Nio Stock: A Real Lift Or A Dead Cat Bounce?

Nio (NIO) has received a couple of nice catalysts over the last several days, sending its share price sky-high.

The first boost came from Nio reporting it has increased October deliveries by 25 percent in comparison to the prior month. The second catalyst was the announcement the company had entered into a partnership with Intel subsidiary Mobileye to help develop autonomous vehicles, with China being the initial market they’ll be marketed to.

In this article, we’ll look at whether or not these two positive reports have legs, or they are only a temporary reprieve from its past weak performance.

(Click on image to enlarge)

October Deliveries

Nio reported October deliveries had jumped to 2,526 vehicles in October, up from 2,019 deliveries in September. The company also pointed out this was significant because October in China includes a seven-day national holiday in the early part of the month.

Of the total October deliveries, 2,220 of them were ES6s, and the remaining 306 were ES8s, its premium SUV offering.

While the percentages were impressive, it has to be taken into account that the number of vehicles delivered were working from a very small baseline.

Although the company needed a positive report, it really isn’t something to get too excited about unless it shows it can consistently increase delivery volume on a consistant basis over a prolonged period of time. That has yet to be proven.

This isn’t bad news for the company, but it shouldn’t be considered more than a baby step until it proves this wasn’t a one-off performance.

Mobileye

In its announced collaboration with Mobileye, Nio Inc. said it would “engineer and manufacture a self-driving system designed by Mobileye, building on Mobileye’s level 4 AV kit.”

Nio’s part will be to mass-produce the system and work on integrating the system into a variety of vehicle lines of Mobileye. The vehicles will be used in Mobileye’s ride-hailing services, as well as vehicles it markets to consumers.

China will be the initial targeted market, eventually followed by expansion into other international markets.

With these back-to-back announcements, the share price of Nio skyrocketed. The question now is whether these positive catalysts will only have a short-term impact on the company’s share price, or it’ll drop back down after the market absorbs the implications.

In this deal, it’s not likely to have much impact on the short-term performance of Nio, but if it’s able to survive into 2020, it could start to provide a sustainable and predictable revenue source.

