Analysts Keep Raising Price Targets For Microsoft Stock - MSFT Is Still Cheap

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

VDB Photos via Shutterstock

Analysts are continuing to raise their stock price targets for Microsoft Corp (MSFT) ahead of its earnings results. As a result, MSFT stock is moving up. Shorting out-of-the-money puts and buying in-the-money calls look attractive.

MSFT is at $519.50 in midday trading on Friday, Oct. 3. The stock is up from a recent low of $495.00 on Sept. 5, but it's off from a peak of $535.64 on Aug. 4.

(Click on image to enlarge)

It could be worth substantially more. For example, in my Sept. 9 Barchart article, I showed that it could be worth over $671 per share ("Microsoft Stock Is Off Its Highs, But Target Prices for MSFT Are Higher.")

I also suggested shorting out-of-the-money (OTM) put options. This article will update both the price targets and related option plays.

Higher Price Targets

Analysts now forecast that revenue for the year ending June 30, 2026, will be $323.21 billion. That's up from $322.15 billion in my last article, just 3 weeks ago.

Moreover, for the following year, they expect sales to be almost $370 billion ($369.96 billion).

So, to project the next 12 months (NTM) of revenue, let's use 3/4ths of the 2026 forecast and ¼ of the 2027 fiscal year estimates:

0.75 x $323.21 billion + 0.25 x $369.96 billion = $242.4 billion + $92.5 billion = $334.9 billion NTM sales

To project free cash flow (FCF), let's use a 53% operating cash flow (OCF) margin and a slightly higher than $71 billion capex estimate (used in my last article):

$334.9 billion x 0.53 = $177.5 billion - ($71 billion x 1.05) = $177.5b - $74.5b = $103 billion FCF

Next, as in the last article, we can value this using a 2.0% FCF yield:

$103b / 0.02 = $5,150 billion market value

That is 33% higher than today's market cap of $3.86 trillion, according to Yahoo! Finance. This is a high-end projection.

In other words, MSFT stock is worth 33% more:

$519.50 x 1.33 = $690.94 per share

However, just to be conservative, even if we use a 50% OCF margin, the projected FCF would be $93 billion (i.e., $167.5b OCF - $74.5b capex = $93.0b).

The projected market value would be 20.5% higher ($93b/0.02 = $4,650b). So, the price target, on a low-end projection, would be:

$519.50 x 1.205 = $626.00 per share

So, the average price target of these two projections is $658.47. That is +26.75% higher than today's price.

That is close to the analysts' target prices. For example, Yahoo! Finance shows that the average price target of 58 analysts is $617.50. That's up from $614.89 just three weeks ago, as seen in my last article.

The bottom line is that MSFT still looks cheap, and analysts keep raising their revenue, FCF, and price targets.

Shorting OTM Cash-Secured Puts and Buying ITM Calls

In the Sept. 9 Barchart article, I suggested shorting the $480 strike put expiring next week on Oct. 10. At the time, MSFT was at $499.17, and the strike price shorted was about 4% out-of-the-money.

But investors would make an immediate yield of almost 1% (i.e., $4.28/$480 = 0.89%).

Today, those puts are priced at just 16 cents and are likely to expire worthless next week. That means the investor has made most of the money. It makes sense to roll over this trade to a later date for more yield.

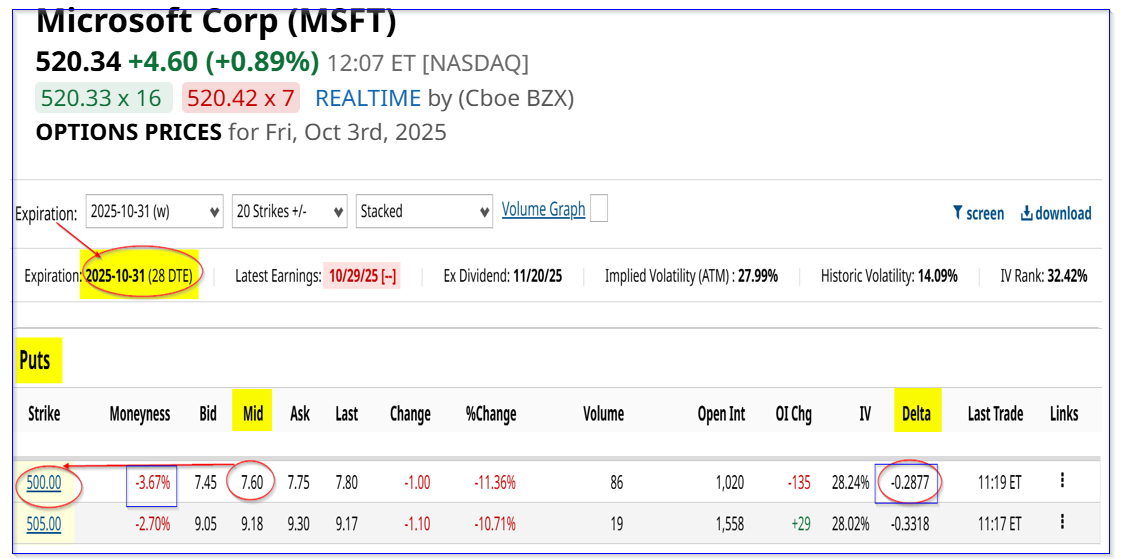

For example, the Oct. 31 expiry shows that the $500 strike price put has a median premium of $7.60. After paying the $0.16 to roll the trade over (i.e., a "Buy to Close), the investor's net yield will be almost 1.5% for one month:

$7.60-$0.16 = $7.44 / $500.00 = 0.01488 = 1.488%

(Click on image to enlarge)

MSFT puts expiring Oct. 31 - Barchart - As of Oct. 3, 2025

That strike price is about $20.34 or 3.90% below today's trading price, so it's well out-of-the-money (OTM). This kind of play works best for existing shareholders.

It does allow new investors to set a potential lower buy-in, but they don't gain any upside in MSFT's price as it rises.

That's why for some investors, it makes sense to also buy in-the-money (ITM) call options.

For example, the March 20, 2026, $500.00 strike price call options have a midpoint premium of $50.45. That means that if an investor can keep making $7.60 by shorting puts they can almost pay for this call option:

168 days to expiry / 30 = 5.6 months

5.6 x $7.60 = $42.56

That is just $7.89 under $50.45 for the calls. The net expected buy-in is thus $500 +7.89, or 2.39% in the money:

$507.89 / $520.34 -1 = -0.239 = 2.39% below today's trading price

Moreover, the upside is very attractive:

$658.47 target / $507.89 = 1.296 = about +30% upside

The bottom line here is that a combination of shorting near-term OTM puts and buying long-dated ITM calls at the same strike price is an attractive way to play MSFT stock.

More By This Author:

Unusual Tesla Call Options Volume Shows Investors Bullish On TSLACisco Stock Moves Higher As Analysts Raise Target Prices - Short Put Plays Work Here

Carnival's Free Cash Flow Rises Y/Y - CCL Stock Could Still Be Over 23% Undervalued