October Of 2024 Will Be Crucial Month For Cryptocurrency Investors

Image Source: Unsplash

In this article, we analyze trends in blue-chip cryptocurrencies BTC and ETH. Both are leading indicators of the crypto markets, and there is a different reason why October of 2024 is crucial for BTC, ETH, and consequently for the entire crypto market.

The summary: Bitcoin’s time/price analysis gives us October 14th, 2024, as a decisive date (source: Bitcoin predictions research). In order for Bitcoin to remain in a long-term uptrend, it should not violate certain levels by Oct 14th, 2024. Similarly, one of the most solid predictive algorithms is forecasting a drop in the price of ETH around October (source: ETH forecast) with forecast price levels right at critical support. Both findings, from separate sources, are consistent with the same conclusion: if both BTC and ETH respect key support, respectively $41.9k and $2,250, it would bode very well for crypto markets in general in 2025.

Bitcoin’s trendline – October is crucial

We start our analysis with the easiest type of chart analysis – trendlines on the long term chart.

Everyone is used to reading trendlines, many are used to spotting them.

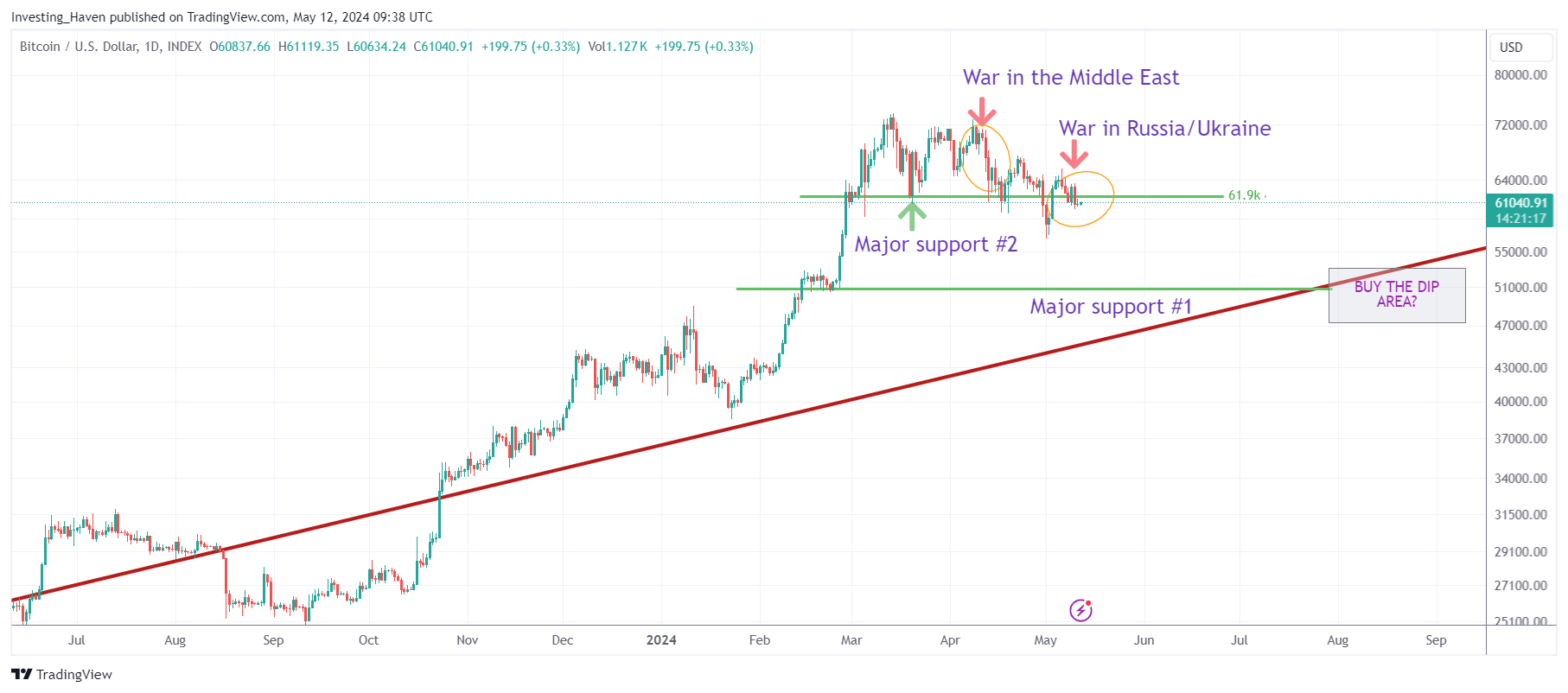

The long-term BTC chart has a rising trendline, representing the long-term trend of Bitcoin, going back to 2016. See the red rising line on the next chart.

What’s interesting is that the current chart structure, since mid-February, when Bitcoin’s latest leg higher started, has 2 major support levels: $61.9k and $49k. If we take the worst-case scenario, Bitcoin might fall through its first support level. Late summer is when the 7-year rising trendline will cross this important support level of $49k.

