Analysts Love Salesforce Stock And Are Raising Their Price Targets - How To Play CRM

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

by JHVEPhoto via Shutterstock

Analysts have been raising their price targets on Salesforce, Inc. (CRM) stock. This is despite CRM stock having been flat over the last month. One of the best plays here is to sell short out-of-the-money puts for income.

CRM is up today to $257.46 in morning trading on Monday, Jan. 5, 2026. It closed at $260.57 on Dec. 5, 2025. So, it's been roughly flat over the last month.

(Click on image to enlarge)

CRM stock - last 3 months - Barchart - Jan. 5, 2026

Price Targets are Higher

I discussed Salesforce's stock value in a Dec. 5, 2025, Barchart article, “Salesforce Generates Strong Free Cash Flow - CRM Could Be 23% Too Cheap.”

I showed how CRM could be worth $321 per share based on its strong free cash flow (FCF) and FCF margins. Moreover, since then, analysts have raised their price targets (PTs).

For example, 58 analysts surveyed by Yahoo! Finance have raised their PTs to $330.06 from $327.38 a month ago. Similarly, Barchart's mean survey PT has risen from $328.52 to $331.71.

In addition, AnaChart.com's survey of 35 analysts has a higher average PT now of $300.06, compared to $283.36 a month ago.

The bottom line is that the average price target, including mine, is now higher at $320.71. That is almost +25% higher than today's price.

But what if it takes a while for CRM to hit this PT? One way to play this is to set a potentially lower buy-in point and get paid while waiting.

That is what happens when you sell short out-of-the-money (OTM) put options in nearby expiry periods.

Shorting OTM CRM Puts Works

For example, last month I demonstrated that shorting (i.e., “Sell to Open”) the $245.00 strike price put option expiring this Friday, January 9, 2026, would yield an income of $3.75, or $375.00, for an investment of $24,500 over the month.

That provided an immediate yield of 1.53% (i.e., $375/$24,500) for a strike price that was 5.57% below the trading price (i.e., out-of-the-money or OTM).

Today, that premium is down to $0.39, or $39 per put contract. In other words, an investor can enter an order to “Buy to Close” this contract and book a $336 profit.

Alternatively, assuming CRM stays over $245.00 by Friday, the investor can let the option expire worthless. That way, the whole $375 can be booked as profit over the last month.

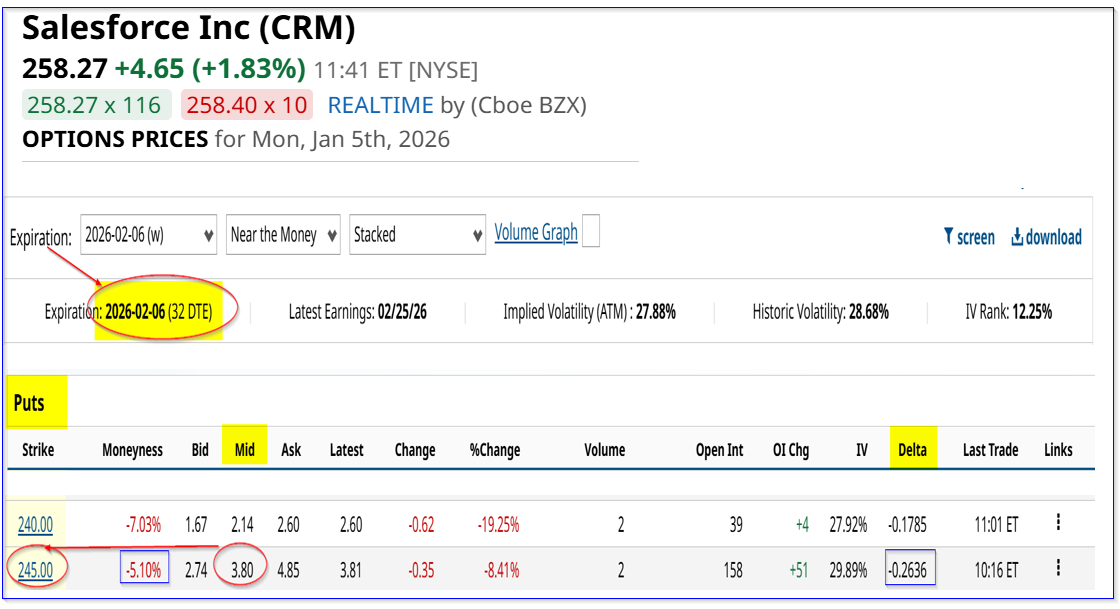

Moreover, this trade can be repeated now. For example, the Feb. 6, 2026, expiry put option at the $245.00 strike price now has a $3.80 midpoint premium.

(Click on image to enlarge)

CRM puts expiring Feb. 6, 2026 - Barchart - As of Jan. 5, 2026

That provides an immediate yield of 1.55% yield to a short-seller of this put contract (i.e., $380/$24,500). That is similar to last month, and the distance from the spot price is also about 5% out-of-the-money (OTM).

Note that there is about a 26.4% chance that CRM could fall to $245 based on the -0.2636 delta ratio. That is based on the historical volatility of CRM.

So, more risk-averse investors may want to short the $240.00 put option. That has a lower delta ratio (less than 18%) but also a lower one-month short-put yield of 0.89% (i.e., $2.14/$240).

However, doing a 50/50 mix of these two would provide an average yield of 1.22%, although this would involve more capital outlay.

However, the bottom line is that an investor can set a lower potential breakeven buy-in point and get paid while waiting.

For example, the $245.00 provides a breakeven of $241.20 (i.e., $245-$3.80). That is 6.60% below today's price and provides a much lower potential buy-in point for both new and existing investors.

And don't forget, continually repeating this short-put play each month builds income. Some investors can use that income to help pay for in-the-money (ITM) call options. That way the investor can gain a leveraged upside in CRM stock as well.

More By This Author:

Tesla Stock Has Been Flat For Two Months - How To Make A 3.2% Yield In One-Month PutsHow To Make A 2.0% Income Yield In GOOGL Stock Over The Next Month

Unusual Activity In Occidental Petroleum Call Options - A Signal Investors Expect A Dividend Hike

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more