Cisco Stock Moves Higher As Analysts Raise Target Prices - Short Put Plays Work Here

/Cisco%20Systems%2C%20Inc_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Piotr Swat via Shutterstock

Cisco Systems (CSCO) stock benefits as analysts have been raising their target prices for CSCO stock. Shorting out-of-the-money put is an excellent way to play this. It works best in one-month expiry periods and is then repeated. This article will describe this strategy.

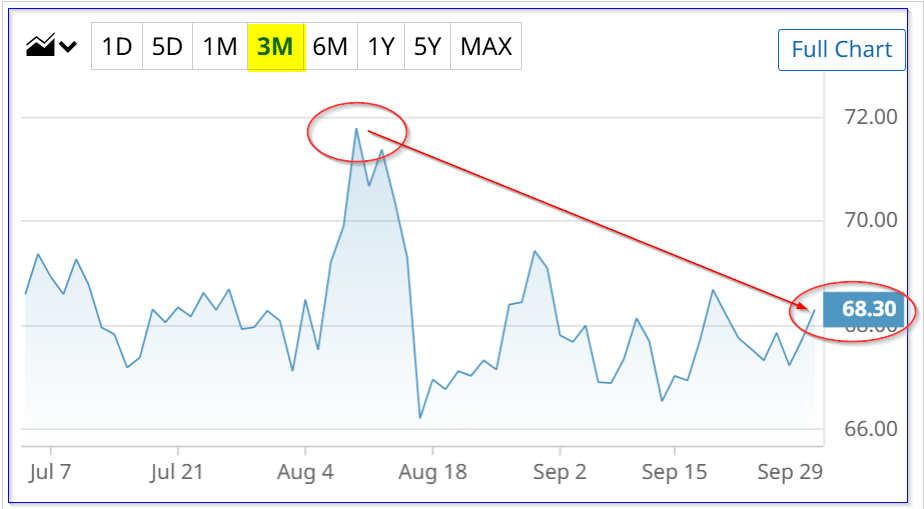

CSCO is at $68.20 today, up slightly, but still down from a recent peak of $71.79 on August 8. That was just before its earnings release on Aug. 13 for the fiscal year ending July 31.

(Click on image to enlarge)

CSCO stock - last 3 months - Barchart - As of Sept. 30, 2025

I discussed how cheap CSCO stock was in my Aug. 18 Barchart article, “Cisco's Strong Free Cash Flow Could Make CSCO Stock Worth 14% More.”

FCF-Based Target Price Update

In the article, I showed that CSCO could be worth $75.81 per share, an 11% upside from today's price. This was based on analysts' FY 2026 (7/31/26) revenue estimates of $60 billion for FY 26 (upper end of management's guidance).

For FY 2026, we can use a 25% FCF margin estimate, as this is higher than the FY 2025 23.46% FCF margin, but lower than the 27.4%, according to Stock Analysis data on Cisco. As a result, FCF next year could be $15 billion (i.e., 0.25 x $60b).

Next, using a 5% FCF yield metric, the same as a 20x FCF multiple (i.e., 1/0.05 = 20), Cisco's market cap could rise to $300 billion:

$15b FCF x 20 = $300 billion market capitalization

That is $30 billion over today's market cap of $270.695 billion, according to Yahoo! Finance. So, the target price is +10.83% (i.e., $300b/$270.695b) higher:

$68.20 x 1.1083 = $75.62 target price

Analysts Have Raised Their Targets

For example, Yahoo! Finance shows that 26 analysts now have a $76.10 price target, up from $75.58 seen in my Aug. 18 Barchart article over a month ago.

Similarly, Barchart's mean survey price is now $76.58, up from $75.06.

Similarly, AnaChart.com, which tracks recent analyst write-ups, reports that the average of 21 analysts is $78.19. That is higher than $77.17 a month ago.

The point is that analysts are continuing to raise their estimates of Cisco's value, as they see the company's strong free cash flow and FCF margins improving.

Shorting Cash-Secured Puts to Set a Lower Price and Gain Income

One way to play CSCO stock is to short out-of-the-money (OTM) puts in one-month expiry periods. That way, an investor can potentially buy CSCO at a lower breakeven price after gaining extra income from the short-sale of OTM puts.

For example, in my Aug. 18 Barchart article, I recommended selling short the $64.00 strike price put option expiring Sept. 19 when CSCO was at $66.50. So, it was 3.76% below the trading price, and the income received was 62 cents per put contract (i.e., $62 for every contract after securing $6,400 in collateral).

