Gamma Gamma Bo-Bamma, GEX

I would like to introduce you to the GEX which is short for “gamma exposure”. Basically, it’s the numerical sum of all the long gamma minus all the short gamma on S&P500 options (not SPY).

If you’re not familiar with gamma, here is the official definition:

“Gamma is the rate of change for an option’s delta based on a single-point move in the delta’s price. Gamma is at its highest when an option is at the money and is at its lowest when it is further away from the money.”

According to their (Squeezemetrics) whitepaper they calculate it as follows:

- the gex of a contract is “open interest” * gamma * 100 * k, where k = 1 for calls and -1 for puts;

- the GEX is the sum of the gex of each contract for all the available contracts;

- the value obtained in the previous point is denominated in shares, so to get the dollar notional value we multiply by the share price.

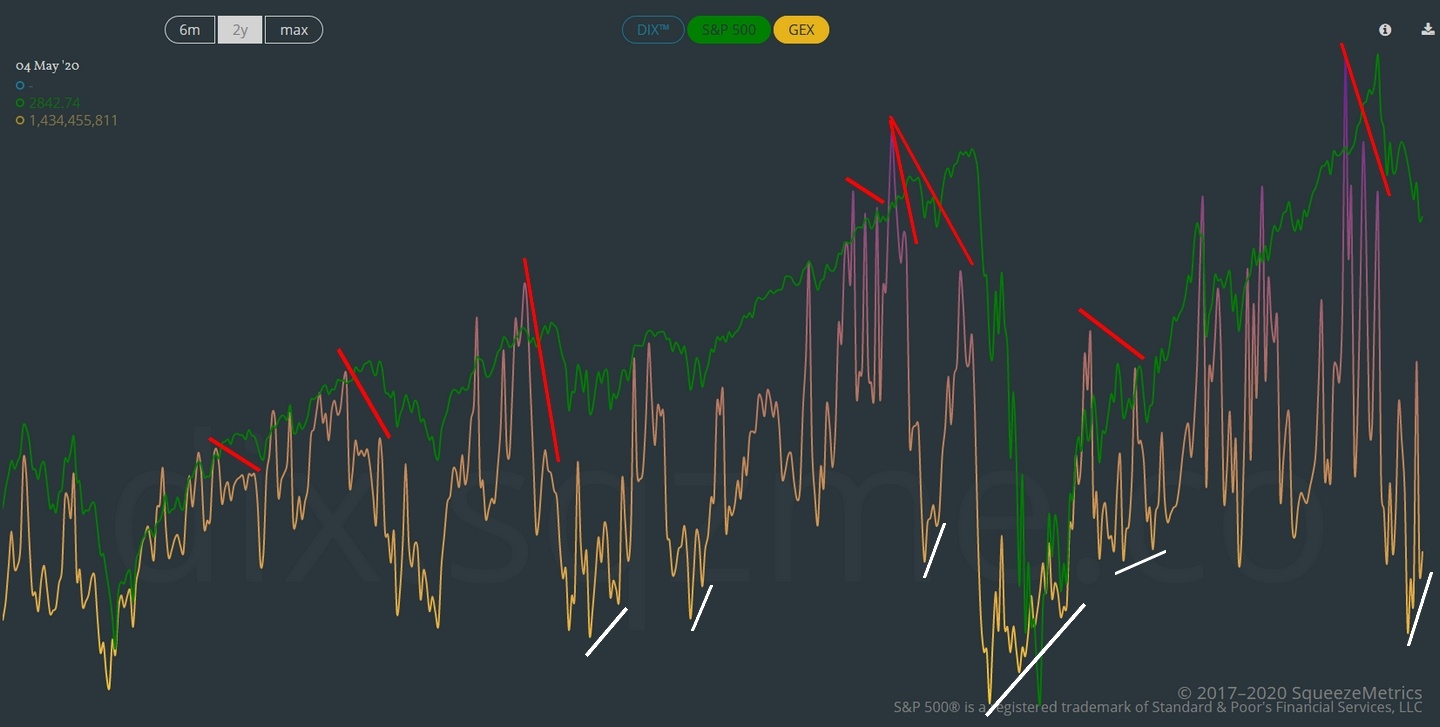

Here is the GEX chart. All you have to do to access is click that little button at the top of the screen labelled “GEX” (and unclick DIX for visibility reasons). Simple enough, right?

The site is here.

GEX has a high tendency to diverge at tops and bottoms. Note the positive divergence in place right now. I think it’s important not to jump the gun too quickly and I’ll let you study the chart to make your own conclusions, but I find that waiting for a trendline break is best. For instance, in the March decline, there was a recognizable higher low around Mar 12th, but SPX kept dropping until Mar 23rd. My advice is to avoid that heat, but recognize that a trendline break after a GEX divergence is very affirming to the likely direction to follow.

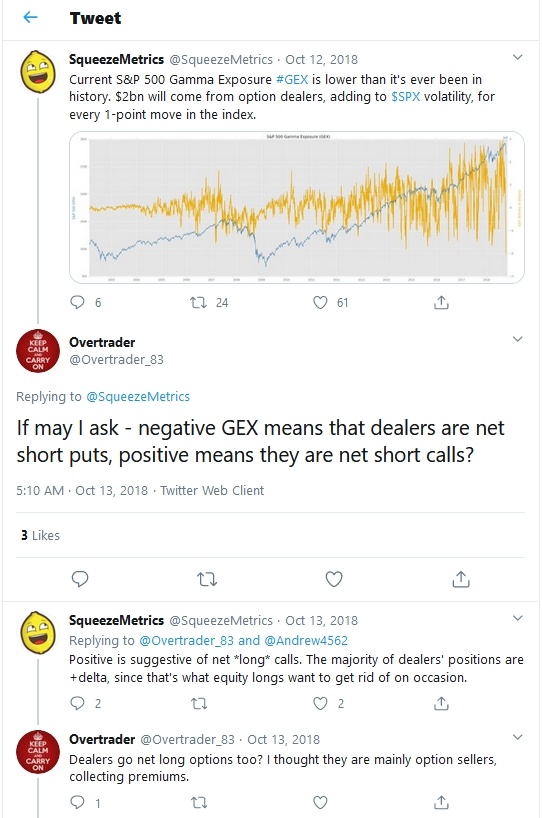

In looking for a GEX definition for this post, I came across this little discussion at Squeezemetrics site. Note that this is from Oct 12th, 2018, NOT NOW.

Hope this helps you all make stronger trading decisions. Go get ’em!