No Shame In Seeking Debt Help

A generation of people has been devastated by monetary and fiscal policies aimed at ‘helping’ them to borrow financially suicidal sums for housing. Grave mistakes have been made, encouraged by many well-meaning family members, policy-makers, and commissioned realtors and lenders.

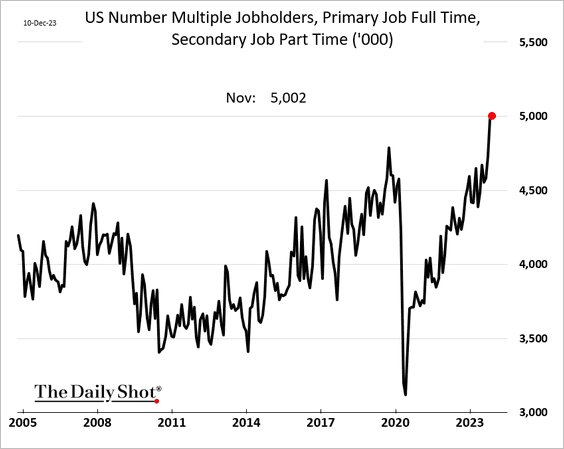

In many cases, costs will be impossible to sustain even as interest rates retreat because the prices paid are too high. It has long been established that 3 to 4 times the household income is the maximum affordable home price, and in recent years, many commonly paid double and triple that ratio. A growing number are now short on cash for basics like food, fuel, and daycare, even as they take on secondary employment (chart below since 2005).

The harm to family unity, health, and community can be long-lasting. See, Two jobs. No money: How mortgage rates have pushed one Toronto father to the brink.

As of the third quarter of 2023, Canadian households must dedicate 55.2% of their income to shelter costs, up from the long-term average of 35% of income. From 2020 to 2022, the shelter cost-to-income ratio increased by 12.5 points as low rates fueled a surge in speculation and home prices. Housing affordability was only briefly worse in the early 1980s when interest rates were much higher. The problem today is not that interest rates are so high, but rather, prices are well beyond mathematical reason.

Participants, politicians, and the Bank of Canada like to cite a “long-standing” housing stock deficit for our problems. This week, a report from Bank of Montreal economists places blame where blame is due, and notes recessions are the payback period; see Canadian Housing Affordability 2nd Worst In History, Recession To Follow: BMO. Here’s a taste:

“Even a cursory look at either the Bank’s own measure of housing affordability or rent inflation readily shows that there was no major issue prior to 2020. The fire was lit by a combination of ultra-low interest rates and then the fastest population growth in 50 years. The Bank’s own measures of home vacancies and new building versus household formation show that the true problem only emerged very recently, and this is not a ‘long-standing’ issue.

…Looking ahead, note that the three prior spikes in unaffordability (early 1980s, early 1990s, and 2007/08) were followed in short order by Canadian recessions.”

A similar tragedy is playing out in other countries at the same time. Australia’s crisis is highlighted in the 60 Minutes segment below. Crazy sums were borrowed when interest rates were unsustainably low.

Australians with a mortgage copped another crippling cost of living hit on Tuesday when the Reserve Bank raised the official cash rate to 4.35%. It’s the 13th interest rate rise in the last 18 months and means many people will now have to become magicians and conjure up money they don’t have if they’re to avoid defaulting on their home loans. Here is a direct video link.

Video Length: 00:13:02

All of these problems were evident in the making. The question is how quickly we can admit, repent, reform, and recover. Fortunately, in North America (unlike China), there are consumer bankruptcy laws to help individuals move out from under impossible situations. Insolvency trustees note that many clients stay in denial too long and seek help much later than they should.

If you know someone struggling, they should be encouraged to seek a review of their situation with an insolvency trustee as soon as possible. Lessons learned can help us make wiser choices for a lifetime. There is no shame in seeking professional help.

More By This Author:

Consumer Spending And Employment Downturn In 2024

Yield Curve Screaming Bear Market In Process

Markets Have Not Yet Priced New Normal Of Slower Growth China