3 Option Trade Ideas In Blackstone

Blackstone has rallied 41.1% since the March 23rd bottom compared to the S&P 500’s rally of 13.5%

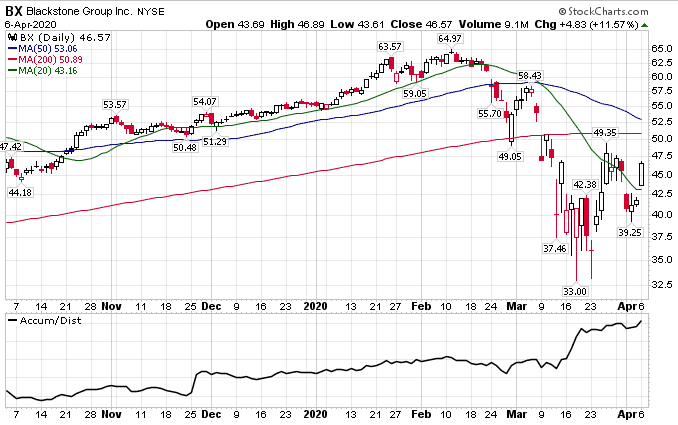

The stock is showing significant accumulation

Three bullish options plays give different ways to play the stock depending on an investors risk/reward preferences.

Blackstone’s stock was hit hard in the recent Covid-19 led selloff falling 49.2% compared to the S&P 500’s drop of only 35.4%. I say only because that’s still a decent decline and one of the worst on record for the major market index.

However, since the market found an intermediate-term bottom on March 23rd, Blackstone has rallied 41.1% compared with the S&P 500’s rally of 13.5%.

Stocks showing relative strength are great candidates for bullish option trades and Blackstone may present some interesting opportunities over the coming weeks and months.

A bullish position in Blackstone gives investors exposure to one of the largest, most respected and successful investment managers in the world. The stock is still 28.3% below its recent high so the upside potential is there is stocks can maintain their recent bullish run.

Looking at the chart, there has been significant accumulation in the stock since mid-March indicating that large trader might be building a position.

Rather than just going long, investors can use the options market to find smart ways to trade Blackstone stock with an attractive risk to reward ratio.

Implied volatility is also high at around 70%. Not quite as high as it was a few weeks ago, but still a lot higher than the 20-30% at which it typically trades.

That means it’s a great time to be a seller of options on BX. That coupled with the potential bullish action makes it a great candidate for a bull put spread.

Option Trade Idea 1: Sell A Bull Put Spread

A bull put spread is a defined risk option strategy that profits if the stock closes above the short strike at expiry.

To execute a bull put spread an investor would sell an out-of-the-money put and then but a further out-of-the-money put.

With BX closing at $46.57, and the 20-day moving average currently around $42.50, placing the bull put spread below $40 makes sense.

Selling a June 19th $40 put and buying a $35 put would generate around $125 in premium based on yesterday’s closing prices.

This trade offers a 33.33% return potential in just over one month, provided BX is above $40 at expiration.

The maximum profit on the trade would be $125 per contract with a maximum risk of $375.

The spread will achieve the maximum profit if BX closes above $40 on June 19th in which case the entire spread would expire worthless allowing the premium seller to keep the $125 option premium.

The maximum loss will occur if BX closes below $35 on June 19th which would see the premium seller lose $375 on the trade.

The breakeven point for the Bull Put Spread is $38.75 which is calculated as $40 less the $1.25 option premium per contract.

Option Trade Idea 2: Sell A Cash Secured Put

A cash-secured put is a conservative options strategy that can be used to purchase a stock for lower than the current price.

Instead of waiting for a pullback (which may never come), the trader can sell a cash-secured put with a strike price of $35.

Investors could sell the June 19th $35 put and generate around $165 in premium. That’s theirs to keep no matter what happens to the stock over the course of the trade.

However, the investor does have an obligation to buy 100 shares of the stock at $35, even if the stock drops well below that level.

A purchase price of $35 less the $1.65 premium received gives an effective purchase price of $33.35, which is 28.4% below the current price.

If BX stays above $35 and the put expires worthless, the trader makes a 4.95% gain in just over 2 months.

Option Trade Idea 3: Buy a Directional Call Butterfly Spread

Directional butterflies are a great way to take exposure to stock without risking too much capital.

I like to pick an area where I think the stock has potential to get to and centre the butterfly there.

Buying a June 19th call butterfly spread using the 45-50-55 strikes will cost around $80.

The maximum potential gain on this trade is $420 which would occur if BX finishes right at $50 at expiration.

The breakeven points are $45.80 and $54.20.

All 3 of these trades are bullish trades, but things can turn quickly in this market, so I would watch the 20-day moving average and use that as a stop loss.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more