No Sign Of Slowdown

Ignore the market action today…better economic results lead to higher markets over time…

“Davidson” submits:

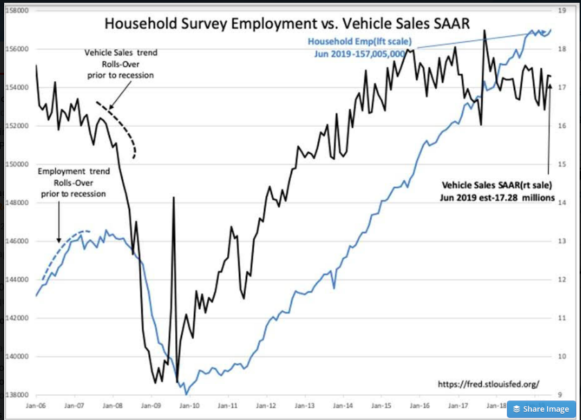

Employment reports today resulted in the Household Survey Emp setting a new high this cycle of 157,005,000 employed, rising 247,000 from May. Vehicle sales remain stable at 17.28mil SAAR (Seasonally Adjusted Annual Rate). These reports are typical of continued economic expansion.

(Click on image to enlarge)

What to look for in future economic data is a rise in Single-Family Home Starts. There has been an effort to reduce regulations on small and regional banks such that they can return to their historical role as mortgage lenders rather than being regulated under Dodd-Frank the same as Money Center Banks. Such deregulation has already begun to raise mortgage credit availability as seen in last month’s rise in the MCAI(Mortgage Credit Availability Index). The next MCAI report arrives next week.

There is also an initiative buy HUD to deregulate recent regs which forced housing cost higher by 25%. Should this occur in conjunction with an improved MCAI, we should see a rise in construction of lower cost ‘starter-homes’ which have been missing this cycle. Such improvements should cause the mix of housing prices to fall. Some may panic at this, but it in truth a decline in the pricing indices will be a sign that economic activity is shifting to serve first-time homeownership.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

moreComments

No Thumbs up yet!

No Thumbs up yet!