'No Hire, No Fire' Economy Confirmed As US Jobless Claims & Hiring Plans Plummet

With the spice flowing once again (post shutdown), initial jobless claims continue to signal no labor market pain at all... plummeting last week to 191k (the lowest since Sept 2022 and before that the lowest since 1969!!)

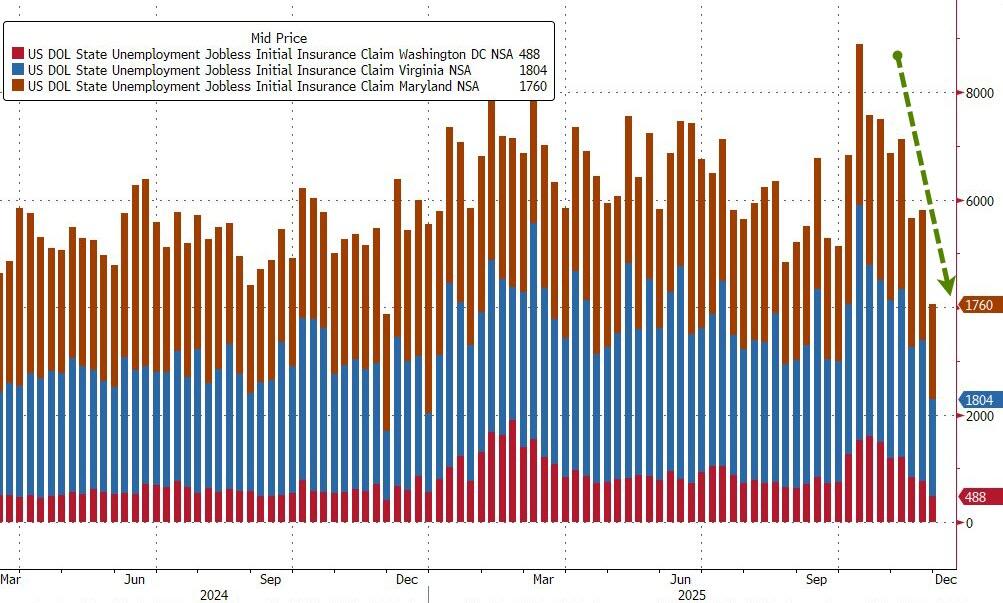

It appears a lack of government firings is helping as the 'Deep Tristate' initial claims tumbled to its lowest since Nov 2024...

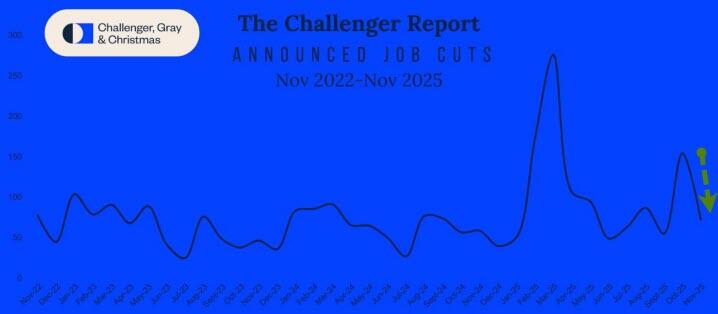

This lack of firing comes as ADP reports the biggest manufacturing sector job losses since COVID and Challenger, Gray & Christmas reports U.S.-based employers announced 71,321 job cuts in November, up 24% from the 57,727 job cuts announced in the same month last year.

“Layoff plans fell last month, certainly a positive sign. That said, job cuts in November have risen above 70,000 only twice since 2008: in 2022 and in 2008,” said Andy Challenger, workplace expert and chief revenue officer for Challenger, Gray & Christmas.

Continuing jobless claims continue to oscillate just above the 1.9 million Maginot Line...

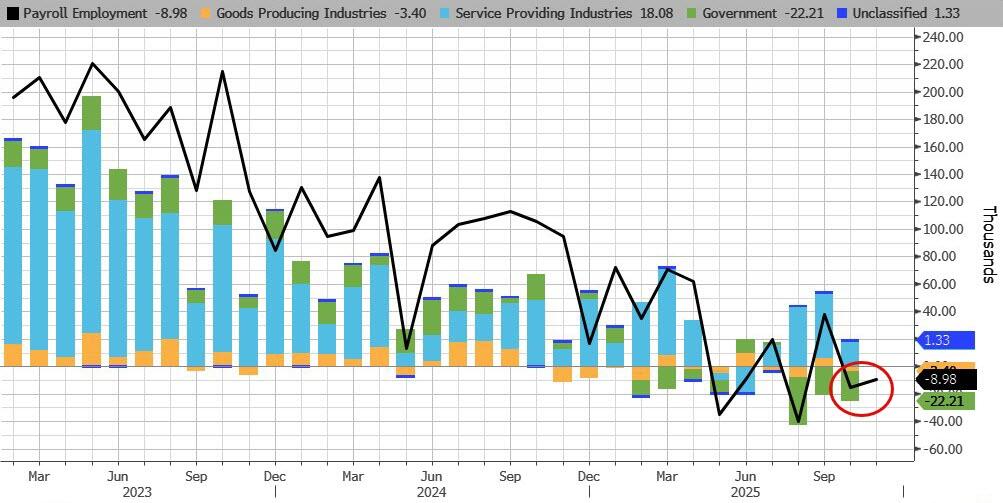

Yet another alternative labor market signal points to weakness (more in line with ADP's job losses) as Revelio shows 9k job losses in November...

