Blackberry: Ripe For A Short Squeeze

Image Source: Pixabay

The shares of BlackBerry Ltd. (BB) surged after the company announced multiple new partnerships recently. These partnerships include one with Alphabet (GOOGL) and another with Qualcomm (QCOM) to drive advancements in next-generation automotive cockpits.

Separately, BlackBerry also revealed it has added Okta (OKTA), Mimecast (MIME), Stellar Cyber, and XM Cyber to its extended detection and response (XDR) ecoystem, and earlier this week was trending on social media as a "meme stock."

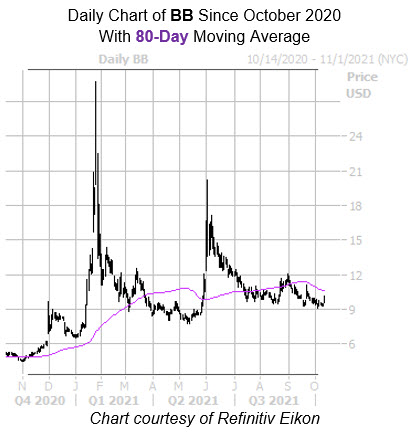

The security has largely cooled off since rallying to the $20 level in June. While shares have since found a floor at the $9 mark, the 80-day moving average has kept a tight lid on gains since early September. Year-over-year, BlackBerry stock still boasts a 91.4% lead.

Analysts are bearish towards the security, with all six in coverage carrying a tepid "hold" or worse rating. Should some of this pessimism begin to unwind, the shares could surge even higher.

Plus, the equity looks ripe for a short squeeze, as the 39.11 million shares sold short still make up 7% of BB's available float, despite short interest falling 16.7% during the most recent reporting period.

The options pits are far more optimistic, with calls being popular. This is per BlackBerry stock's 10-day call/put volume ratio of 15.14 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and Nasdaq OMX PHLX (PHLX), which sits higher than 90% of annual readings. This means calls are getting picked up at a much faster-than-usual clip.

For those wanting to speculate on BB's next move, options may be the way to go. The equity's Schaeffer's Volatility Index (SVI) of 64% sits higher than just 4% of readings from the past year, suggesting options players are pricing in low volatility expectations right now.

Plus, its Schaeffer's Volatility Scorecard (SVS) sits at 87 out of 100, suggesting the stock has exceeded options traders' volatility expectations in the last 12 months — a boon for buyers.

Disclaimer: © 2021 MoneyShow.com, LLC. All Rights Reserved.