Apple: Replacing My Stock For Calls

At the end of December, there was a report by Nikkei which stated that Apple (AAPL) was going to cut iPhone production by 10% which sent shares of the Cupertino giant down about 1%. The reason the stock dropped perhaps is because it was the second consecutive time that Apple would cut production at the beginning of a new year. The report is however predicated on Nikkei’s own supplier calculations. I was extremely upset at the time because I was long shares of Apple and Skyworks (SWKS), a famed Apple supplier whose shares were sent tumbling 2.4% on the news.

This is a bold prediction from Nikkei, in my opinion, part of the reasoning is because the iPhone 7 sold less units than anticipated as well. Apple’s stock dropped on the news and rightfully so, because the iPhone accounts for roughly 60% of the business. However, analysts anticipate that Apple will sell nearly 55M iPhones versus 51M from last year for the March quarter.

Nikkei for those of you that don’t know is the world’s largest financial newspaper based in Tokyo, Japan. It is highly likely that Nikkei was estimating this data from Apple’s Asian partners at the time to try and calculate the production based off of supply chain movements. However, investors should have remembered that Samsung had to concede sales in the latter part of the year to Apple because of their Note 7 production woes. So at best, I would estimate that production remained at the status quo as opposed to getting cut.

Apple is still a one trick pony because of the iPhone, but currently, there aren’t any competitors to take a bite out of Apple’s revenues. This stock is relatively inexpensive as it is trading around 11.9x next year’s earnings estimates with anticipated earnings growth of 13.1% next year and 13.8% for the long-term. With fiscal first quarter earnings due January 31st after the market closes, it is important to note that the stock was up 10% in 2016 amid its first earnings and revenue drops on a yearly basis in quite some time.

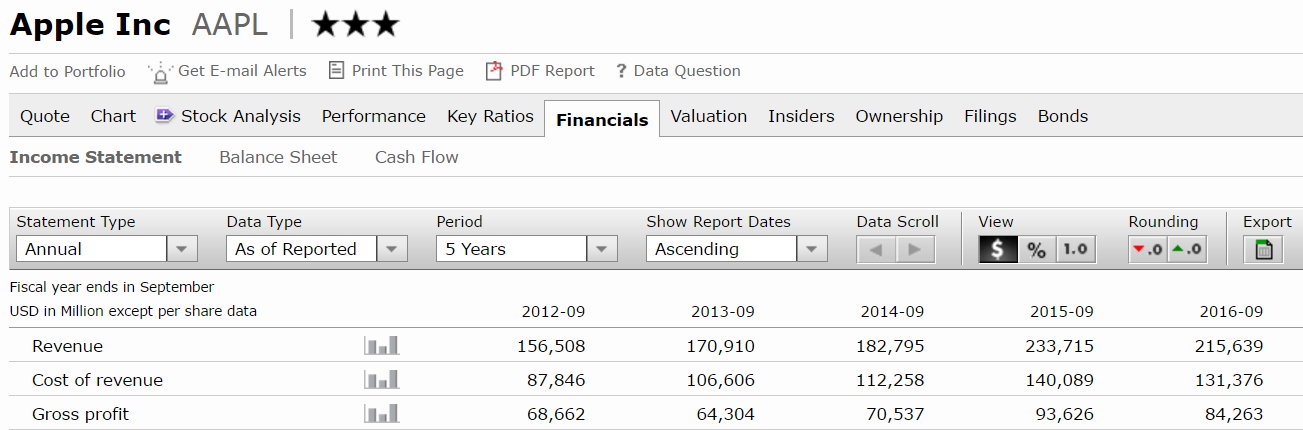

(Click on image to enlarge)

Source: Morningstar

At the time, I was long the stock in my IRA so what I did was write the January $120 call for $1.28 and I ended up getting exercised on those calls. But that didn’t bother me because I netted a great capital gain on top of the income from the call. Apple’s stock was trading around $116 and what I chose to do after that was buy the $120 February call for $1.78 just in case the stock was going to get away from me after the earnings announcement. Basically what I did was a stock replacement strategy but using different accounts. Those February $120 calls are now worth $2.60; not a shabby return I might say.

The reason I did the stock replacement strategy is because I felt that guidance may have been bad once the quarterly announcement was made. Because sales may have peaked in 2015 I didn’t want to be caught owning the shares if there was something bad announced on the call, but instead risking just a little bit to make a lot is what I felt was the safer play. But also in this call I bought I wrote the $110 put in February for $1.66 (because if it did drop to $110 by then that is definitely a price I want to own it) and I wrote the $125 call for $0.60 to be able to fund the call buy. Overall I netted $0.47 on the trade and stand to gain more if it goes higher or perhaps purchase it at a reasonable price if it goes lower.

I still own some shares of Apple in my IRA because I didn’t have an even number of shares in the account at the time to be able to write another call for January. At the end of the day, it only matters what a stock has done for your portfolio, and for me Apple has been a good investment because I have owned it for a while now. I will continue to hold the shares that I do in my IRA. For now, here is a glance at my IRA and how each position has performed. Thank you for reading and I look forward to your comments.

|

Company |

Ticker |

% Change |

% of |

|

KeyCorp. |

(KEY) |

56.58% |

0.77% |

|

Southwest Airlines Co. |

(LUV) |

35.09% |

1.58% |

|

The Boeing Company |

(BA) |

33.91% |

0.45% |

|

Robert Half International Inc. |

(RHI) |

28.92% |

2.28% |

|

AT&T Inc |

(T) |

25.05% |

0.86% |

|

Johnson & Johnson |

(JNJ) |

20.26% |

0.76% |

|

LyondellBasell Industries N.V. |

(LYB) |

19.52% |

1.56% |

|

Skyworks Solutions Inc. |

(SWKS) |

19.28% |

1.45% |

|

Intel Corporation |

(INTC) |

17.72% |

0.49% |

|

Ameriprise Financial |

(AMP) |

10.31% |

9.43% |

|

The Home Depot, Inc. |

(HD) |

6.70% |

8.13% |

|

Cummins Inc |

(CMI) |

2.64% |

4.03% |

|

Delphi Automotive PLC |

(DLPH) |

2.54% |

1.28% |

|

Hasbro Inc |

(HAS) |

2.53% |

0.49% |

|

Apple Inc. |

(AAPL) |

2.50% |

1.09% |

|

H&R Block, Inc. |

(HRB) |

2.01% |

5.28% |

|

Wyndham Worldwide Corporation |

(WYN) |

1.16% |

0.65% |

|

Invesco Ltd. |

(IVZ) |

-0.83% |

2.51% |

|

Affiliated Managers Group Inc. |

(AMG) |

-1.05% |

9.06% |

|

Caterpillar Inc |

(CAT) |

-1.24% |

2.74% |

|

PPG Industries, Inc. |

(PPG) |

-3.32% |

7.79% |

|

Amgen Inc. |

(AMGN) |

-7.01% |

11.51% |

|

AbbVie Inc. |

(ABBV) |

-7.47% |

4.09% |

|

Cash |

$ |

|

21.83% |

Disclaimer: This article is in no way a recommendation to buy or sell any stock mentioned. This article is meant to serve as a journal for myself as to the rationale of why I ...

more

Excellent analysis, thanks @[Abba's Aces](user:34082).

Thanks for reading Kurt!