Apple Is An Analyst Favorite, But AAPL Stock Has Been Flat - Shorting Puts Is The Best Play

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

by PhillDanze via iStock

Shorting out-of-the-money (OTM) put options in Apple, Inc. (AAPL) stock has clearly been the best play over the last month. This is because AAPL has been in a small trading range over the last month. The average analyst price target is over 5% higher, but my price target is $325, 19% above today's price.

AAPL is trading at $272.93 in morning trading on Dec. 30. AAPL has ranged from a Nov. 7 low of $268.47 to a Dec. 2 closing peak of $286.19.

(Click on image to enlarge)

AAPL stock - last 3 months - Barchart - Dec. 30, 2025

AAPL Stock Price Targets

I discussed Apple stock's value and shorting puts in a Dec. 1 Barchart article, “Apple Stock Looks Cheap Here Based on Strong FCF - Shorting OTM Put Options Has Worked.”

I showed that AAPL could be worth $325 per share based on its strong free cash flow (FCF) and FCF margins. Since then, analysts have raised their revenue estimates, so one could argue that the price target (PT) could be even higher.

Moreover, analysts now estimate AAPL is worth $287.17 (Yahoo! Finance), $290.85 (Barchart), and $285.20 (AnaChart). That works out to a survey average of $287.74, or +5.4% higher than today's price.

The point is that the PT range is between $287 and $327, or at least $306, about +12% over today's price.

That's not a table-thumping amount. So, one way to potentially play the stock is to set a lower potential buy-in point and collect income while waiting.

Why Shorting OTM Puts Works Here

I discussed shorting the $265.00 and $270.00 put option strike prices expiring Jan. 2, 2026, (this Friday) in the Dec. 1, 2025, Barchart article.

At the time, the premiums received by a short-seller of these put contracts were $2.27 and $3.40, respectively. Today, the premiums have dropped to $0.13 and $0.61, respectively.

In other words, the short-put play has worked. It might make sense to do this again by rolling the trade over to a new monthly expiration period.

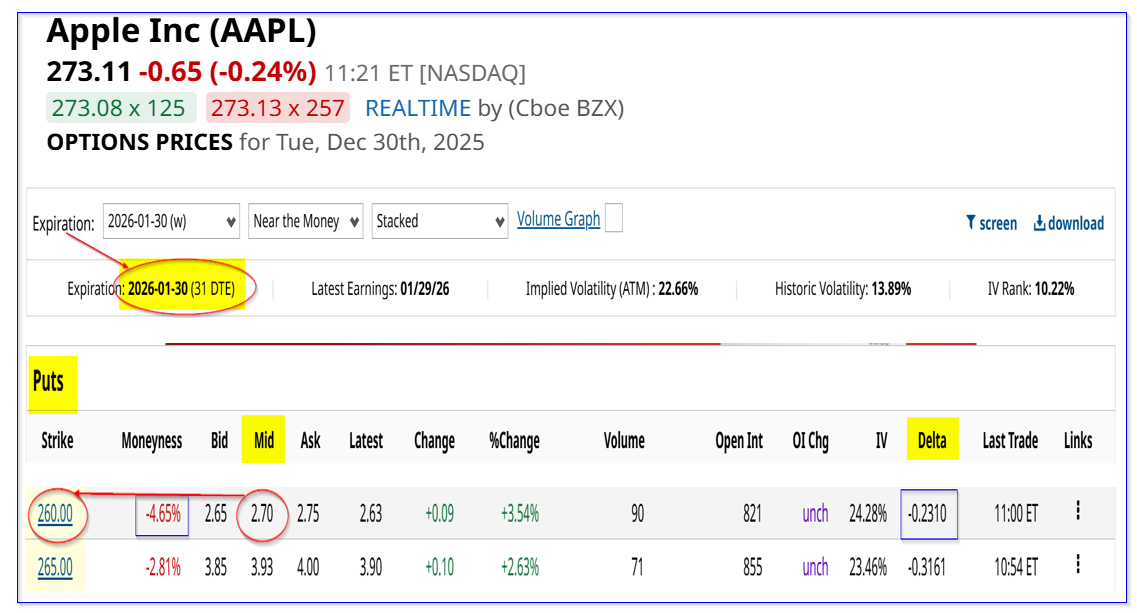

For example, the Jan. 30, 2026, expiry period shows that the $260.00 put contract has a $2.70 midpoint premium. That works out to a one-month yield of 1.04% (i.e., $2.70/$260).

