Best Stock Options To Buy Today – Here They Are

The bulls are running through the markets, and my inner bull is pumped!

My Money Calendar says the bottom is in the rearview mirror, and Thursday's action looks like the follow-through we need for confirmation.

So, what better way to celebrate more bullish days ahead than with a nice, extremely cheap trade?

Let me put it together for you...

Image Source: Pexels

It's All About Implied Volatility

The textbook definition of implied volatility (IV) is actually pretty good: It's "the market's forecast of a likely movement in a security's price." For traders, it affects how options are priced - expensive or cheap.

I like cheap - and I'm betting you do, too. I consider IV to be cheap when it's at or near the bottom end of its 52-week range; this means the market's expectations for volatility in whatever shares are pretty low compared to the past year.

Cheap IV means options premiums - the price you pay for the options themselves - are less expensive than usual in the stock or exchange-traded fund you're interested in.

That also means conditions are great for buying calls or puts, regardless of your directional view - whether you're looking at a security you expect to go up or down.

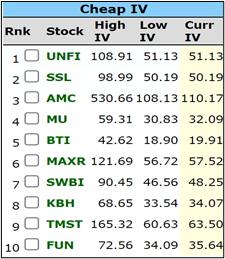

At the left here, you can see some stocks underlying options with some of the cheapest IV on the market right now:

As you can see, at the top of the list is food distributor United Natural Foods Inc. (NYSE: UNFI).

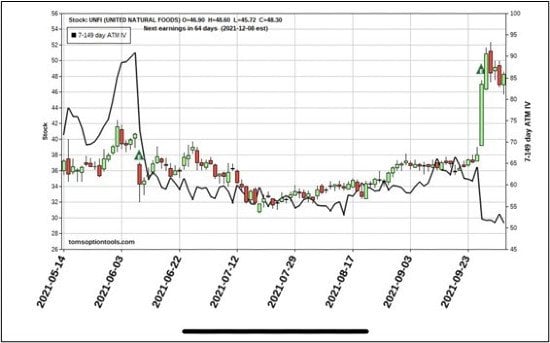

While most companies will report their quarterly figures in the coming weeks, United Natural reported early last week - to much fanfare.

UNFI stock skyrocketed more than 20% in a day, as demand picked up from last year's pandemic-ravaged quarter.

I believe that's why UNFI options are on the "Cheap IV List," because of a phenomenon we've talked about before: the "volatility crush." See, IV tends to inflate ahead of a known catalyst like earnings, because these events can obviously trigger some wild price swings.

Therefore, an option that's out of the money (OTM) has a better chance of moving into the money (ITM) after these events, compared to normal, so option buyers are willing to pay up for those premiums.

So, if you expect UNFI to move back up, an out-of-the-money call expiring within 30 to 90 days is the way to go. But if you happen to be bearish on UNFI, an out-of-the-money put expiring within that window makes good sense.

But once the earnings news is out and the stock swings - or doesn't - IV deflates rapidly, in what's known as a volatility crush. And believe me, you don't want to be "under" it when it happens.

But you definitely want to be there to take advantage of the aftermath. The post-earnings period is the perfect time to trade options on stocks you want to own at a discount - contracts are "on sale."

Disclaimer: Any performance results described herein are not based on actual trading of securities but are instead based on a hypothetical trading account which entered and exited the suggested ...

more