E-Mini S&P 500 Plain Observations (SPX)

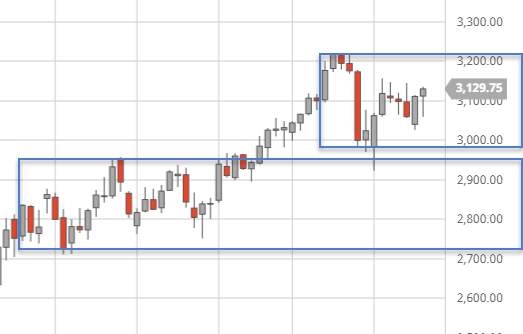

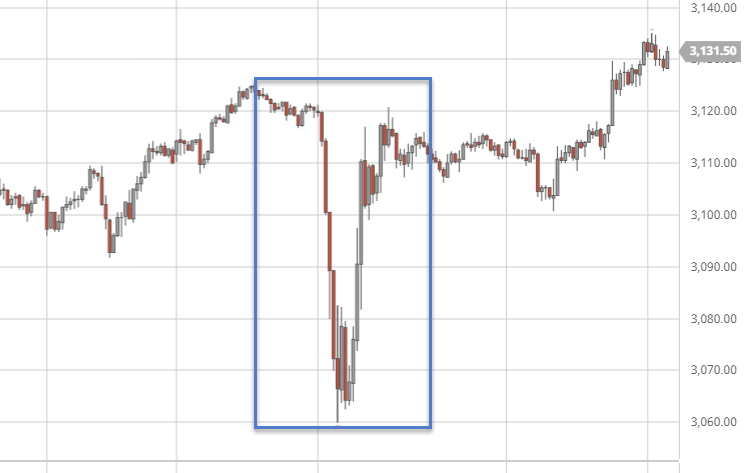

Well, the market still testing the mean of the prior pullback on the daily periodicity with some resistance. In the early overnight session the market seemingly broke lower but corrected that movement as quick it was dropping on the lower perspective, establishing a pattern which I call "V inventory correction" or a "repair". Happened dozen of time in this market - either it will revisit that price range to repair it or we will see a surge higher which happened most of the cases as much I can remember. It depends on the reaction around the mentioned resistance level.

Currently, the market is quite rotational on the hourly periodicity; therefore we can leaning us on the balance extremes again. Looking for any bearish patterns such as absorption or swing failures to conclude the next rotation lower as the market testing the bracket's high should be a good idea in my opinion. Depending on the reaction around the bracket's high now.

Quick view on the HTF: The weekly perspective still with the outside bar (a sign of a possible change in the overall market context) in mind which brought the market from a bullish to a balanced structure. And the monthly with an inside month break higher testing the higher macro extreme. Perhaps the market tries to establish a macro balance area.

Visit our trading community to learn a more indepth analysis process with various tools such as the VWAP or Footprint chart.

Disclosure: ...

more

Good read.