(Click on image to enlarge)

AAPL puts expiring Jan. 30, 2026 - Barchart - As of Dec. 30, 2025

In other words, in return for an obligation to buy AAPL stock at a price almost 5% below today's price, the investor gets to make a 1% monthly income yield.

That works out to a 12%+ annualized expected return (ER).

This ER is the same as the expected upside return from holding AAPL stock over the next year (12%) - see above.

Note, there is only a low 23% chance that AAPL will actually fall to $260.00, according to its delta ratio. So, some less risk-averse investors might be willing to buy longer-dated in-the-money (ITM calls.

That way, these investors can gain exposure to AAPL's upside on a leveraged basis on a longer-term basis. Moreover, shorting OTM puts helps pay for this upside.

Buying ITM AAPL Calls

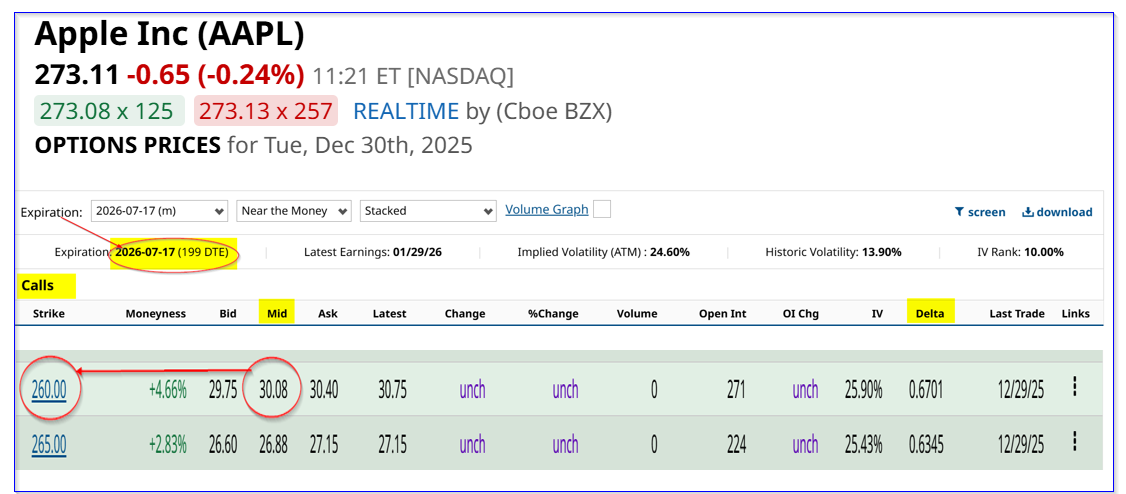

For example, look at the July 17, 2026, expiry period. It shows that the $260.00 call option trades for about $30, or $3,000.

(Click on image to enlarge)

AAPL calls expiring July 17, 2026 - Barchart - As of Dec. 30, 2025

The point is that an investor who collects $270 in short-put income for 7 months (although there is no guarantee) could potentially accumulate $1,890. That would reduce the call option cost to just $1,110.

So, let's say that AAPL rises to $300 by July. That means the intrinsic value of the July 17, 2026, $260 call option would be $40 (i.e., $300-$260), or $4,000 per call contract.

Therefore, the investor has a potential profit of $2,890 ($4,000 - $1,110).

Given that the investor had to invest approximately $26,000 each month to generate the $270 monthly income (i.e., $260 x 100 shares per put contract), the ROI is:

$2,890/$26,000 = +11.11% over 7 months

That works out to almost a 20% annualized compounded expected return (i.e., +19.79%). (For you nerds, here is how that is calculated: 1.1111^(12/7) -1 = 1.1111^1.714 -1=1.1979-1=0.1979).

The point is that this is a leveraged, slightly more risky way to play AAPL for a higher expected return. For example, if AAPL stays flat, the call option premium will deflate, and the investor could end up with a capital loss.

Summary and Conclusion

The truth is that if AAPL rises to $300, the value of the ITM $160 calls will be higher than $40 due to extrinsic value. That would allow the investor to sell these calls at an even better ER.

The bottom line here is that AAPL stock looks undervalued on a long-term basis. Shorting OTM puts is a relatively defensive way way to gain income and set a lower potential buy-in point.

Investors willing to take on more risk can use that income to buy in-the-money (ITM) call options in longer-dated periods. That way, they can gain a leveraged expected return, with greater risk.

More By This Author:

A Less-Costly Way To Buy Costco To Gain Leveraged Upside In COST StockCostco Has Tumbled Despite Higher FCF And FCF Margins - Time To Buy COST Stock?

Cisco Systems Stock Is Treading Water - How To Use Puts And Calls To Play CSCO

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more