Dividends And Option Premiums: A Dual Income Story

Income generation may be sought out by a variety of market participants, including those nearing retirement and those seeking a source of passive income. An income-focused strategy requires a different approach to those focused on generating growth. Traditional sources of income include dividend-paying stocks and coupon-paying bonds. The economic landscape of the past 18 months has been shaped by persistent inflation, rising interest rates and general market uncertainty, all of which have negatively affected the performance of these traditional strategies.

To help diversify risk and add incremental income, market participants might look for non-traditional sources of income generation such as a covered call strategy. The Dow Jones U.S. Dividend 100 3% Premium Covered Call Index and the Dow Jones U.S. Dividend 100 7% Premium Covered Call Index are designed to measure the performance of a long position in high-dividend-yielding stocks and a short position in a standard S&P 500® monthly call option.

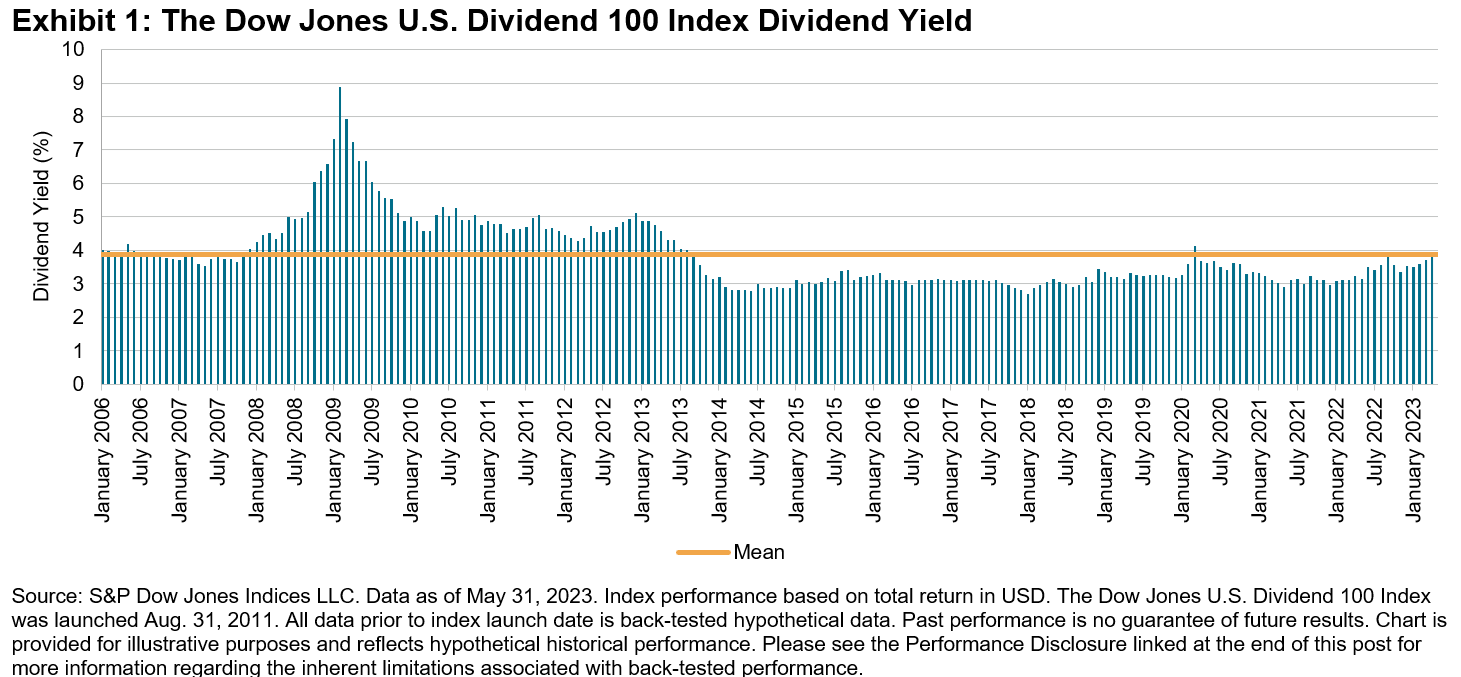

The underlying equity index used for the Dow Jones U.S. Dividend 100 Covered Call Indices is the Dow Jones U.S. Dividend 100 Index, which measures the performance of high-dividend-yielding U.S. stocks. Since 2006, the Dow Jones U.S. Dividend 100 Index has posted an average dividend yield of 3.88% (see Exhibit 1), comfortably outperforming the S&P 500 Dividend Aristocrats® (2.58%) and the S&P 500 (1.95%).

(Click on image to enlarge)

A covered call strategy involves selling a call option on a long equity position. If the asset’s market price exceeds the option’s strike, a rational option buyer would exercise the contract and obligate the option writer to sell the asset or settle in cash. The main potential benefits of this strategy are the cash flow generated from writing the calls—option premiums—and the limited downside protection that the premiums can provide. Similarly to dividends, the cash flow received from option premiums can mitigate the effects of down markets. The main drawback of a covered call is the limited upside potential of the equity position. Covered call strategies are particularly relevant during volatile market conditions. Option premiums tend to increase as volatility rises, offering the potential for greater income generation and added downside protection.

(Click on image to enlarge)

What makes the Dow Jones U.S. Dividend 100 3% Premium Covered Call Index and the Dow Jones U.S. Dividend 100 7% Premium Covered Call Index unique is that they combine a traditional dividend-paying income strategy and a non-traditional covered call approach. Both indices reflect the same dividend yield as the underlying Dow Jones U.S. Dividend 100 Index, which has averaged 3.88% since 2006. In addition, each index targets a specific premium yield of 3% and 7%, respectively.

Historically, these indices have adjusted their coverage ratios and successfully achieved their target yields (see Exhibits 3 and 4). The coverage ratio is defined as the notional value of the short call position as a fraction of the long equity notional amount. For example, a coverage ratio of 100% means that calls were written against the entire value of the long equity position, while a coverage ratio of 25% signifies that the value of the calls represents one-fourth of the equity position. The dynamic nature of the coverage ratio provides the index with some downside protection (from the covered short position) as well as exposure to equity upside (from the uncovered long equity position).

For market participants searching for two sources of income, adding a covered call overlay may provide incremental income beyond what could be accessed from a purely dividend-paying equity index. The option for target yields of 3% or 7% provides the ability to choose the ideal upside potential.

(Click on image to enlarge)

More By This Author:

Hot Temperatures And A Hot Start To The Second Half Of 2023 For Commodities

Mean Reversion

Energy Transition Progression In H1 2023

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.