Gaming & Leisure Properties: 5.64% Dividend Yield, Income Plays

Gaming & Leisure Properties (GLPI) owns real estate in the casino gaming and leisure area and its dividend now yields 5.64%. In addition, the REIT's near-term out-of-the-money (OTM) put and call short premiums are high making them attractive as income plays.

As a result, the stock started moving up from its lows of $47.60 earlier this month. In the last month it is down 1.77% and YTD it is up over 3.0%. This makes it an extremely good time to take a position in the REIT stock.

Good Portfolio and Cash Flow

The GLPI portfolio was formed from the 2013 spin-off of the Penn Entertainment (fka Penn National Gaming) (PENN) casino properties. Its 57 gaming and leisure properties are mostly mid-West casinos under the Hollywood and Ameristar brands, along with 12 other land and riverboat brands.

The leases are all triple-net which means that the casinos, not GLPI, have to pay for the upkeep. This lowers the capex requirements for GLPI and indeed allows it to have tremendous free cash flow (FCF).

For example, last quarter the company reported on July 28 that its adjusted funds from operations (Adj. FFO) was $231.6 million compared to $203.8 million last year. This represents an increase of 13.5% YoY.

On a per-share basis, this AFFO works out to 91 cents, which more than covers the 70.5 cents quarterly dividend. As a result, the annualized $2.82 dividend represents an extremely attractive and secure dividend yield of 5.64%, based on its closing price of $49.98 as of Sept. 9.

Attractive Short Options Income Plays

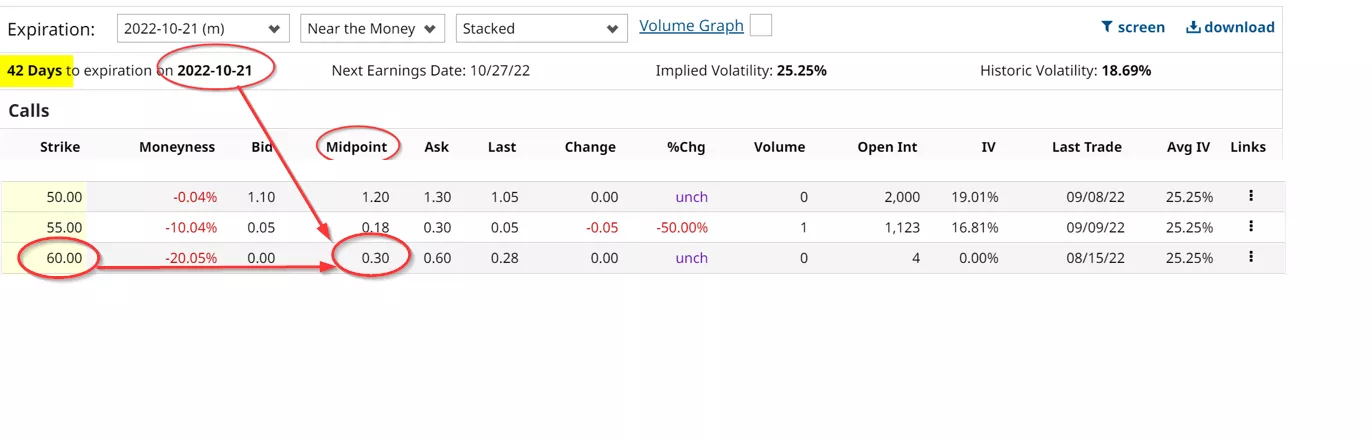

GLPI stock has attractive near-term short put and call option income plays. For example, the Oct. 21 option chain below shows that the $60 strike price offers premiums at the midpoint price of 30 cents.

This means that 42 days from now unless the stock rises over $10 to $60 (or over 20%) the covered call investor who bought 100 shares for $4,998 not only keeps the $30 he collected, but he can also do the same thing for the next month. That represents a gain of 0.60% for a month and a half investment. This annualized out to a 4.80% yield. And remember that is on top of the 5.64% dividend yield that an investor makes, as long as the stock does not rise to $60 or higher by Oct. 21.

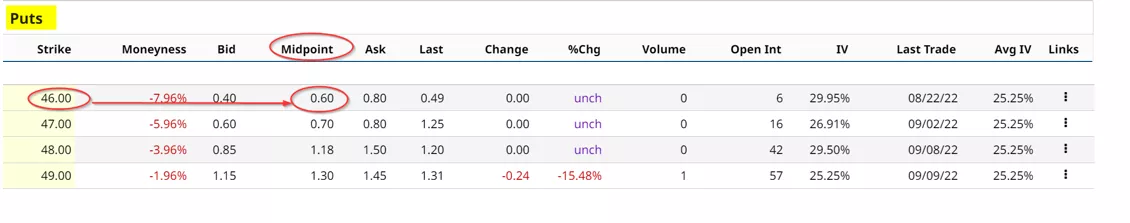

In addition, the cash-secured put income play is even more profitable. For example, the Barchart option chain below shows that an investor can receive $60 per put option contract sold at the $46 strike price.

This means that a short put investor makes a return of 1.30% (i.e., $60/$4,600) for an investor if the stock falls to $46.00 and the $46.00 strike price put is exercised.

However, the short put investor does not have the chance of making a capital gain like the covered call income investor has, and he does not make any dividend income.

This is why sometimes investors do both short puts and short calls at the same time.

Either way, this stock looks very attractive to income investors, both from a dividend yield standpoint and using short puts and calls.

More By This Author:

Credit Karma Gets In Trouble With The FTC

Microsoft Looks Cheap Now With Attractive Option Income Plays

Shell Looks Particularly Cheap As An Energy Stock

Disclosure: None

Mark R. Hake, CFA, does not provide financial advice and you should not rely on my analysis to buy or sell any stock. I am not undertaking to induce you to buy or sell any ...

more