Facebook: An Interesting Covered-Call Writing Candidate

When investors hear about covered-call writing for the first time and the opportunity to generate instant cash flows into their brokerage account, they get super excited about it. However, most retail investors continue to make huge mistakes with this strategy supposing it's a free lunch. Every strategy has its advantages and limitations, no doubt about that, but in the end, it's all about understanding and mastering those aspects to use them in your favor. To learn more about the basics of covered-call writing, you can go to my website where I provide coaching videos for premium members.

In this article, I'll discuss a defensive setup with Facebook (FB), as this stock can be a very compelling vehicle for covered-call writing if you stick to your own targeted monthly return and risk tolerance. In my case, I'd be happy with a consistent initial one-month return of 2%-4% like I highlighted in my portfolio review of January.

Option Selection

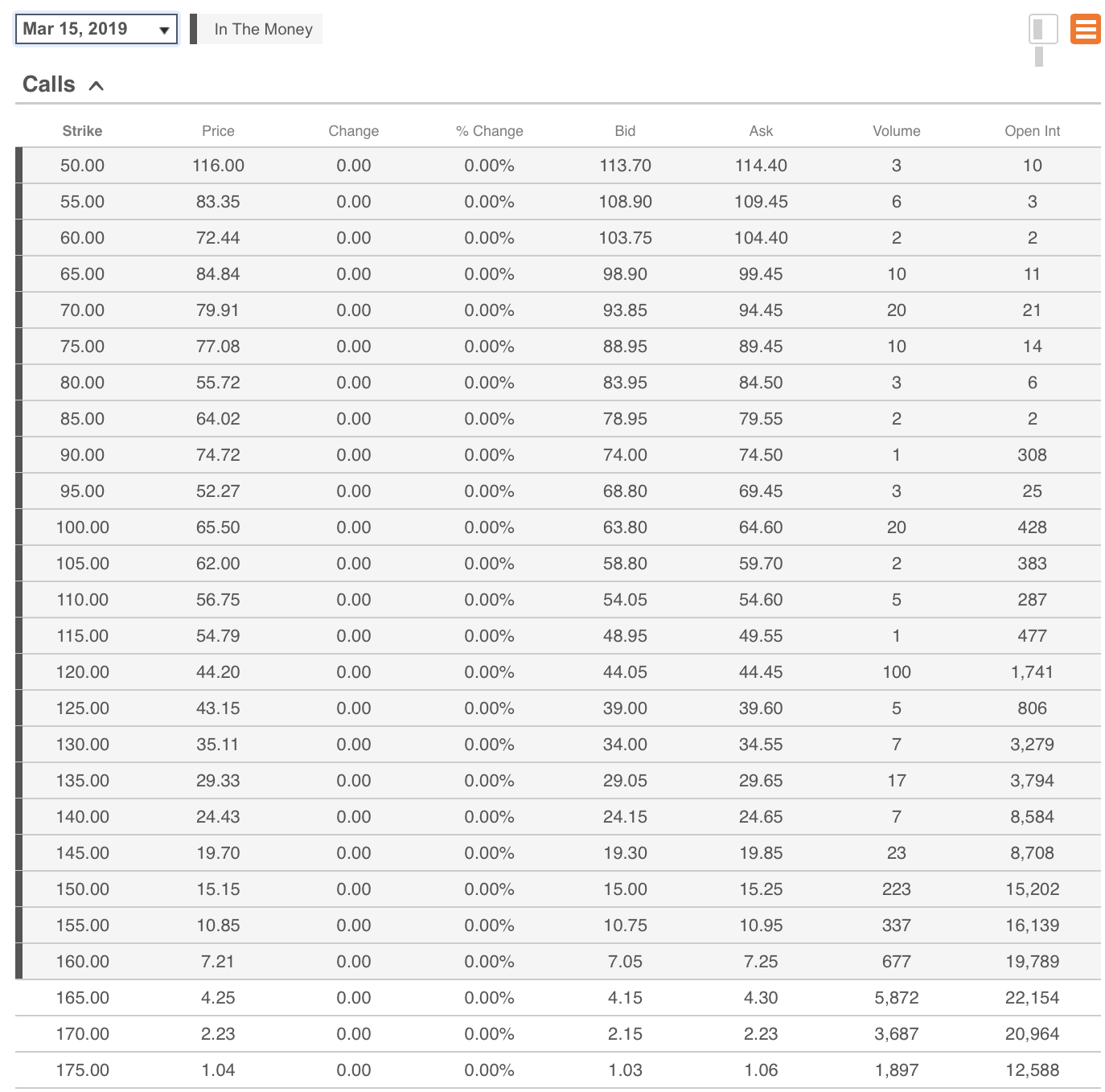

Assessing the Options Chain (expiration date is March 15, 2019)

First of all, let's take a look at Facebook's options chain and assess time value returns, downside risk protection, and breakeven levels.