Takeaway: in case BTC is unable to set new ATH by August, we expect late summer selling to pick up. If BTC can respect $49k (on a 3 to 5-week closing basis, similar to the summer of 2023) it would bode well for BTC in 2025.

(Click on image to enlarge)

Bitcoin timeline findings – October is crucial

We now flip the view and focus on the timeline.

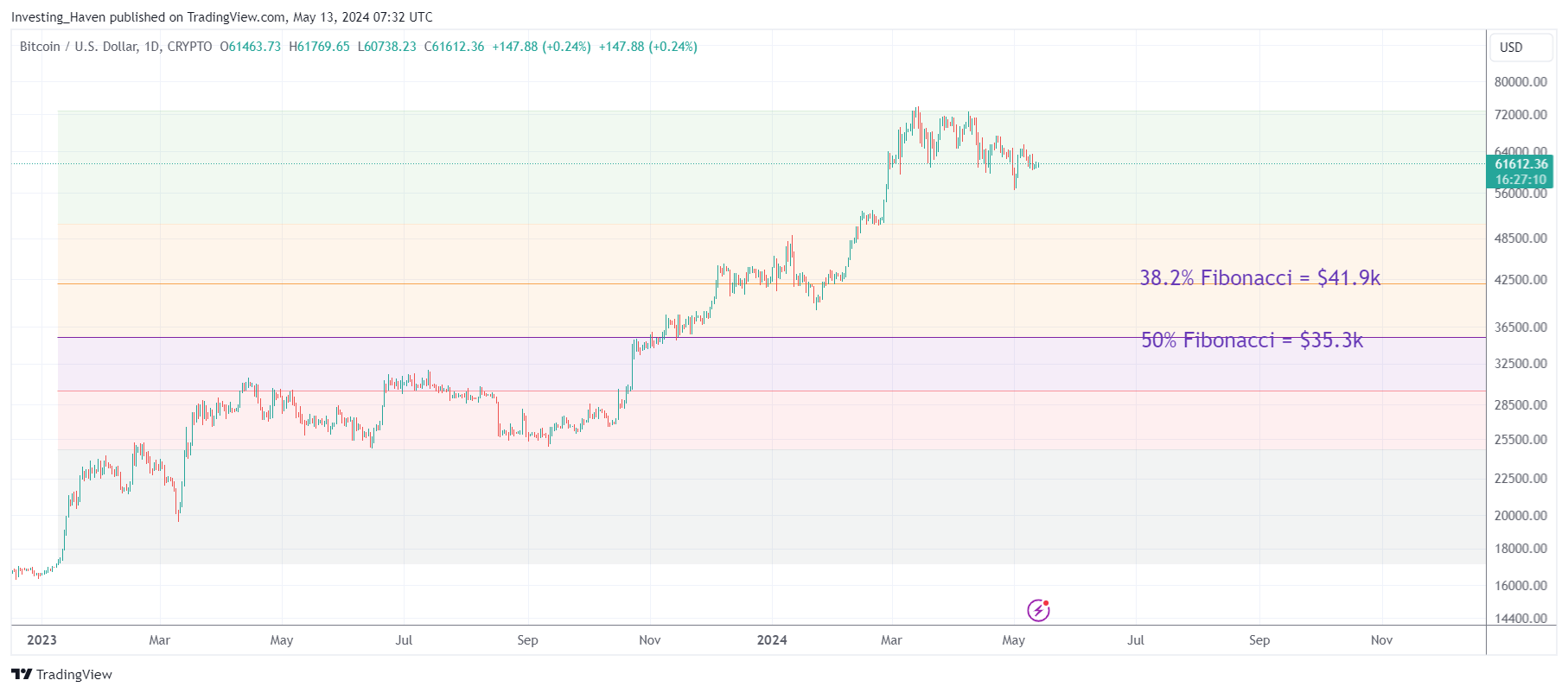

One often overlooked rule of thumb is that the time that a bull run took to complete is an important data point. That’s because, very often, the subsequent retracement tends to take 50% of the time of the bull run.

When applied to Bitcoin’s run that started around Jan 10th, 2023, and ran until March 13th, 2024, divide this number by 50%, and we get to October 14th, 2024.

What we are saying is that IF Bitcoin is unable to set new ATH, retrace the coming months, and bottom around Oct 14th, 2024, it would be a timeline confirmation of a long-term bullish pattern.

(Click on image to enlarge)

Ethereum priced in BTC confirms the importance of October

How does this BTC price and timeline analysis relate to Ethereum?

Very simple, we look at the ETH chart priced in BTC.

First, however, we rely on the predictive model forecasting a drop in ETH to the $2,300 area around October. This makes sense to us, humans, for two reasons. One, w have a similar prediction. Second, the $2,250 level is the 50% Fibonacci level, a key level providing support (but also much more downside if it gives up).

