From $3 To $22 In Two Days

Image Source: Pexels

That 197 call on Wednesday for Friday was $3. It finished the week at $22.

Nineteen dollars per contract in forty-eight hours while everyone else was arguing about China trade deals.

This wasn't luck.

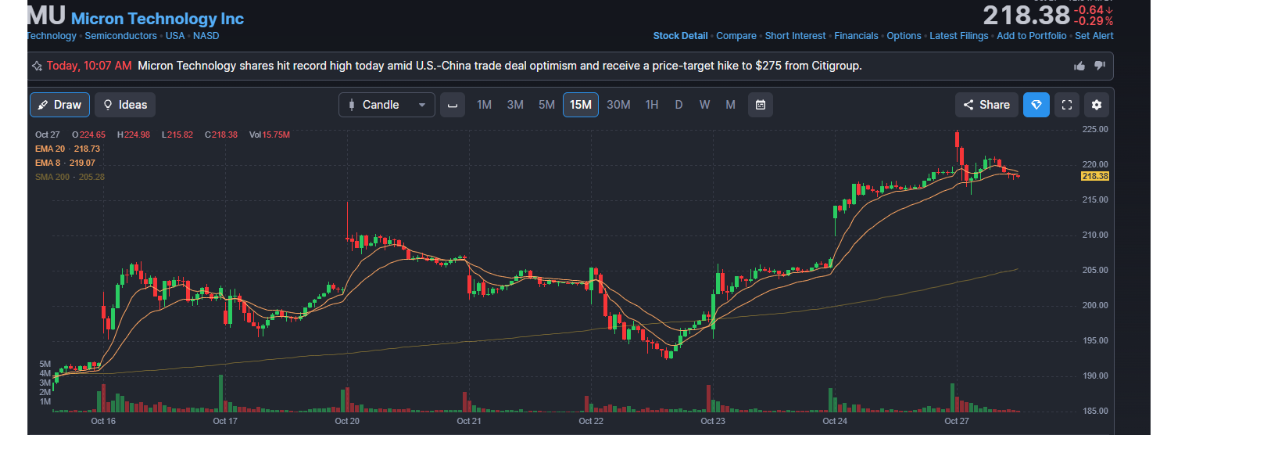

This was watching an 8-day EMA cross a 20-day EMA on a 15-minute chart and understanding what institutional money does at those crossings.

The Breakdown Nobody Saw Coming

While momentum chasers were piling into Micron (MU) near $209, my 15-minute chart was flashing red. Smart money was taking profits. Algorithmic selling was about to begin.

Fifteen times eight is 120 minutes. When momentum breaks on this timeframe, it doesn't whisper - it screams. Micron dropped $17 in two sessions, then slingshot back $28 higher. Wednesday afternoon, Micron bottomed at $192. The chart showed the 8 EMA trying to cross back above the 20 EMA. This is the slingshot setup - the harder something gets pulled back, the more violent the snap forward.

(Click on image to enlarge)

Why the $197 calls?

Because when these momentum names reverse, they don't bounce - they explode back toward previous highs. The leverage was mathematical, not emotional.

Systems Over Stories

Here's what I track:

- 8/20 EMA crossover on 15-minute charts

- RSI positioning for entry timing

- Volume confirmation on the reversal

- Options liquidity for clean execution

Names near 52-week highs with tight option spreads. Ark Innovation, AMD, Nvidia, American Express. Not because I believe in their stories, but because they have the volatility to generate these moves.

Why Headlines Are Noise

A 633% gain on Micron, while everyone else was debating whether this China trade deal was real.

They were analyzing memory demand cycles and writing research reports.

The 15-minute chart doesn't care about fundamentals.

It shows you institutional positioning as it happens. By the time news reaches retail, it's already priced in.

The Mathematics

The purpose of the market is to sell. You can make money both directions if you focus on names with high volume and tight option spreads.

Eighty percent probability of profit, twenty percent return. Do that trade five times during the year, you double your money. Simple math. The only variable is execution discipline.

This Week's Targets

Ark Innovation is particularly interesting right now.

Cathie Wood's momentum tracker with no real strategy beyond "buy AI-related stuff." That's exactly what makes it perfect for slingshot setups. Pure technical trading on pure momentum.

I don't care what Micron makes. Memory chips, gummy bears, doesn't matter. All I care about is: is the stock going up or down? The system doesn't care about the stories. It cares about the crossovers.

More By This Author:

And There Goes Tech, Again

The Fed Quietly Gave Up On 2% Inflation

The Quantum Computing Trade

Neither TheoTrade nor any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, registered ...

more