(Source: Seeking Alpha)

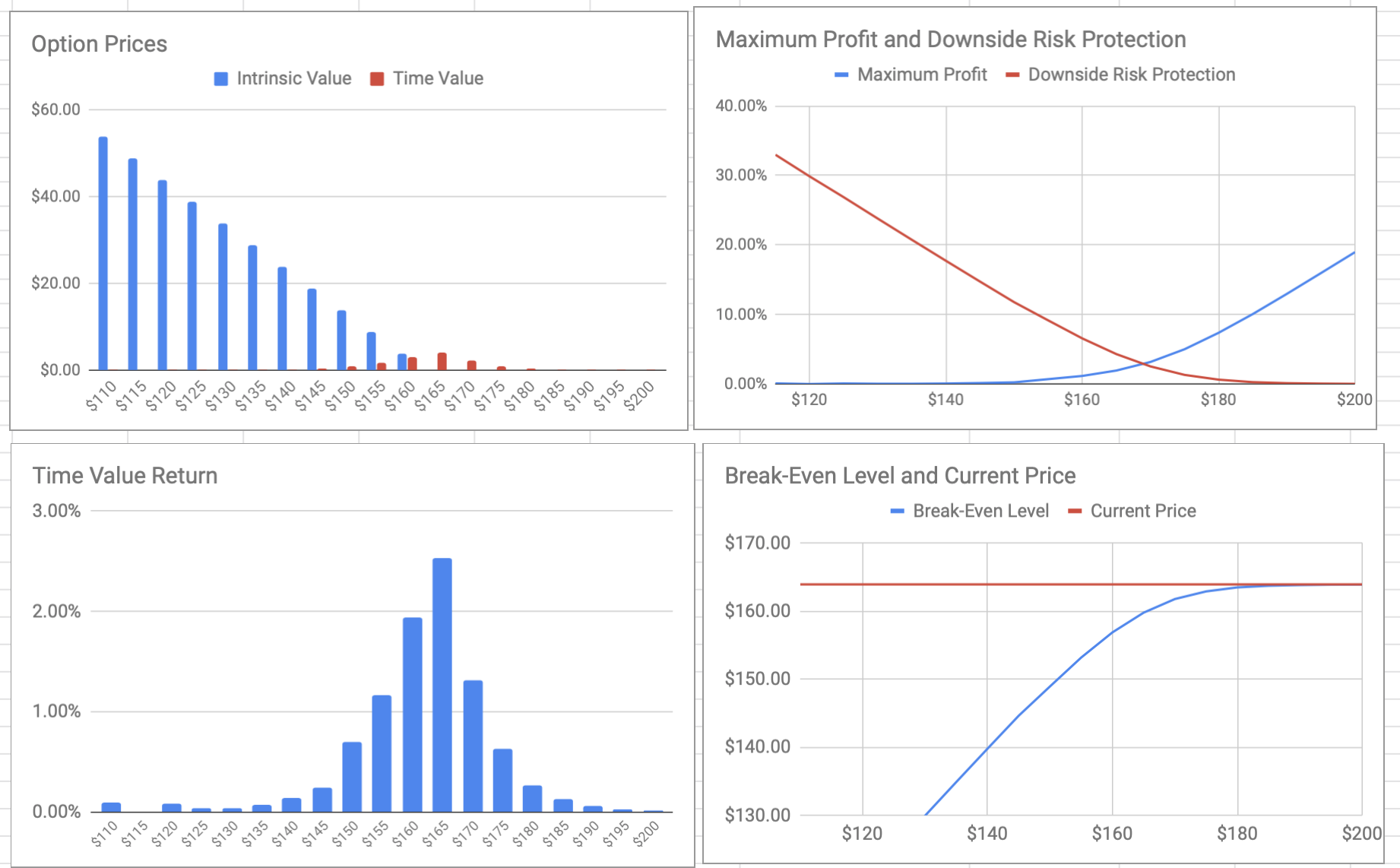

Let's see how these numbers play out. Therefore, I need to feed the options chain into the following table:

(Source: Author's work)

It’s important to note that even in-the-money contracts generate annualized time value returns of more than 25% as a result of reasonably high volatility.