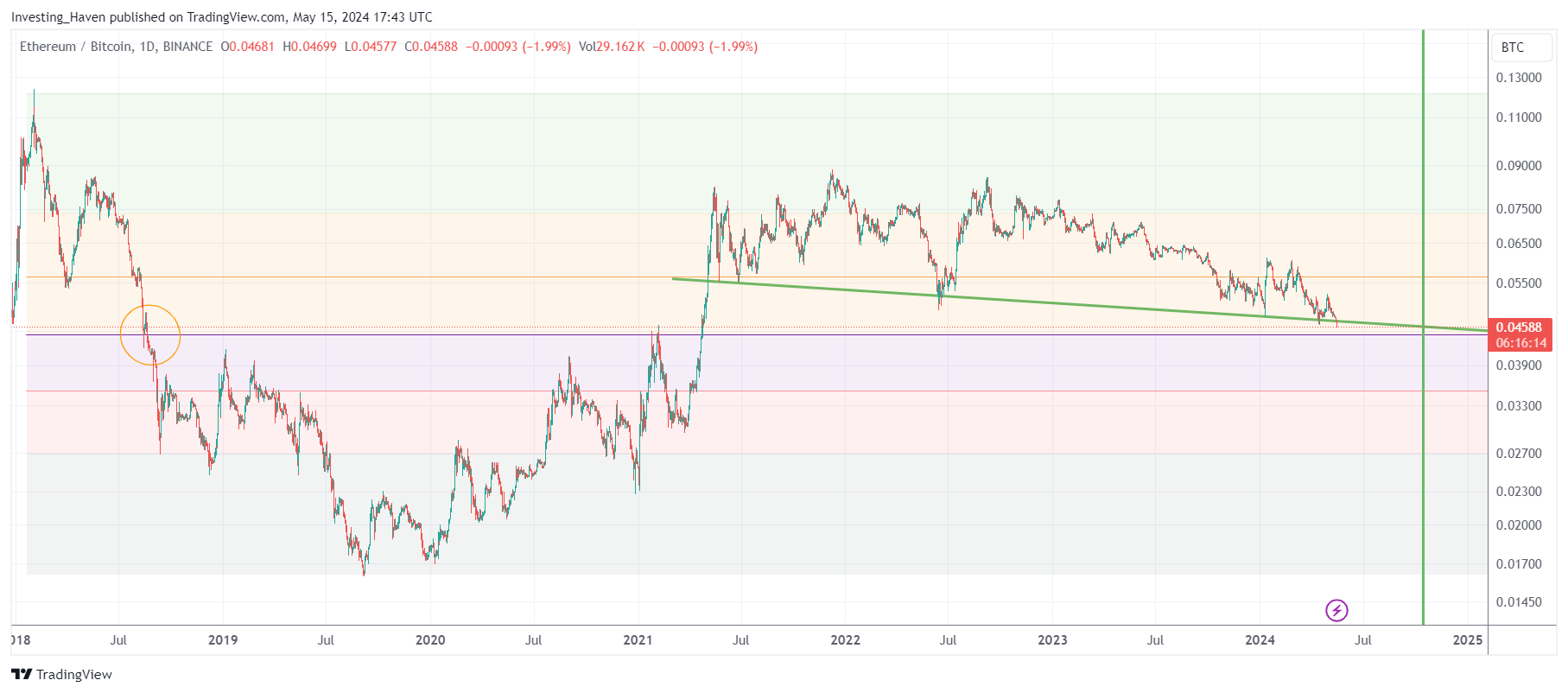

Moreover, the ETHBTC chart, shown below, has a very clear pattern, hence a very clear message:

- Ethereum, relative to BTC, has been weakening since the summer of 2022.

- The really important level is 0.040 – back in the summer of 2018, once breached, it resulted in a big decline in the price of ETH relative to BTC.

- Conversely, back in 2021, once ETHBTC reclaimed 0.040, ETH vastly outperformed BTC.

ETHBTC is approaching 0.040. It looks like it is a matter of a few months until it will test that level. Concurrently, the multi-year falling trendline (green falling line) will cross 0.040 in late 2024. The green vertical line represents the important date we retrieved from Bitcoin’s timeline analysis – Oct 14th, 2024.

(Click on image to enlarge)

Take-away: if ETHBTC can respect 0.40 by October/November of this year, it will avoid a big breakdown most likely. That’s when BTC has the possibility to turn upward, assuming a late summer dip.

Conclusion

The conclusions from this analysis is very clear. While focused on blue chips BTC and ETH, the implications are relevant for the entire crypto market.

From different viewpoints, we conclude that October 2024 may become a crucial month for BTC, as that’s where a turning point may occur. We assume that BTC cannot set a new ATH, at least not in a structural way (which means on a 3-week closing basis).

Simultaneously, ETHBTC should avoid a breakdown. There is double support to avoid this, ideally, ETHBTC does not fall below 0.040 until BTC turns higher in the Oct/Nov timeframe.

More By This Author:

Crypto Momentum Fading - Are Buy The Dip Opportunities Underway?

Is Solana Able To Move To And Exceed Its Former Highs?

Crypto in 2024 – AI Coins Exploded, Now Might Be The Time For Web3

Disclaimer: None.