Adobe Impresses The Market With Strong Free Cash Flow - Is ADBE Stock Worth Buying?

/Adobe%20Inc%20site%20magnified-%20by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

by Pavel Kapysh via Shutterstock

Adobe Inc. (ADBE) reported on Dec. 10 that its Q4 revenue for its fiscal quarter ending November 30 was up +10% YoY and +11% YoY for the fiscal year.

Moreover, it generated 8.8% higher free cash flow (FCF), and its FCF margins were over 41.45% over the last year. That implies ADBE stock could be worth over 21% over the next year or so at $425 per share. This article will show why.

ADBE closed Thursday, Dec. 11, at $350.43, up +7.30 or +2.30%, as the market approved of Adobe's solid revenue growth and FCF generation. However, this price is still well off its May 19, 2025, peak price of $420.68.

(Click on image to enlarge)

ADBE - last 6 months - Barchart - Dec. 11, 2025

Free Cash Flow Forecast

However, based on analysts' revenue forecasts, if its FCF margins stay strong, it could be worth almost 20% more. Here's why.

In the past year, Adobe generated almost $10 billion in FCF ($9.852 billion) on $23.769 billion in revenue in FY 2025. That works out to 41.45% of its annual revenue (i.e., its FCF margin).

That is very strong and is equal to last quarter's 41.41% trailing 12-month (TTM) FCF margin. So, if Adobe can keep generating this strong FCF, as I discussed in my last Barchart article, it could lead to a higher FCF forecast.

For example, analysts now project that revenue this coming fiscal year will be +9.4% higher at $26.01 billion. And for the following year, it's expected to be $28.32 billion. In other words, the market forecasts sales will be 19% higher in two years.

As a result, if Adobe maintains a 41.5% FCF margin, its FCF could reach between $10.79 billion and $11.75 billion annually (i.e., 41.5% x $26 billion and $28.32 billion). That works to an average of about $11.27 billion over the next two years.

Here is how the market might value this.

Price Target for ADBE Stock

The market capitalization for ADBE is $148.65 billion, according to Yahoo! Finance. That means that it has a 6.6% FCF yield, based on its free cash flow generated over the last year:

$9.852b / $148.65b = 0.06627 = 6.6% FCF yield

This is also the same as a 15.1x multiple (i.e., 1/0.06627 = 15.089). We can use this to project Adobe's future market value.

For example, let's use a 16x multiple (i.e., slightly higher as its FCF rises) multiplied by its average projected FCF over the next 2 years:

$11.27 b FCF x 16 = $180.3 billion mkt value

That is $31.67 billion higher than today's market cap of $148.65 billion, or a gain of +21.3% (i.e., $31.67/$148.65 billion = 0.213).

That means Adobe's FCF-based price target is over $425 per share:

1.213 x $350.43 price today = $425.07 price target (PT).

Analysts Agree ADBE Stock is Undervalued

That is higher than its May peak of $420.68.

Moreover, analysts tend to agree. Yahoo! Finance reports that 40 stock analysts have an average PT of $436.19. In addition, Barchart's mean survey PT is $461.84.

AnaChart's average PT from a survey of 22 analysts is $403.00 per share. So, these analyst surveys have an average PT of $433.68, close to my $425 price target.

The bottom line here is that Adobe stock looks undervalued, both from a FCF standpoint and also based on analysts' price targets.

One way to play this is to set a lower potential buy-in point by shorting out-of-the-money puts. That way, an investor can get paid while waiting to buy in at a lower strike price.

Shorting OTM ADBE Puts

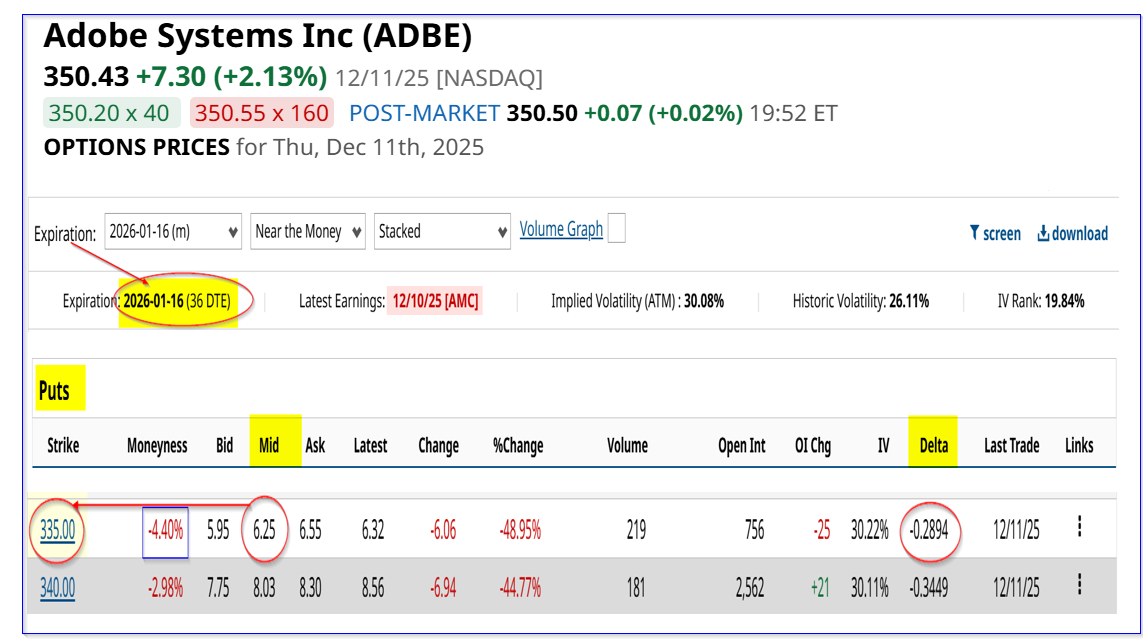

For example, the Jan. 16, 2026, expiry period, a little over one month from now, shows that the $335.00 put option contract, 4.4% below Thursday's close, has a high premium of $6.25 per put contract.

That means that a cash-secured short-seller of this contract makes an immediate yield of 1.866% (i.e., $625/$33,500 invested).

(Click on image to enlarge)

ADBE puts expiring Jan. 16, 2026 - Barchart - As of Dec. 11, 2025

This also sets a potentially lower buy-in breakeven point for the short-seller of these puts:

$335-$6.25 = $328.75, i.e., -6.19% below $350.43

This only happens if ADBE falls to $335.00 on or before Jan. 16, and the investor's brokerage account is then assigned to use the cash secured as collateral (i.e., $33,500) to buy 100 shares at $350.00.

Nevertheless, the 1.866% income yield, which is earned immediately, can be repeated each month (although there is no guarantee what the yield will be each month). That implies the expected return could be 5.60% over the next three months.

That shows that a patient investor, especially those who are long ADBE shares and also short OTM puts, can make a good expected return.

In addition, as I have shown in other articles, investors can buy longer-dated in-the-money (ITM call options using the income generated from shorting OTM puts. That way, the short-put option investor can gain some upside in ADBE stock if it keeps rising from here.

More By This Author:

Unusual Call Options Volume In GameStop Corp. Stock - Should Investors Buy GME Stock?How To Make A 1.1% Yield Shorting One-Month Microsoft Puts

Snowflake Stock Is Down But Its FCF Margin Guidance Could Lead To A 22% Higher Price Target

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more