For instance, the $160 calls generate a maximum profit of 1.94% with total downside risk protection of 4.3%. This makes a lot of sense for defensive investors feeling the chart technicals are mixed or when the market is volatile. No matter into which direction the price is heading, you still capture that one-month maximized return of 1.94% unless shares drop below $160. Your breakeven level is a comfortable $156.90. On the other side of the spectrum, bullish investors can choose the out of the money calls with a strike price of $170. Selecting this strike allows you to generate a maximum profit of 5.00%, of which 1.31% is time value.

My Moderately Bullish Setup: Slightly Out-Of-The-Money Calls

If I sell the $165 call, total maximum profit would amount to our collected time value ($ 415 for 100 shares) and additional share price appreciation to $165, adding another $1.05 per options contract. Our breakeven level stands at $159.80, reflecting downside risk protection of 2.53%. We would lag the ordinary investor if the price goes above $169.15.

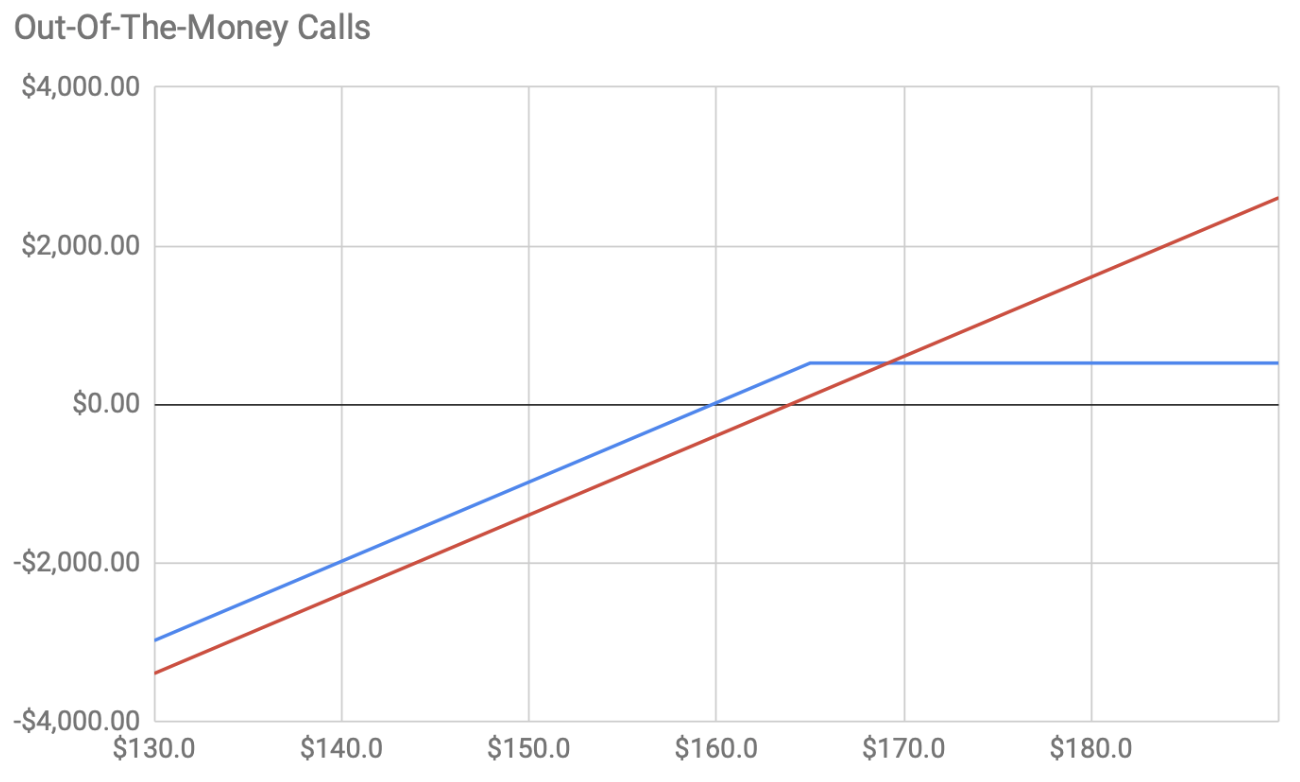

Profit And Loss Graph

(Source: Author's work)

With our breakeven level and maximum share price profit highlighted in the following graph, this trade setup offers an attractive risk/reward ratio when looking at Facebook’s chart technicals.