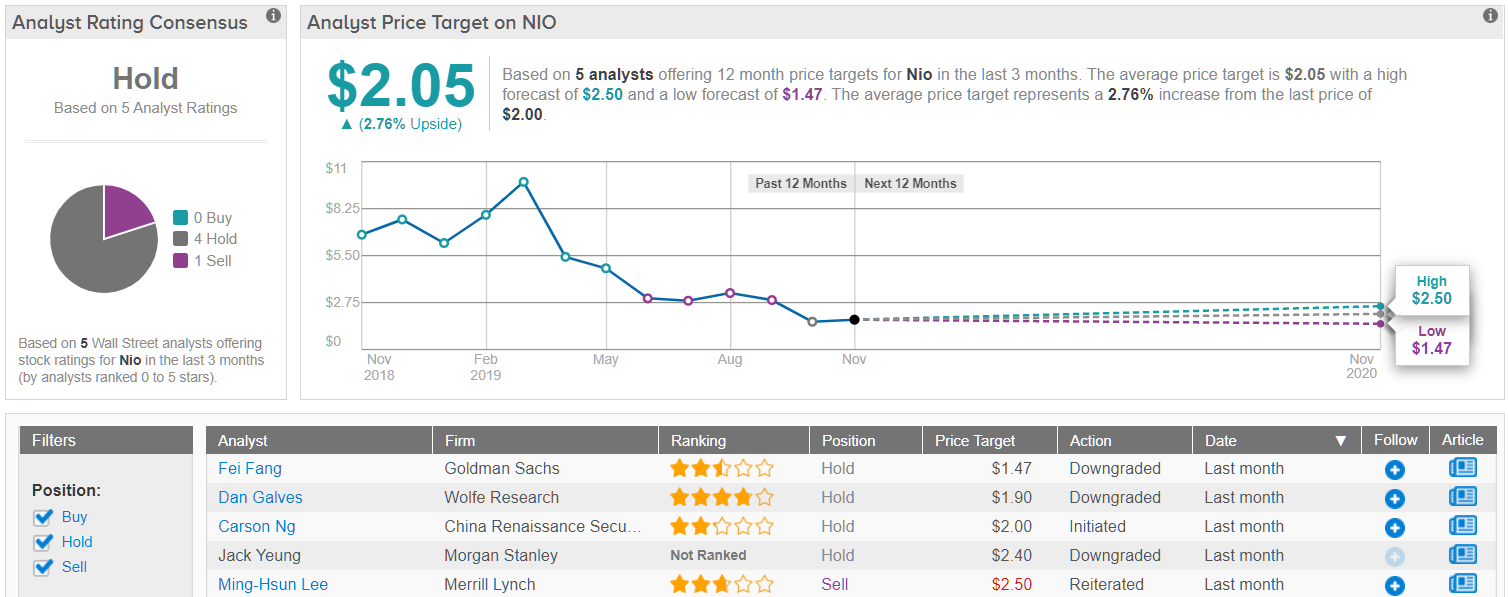

Wall Street Verdict

Wall Street is not convinced that the Chinese electric-vehicle maker’s reward is worth all the risk, especially when taking note that TipRanks analytics exhibit NIO as a Hold. Based on five analysts polled in the last three months, four rate a “hold” rating on Nio stock, while one says “sell.” The 12-month average price target stands at $2.05, which aligns evenly with where the stock is currently trading. Wall Street needs to see more from NIO before getting more confident on the story. (See Nio stock analysis)

(Click on image to enlarge)

Conclusion

The increase in deliveries and deal with Mobileye are important, but I don’t see this having a significant impact on the performance of Nio in the near term.

For that reason, the issues of its survival remain in play, as it continues to burn cash and concerns over whether or not it’ll have any working capital within a few months remain in place.

If the company shows it can continue to increase vehicle deliveries as it works on Mobileye’s self-driving system, it could slowly start to work its way out of extreme trouble. It’s still a long shot, but it is more positive for Nio now than it was at the end of October.

What this probably does in my view is make it a little more attractive to a potential suitor that is looking to take a position in this space.

That said, the last thing a larger company would want is to acquire Nio and then have to write off the acquisition if it continues to struggle to grow.

There is not doubt this has and probably will continue to provide a higher bottom and top for Nio in the near term, but it’s questionable as to whether it’ll be able to continue to hold those higher tops and bottoms, or it slides back into its former weak performance.

I think it’ll probably do a little better than before the news was announced but the overall macro problems at the company remain in place, and it needs more than these positive but small catalysts to change its future prospects for the better.

Nio will probably be a decent stock to trade for a short period of time, but I wouldn’t take these two positive catalysts as a reason to take a long-term position in the company. The problems it had before the increase in deliveries and Mobileye deal remain in place.

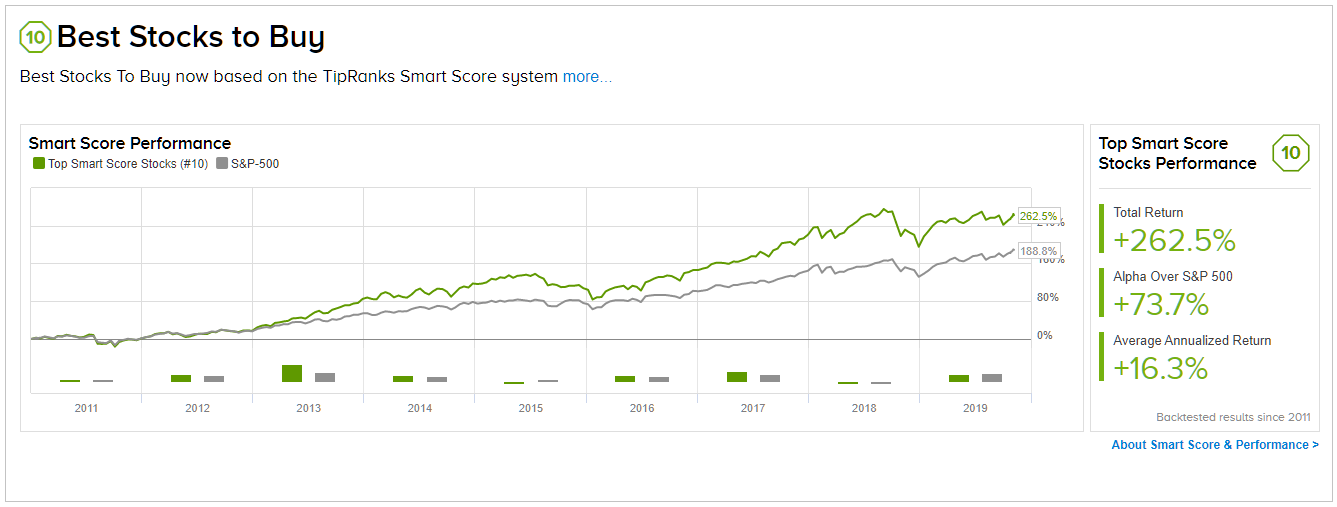

(Click on image to enlarge)

To find ideas for stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched feature that ...

more