That means the investor made a one-month 1.0% yield (i.e., $62/6,400 = 0.97%), as it expired out-of-the-money (CSCO closed at $68.21 on Sept. 19).

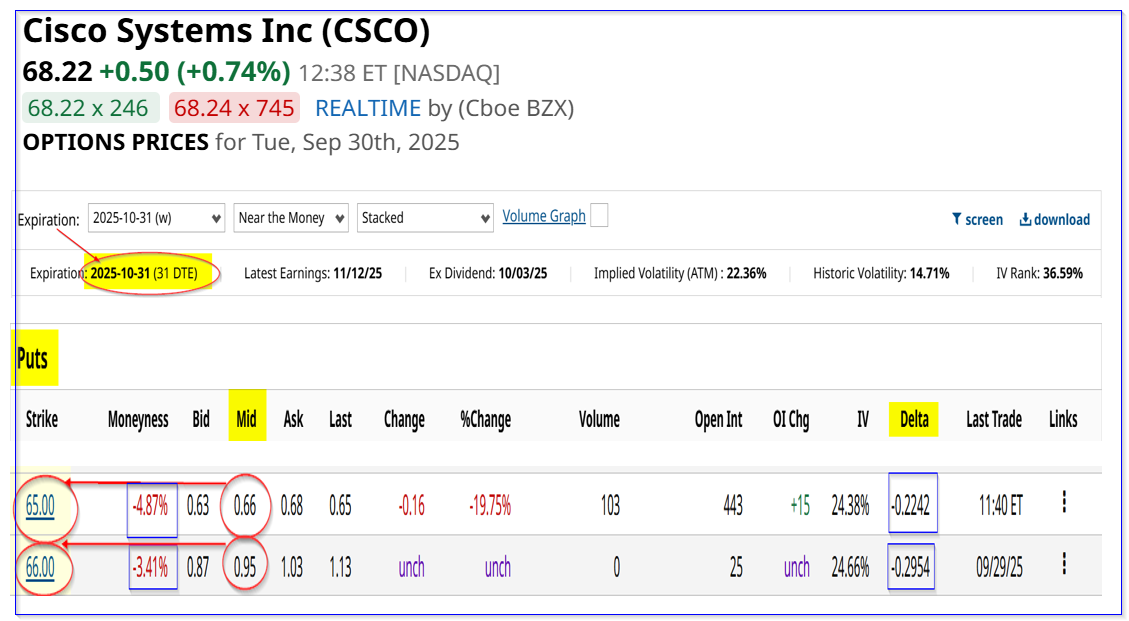

This 1% 1-month short-put play can be repeated. For example, in the Oct. 31 expiry period, the $65.00 strike price put option has a $0.66 midpoint premium, for a 1.01% yield, and the $66.00 put has a $0.95 premium, for a 1.439% one-month yield.

(Click on image to enlarge)

CSCO puts expiring Oct. 31 - Barchart - As of Sept. 30, 2025

These two strike prices are out of the money by 4.87% and 3.41%, respectively, or just over 4%, about the same as last month. But the average one-month yield is now higher:

(1.01% + 1.439%) / 2 = 1.223%

In other words, an investor who invests $6,500 and $6,600 for both of these short put plays will make $161 ($66+95) for 1.223% over one month:

$161 / $13,100 = 0.0123 = 1.23% yield

So, over the past two months, the expected return (ER) is now 2.223% (i.e., 1% +1.223%). If the investor can repeat this over the next 6 months, the ER is

2.223% x 3 = 6.669% 6 mo ER

Downside Risks

Note that this also lowers the investor's overall breakeven point from accumulated income, each time the short put is repeated.

That assumes that CSCO does not fall to the OTM strike prices and stays flat or slowly moves higher. This is actually slightly better than the annualized 11% ER from holding CSCO, as seen above.

There is a downside risk that CSCO stock falls below the strike price. That could result in an unrealized capital loss. But the delta ratios are low (mid-20%), so there is a low chance this will occur. Investors can study Barchart's Options Education webinars to understand these risks.

The bottom line is that CSCO is slowly moving higher as its strong FCF is assessed by analysts. That is an ideal situation for short-put plays, especially for existing investors who already hold CSCO shares.

More By This Author:

Carnival's Free Cash Flow Rises Y/Y - CCL Stock Could Still Be Over 23% UndervaluedPayPal Could Still Be 20% Too Cheap - Use Options To Play The Stock

Alphabet Stock Off Its Peak - Is It Undervalued? It Could Be If FCF Stays Strong