(Source: marketscreener.com)

Managing Our Trades

Covered-call writing is not a lazy strategy whereby you just have to sit back and collect time value along the way. It's about looking closely at the time value remaining in your option contracts sold and your breakeven level. In Facebook’s case, let's assume shares rise above $175 in a short period of time. We've agreed to sell our shares for $165, which means that this strike is in-the-money with less time value remaining in the contracts we’ve sold. If we decide to unwind our position, we will elevate our profits to the highest possible levels as time value of the initially sold contracts approaches zero. So, when there's enough time left until expiration Friday and the cost-to-close is low, we can move on the next trade with the same cash in the same month. As such, our maximized return of 3.17% can be improved by a new trade setup in an entirely new position. But therefore, you need to feed the options chain into your calculator to see whether it is appropriate to close your position faster than initially anticipated. I often use different types of exit strategies to enhance my maximum one-month profits.

Investor Takeaway

Selling the $165 call against Facebook provides opportunities for covered-call writers who want to generate an initial one-month return of 3.17% while generating an additional $1.05 if the price goes up to the strike price. Depending on Facebook’s future price action, we may institute an exit strategy to enhance our total one-month return.

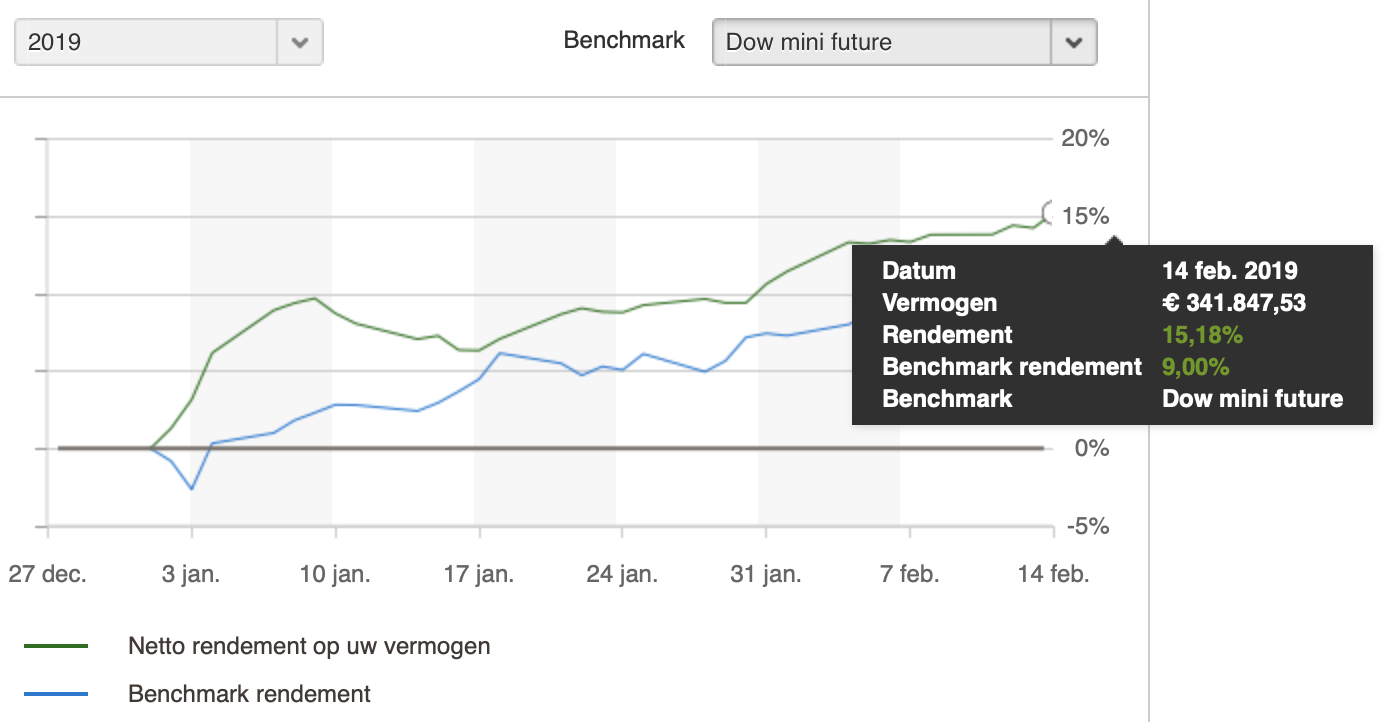

So far this year, my covered-call writing portfolio is up by 16.2% year-to-date. You are always free to join my community and start generating reliable monthly cash flows!

Nice idea!