on Friday, Jan. 2, 2026. It's still below $323.44, where it peaked on Nov. 25, but could still be worth considerably more.

(Click on image to enlarge)

GOOGL stock - last 3 months - Barchart - Jan. 2, 2026

I discussed this in several recent Barchart articles, including on Dec. 14, when I discussed how GOOGL stock could be worth $402.54 per share. That is based on its strong free cash flow (FCF) and its FCF margins.

In other words, it has a potential upside of at least $87.00, or approximately +27.5%.

A lot of this will depend on how strong its ongoing FCF margins will be. Alphabet is set to announce its upcoming Q4 2025 earnings around Feb. 4, according to Seeking Alpha.

So, just in case the stock remains flat until then, it might make sense to sell out-of-the-money (OTM) put options to generate extra income.

Shorting Near-Term OTM GOOGL Puts

I discussed shorting Jan. 16, 2026, expiration put options at the $295.00 strike price in my Dec. 14 Barchart article, “How to Make a 1.77% 1-Month Yield in GOOGL Stock - It Still Looks Undervalued.”

The premium received by short-sellers of these puts at the time was $5.23 per put contract. Today, that put option premium has dropped to $1.00. In other words, this has been a successful short play.

That means an investor could enter an order to “Buy to Close” these puts. That would lock in $4.23 in income over the past 2 weeks. That works out to a one-month yield of

$4.23/$295.00 x 2 = 1.434% x 2 = 2.87%

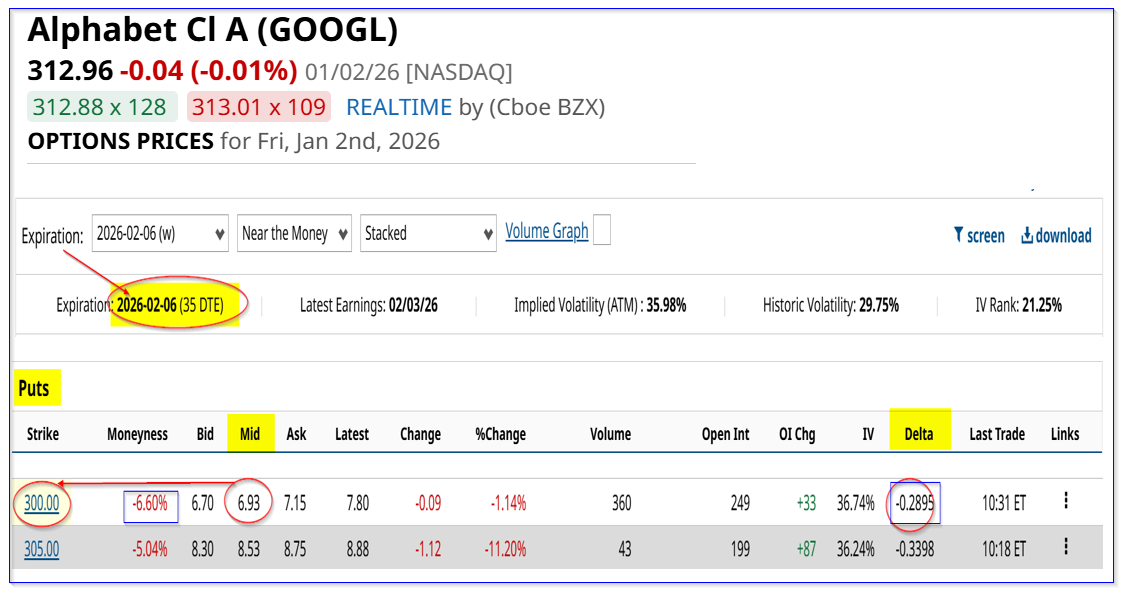

Moreover, this trade can be repeated for the next month. Look at the Feb. 6, 2026, expiration option period. It shows that the $300.00 strike price put option has a midpoint premium of $6.93 per put contract.

This works out to a 2.31% one-month yield (i.e., $6.93/$300.00).

(Click on image to enlarge)

GOOGL puts expiring Feb. 6, 2026 - Barchart - As of Jan. 2, 2026

In other words, an investor who secures $30,000 with their brokerage firm can enter an order to “Sell to Open” 1 put contract at $300.00 for expiration on Feb. 6.

That allows the investor to immediately make $693.00 in their account (i.e., $693/$30,000 = 2.31%).

Note that the $300.00 strike price is still 6.6% below today's trading price, i.e., it's out-of-the-money (OTM). That implies that there is some downside protection.

For example, the $30,000 collateral will not be assigned to buy 100 shares unless GOOGL falls to $300.00 on or before Feb. 6.

Moreover, there is just a 29% chance this will occur, based on its -0.2895 delta ratio. That is based on its historical volatility.

The shows that this play is a good way to make extra income for existing shareholders. Moreover, for new investors, it's a way to set a lower potential buy-in point.

The bottom line is that GOOGL stock is cheap here. Shorting out-of-the-money (OTM) puts is one way to play the stock.

Buying In-the-Money (ITM) Calls

In my last article, I also discussed buying in-the-money (ITM) calls as a way to benefit from any upside in GOOGL stock. An investor can use the short-put income to defray much of the cost of buying ITM calls that are further out in expiration.

For example, the $295.00 call expiring July 17, 2026, cost $44.93 last month. Today, it's at $45.95.

However, an investor would have already collected a net $4.23 and $6.93, or $11.93 in the last two short-put trades. That has lowered the all-in call option cost to just $33.00:

$44.93 call cost - $11.93 put income = $33.00

In other words, the net cost to buy the $295.00 GOOGL calls expiring July 17, 2026, is just $328.00, or less than 5% over today's price:

$295.00 strike + $33.00 = $328.00

$328 - $313 = $15,

$15/$313 = 1.0479 - 1 = +4.79%

Moreover, if an investor can continue to make a 2.0% yield each month for the next 6 months, or $6.00 per month, the total income would be $36.00. That more than covers the remaining $15.00 and lowers the all-in cost to just $292.00

In other words, there would be a net profit of $21.00 even if GOOGL stays flat. That works out to an expected ROI of 7.1% (i.e., 21/$295) over 7 months, or 12.5% annualized.

However, if GOOGL rises to $402, the expected return is $110 (i.e., $402-292 net call option cost), or $11,000 on an average monthly investment of $29,500 to sell short the puts (i.e., 37.3%.) That is better than the 28% expected upside from owning GOOGL shares.

The point is that this is an excellent way to gain upside in Alphabet stock using short OTM puts and long ITM calls.

More By This Author:

Unusual Activity In Occidental Petroleum Call Options - A Signal Investors Expect A Dividend HikeApple Is An Analyst Favorite, But AAPL Stock Has Been Flat - Shorting Puts Is The Best Play

A Less-Costly Way To Buy Costco To Gain Leveraged Upside In COST Stock

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more