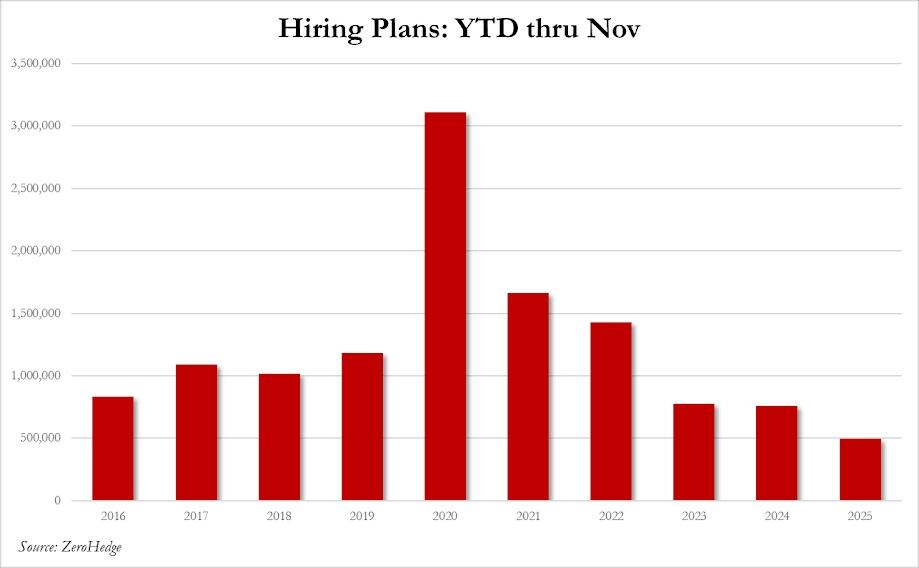

Hiring Plans Plummet

Through November, global outplacement and executive coaching firm Challenger, Gray & Christmas reports that U.S. employers have announced 497,151 planned hires, down 35% from the 761,954 announced at this point in 2024.

It is the lowest year-to-date total since 2010...

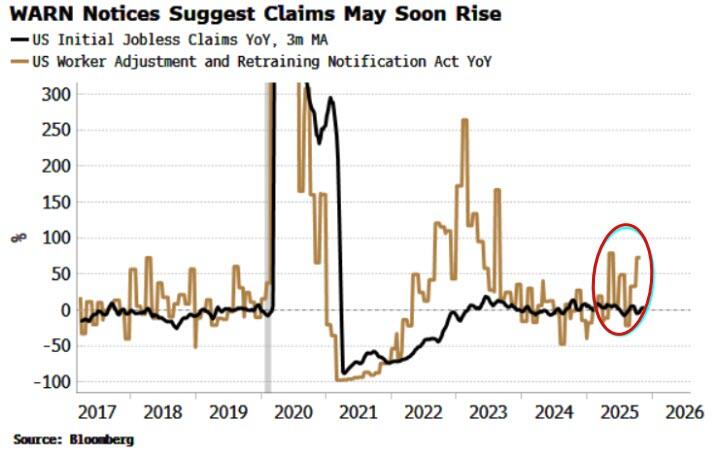

WARNing

Additionally, WARN notices, which have previously led unemployment claims, are rising again.

As Bloomberg's Simon White notes, The WARN Act obliges employers with more than 100 full-time workers to provide written notice to the state and the workers themselves at least 60-90 days ahead of planned plant closings and mass layoffs. It is one of the best real-time reads on the labor market, and has remained very low and steady, around an average of 220-230k, over the past two years.

As the chart below shows, WARN notices has led previous rises in claims. It has also given some false positives, but given the likely impact on yields should we see a sudden deterioration in employment, the recent rise is notable.

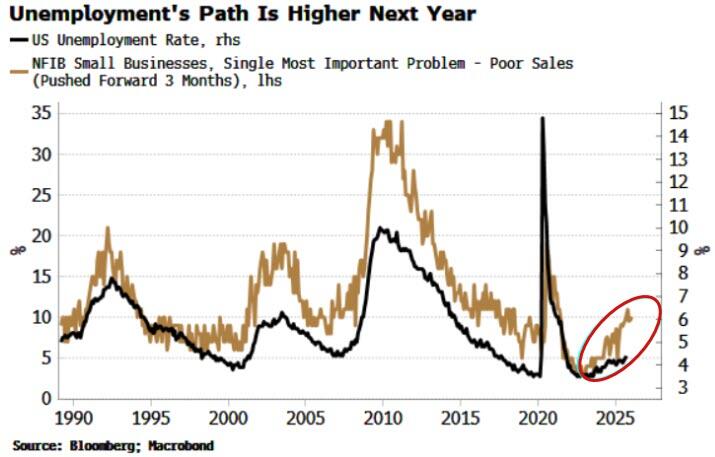

That the slowing in the jobs market is set to gather pace is captured in other indicators.

The NFIB small business survey polls respondents on whether they think the single most important problem they face is poor sales.

That has been rising, which often precedes the unemployment rate. Small businesses employ about half the workforce in the US and given the plunge in small business jobs reported by ADP yesterday, it seems labor market pains are starting to accelerate under the surface.

In short - the labor market remains a riddle, wrapped in a mystery, inside an enigma with every indicator pointing in different directions - choose your own adventure.

More By This Author:

WTI Holds Gains As Cushing 'Tank Bottoms' Loom; US Crude Production At Record HighUS Industrial Production Sees Biggest Annual Gain In 3 Years Despite Slowing Capacity Utilization

Gas Prices Hit Four-Year Low

Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you ...

more