Here’s What A One-Year Covered Call In Microsoft Looks Like

In the era of ultra-low interest rates, yield enhancement strategies have become prolific. Actually, let’s take a step back. It used to be that you could generate a reasonable yield from fixed interest investments, like government or corporate bonds. However, with interest rates approaching zero, those types of investments just don’t provide robust yields.

So many investors switched from bonds to stocks, particularly dividend-paying stocks. However, as stock prices continue to rise, yields have dropped on most dividends (and it’s harder to afford to buy those stocks anyhow). Furthermore, many of the best-performing stocks don’t pay dividends. In fact, the trend is for newer companies not to pay dividends at all.

So how can you find an appropriate yield in this environment? That’s where yield enhancement strategies come in – but in particular, covered calls.

A covered call is simply buying the shares of some stock or ETF and selling a call against those shares (1 call per 100 shares) to generate extra income. Done properly, you can make money on stock appreciation and also generate a yield from the short calls.

Depending on your goals, covered calls can have durations from one week to multiple years. Typically you see these trades last for one to three months. However, I just came across a covered call in Microsoft (MSFT) options that could last for a whole year.

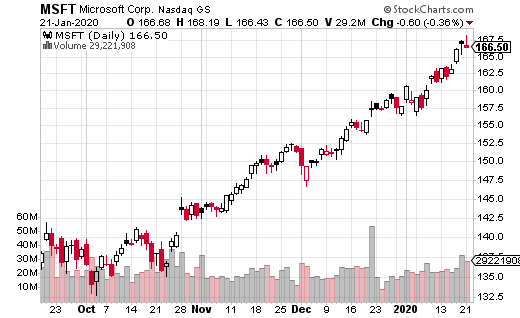

Software giant MSFT is the second-largest public company in the world and has climbed a whopping 57% over the last year. However, it’s safe to assume this sort of share appreciation won’t continue (and it’s a good bet it will at least slow down).

In that case, the dividend becomes more important. However, MSFT’s dividend yield is only 1.2%. So, again, investors essentially are relying on share appreciation in their portfolio, which is far less predictable than income generation from dividends.

This situation can be improved dramatically with covered calls. For instance, the trade I spotted was someone buying 500,000 shares of MSFT for $167.72, while selling 5,000 January 2021 175 calls for $11.80. The position collects nearly $6 million in premium, which amounts to an annual yield of 7%.

Okay, in a low rate environment, a 7% yield is not bad at all. And while MSFT shares may go down in value, the stock isn’t likely to crash. In fact, if the person making this trade doesn’t plan on closing the shares at the end of the trade (perhaps rolling out the calls or selling new ones), then the underlying price of MSFT doesn’t even matter all that much (to some extent).

What’s more, there is also some built-in upside potential for this trade. The gains are capped at $175 because that is the short strike of this covered call. But, it does provide a bit over $7 of stock appreciation before the cap is hit.

If this is the sort of trade you are interested in, it’s easy enough to emulate in your own account. Of course, buying MSFT shares isn’t cheap – but if you already own them, you can just do the short call part of the trade to generate some extra yield for the next year.

This chart could make today the easiest time in history to retire and feel rich while doing it.