NFIB Small Business Survey: Future Growth Outlook Dismal

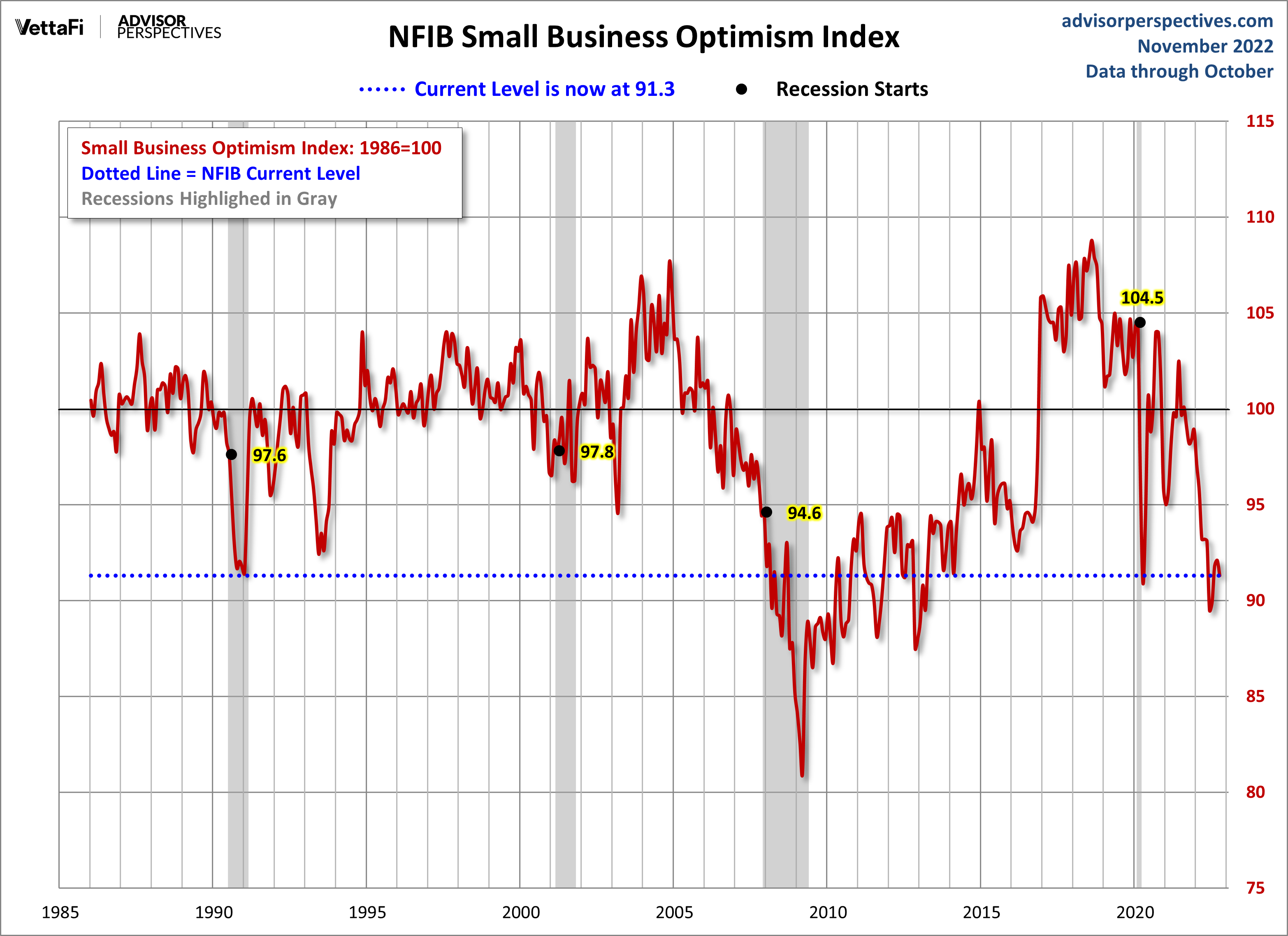

The latest issue of the NFIB Small Business Economic Trends came out this morning. The headline number for October came in at 91.3, down 0.8 from the previous month. The index is at the 10th percentile in this series.

Here is an excerpt from the opening summary of the news release.

“Owners continue to show a dismal view about future sales growth and business conditions, but are still looking to hire new workers,” said NFIB Chief Economist Bill Dunkelberg. “Inflation, supply chain disruptions, and labor shortages continue to limit the ability of many small businesses to meet the demand for their products and services.”

The first chart below highlights the 1986 baseline level of 100 and includes some labels to help us visualize the dramatic change in small-business sentiment that accompanied the Great Financial Crisis and now the COVID-19 pandemic. Compare, for example, the relative resilience of the index during the 2000-2003 collapse of the Tech Bubble with the far weaker readings following the Great Recession that ended in June 2009 and today's figures.

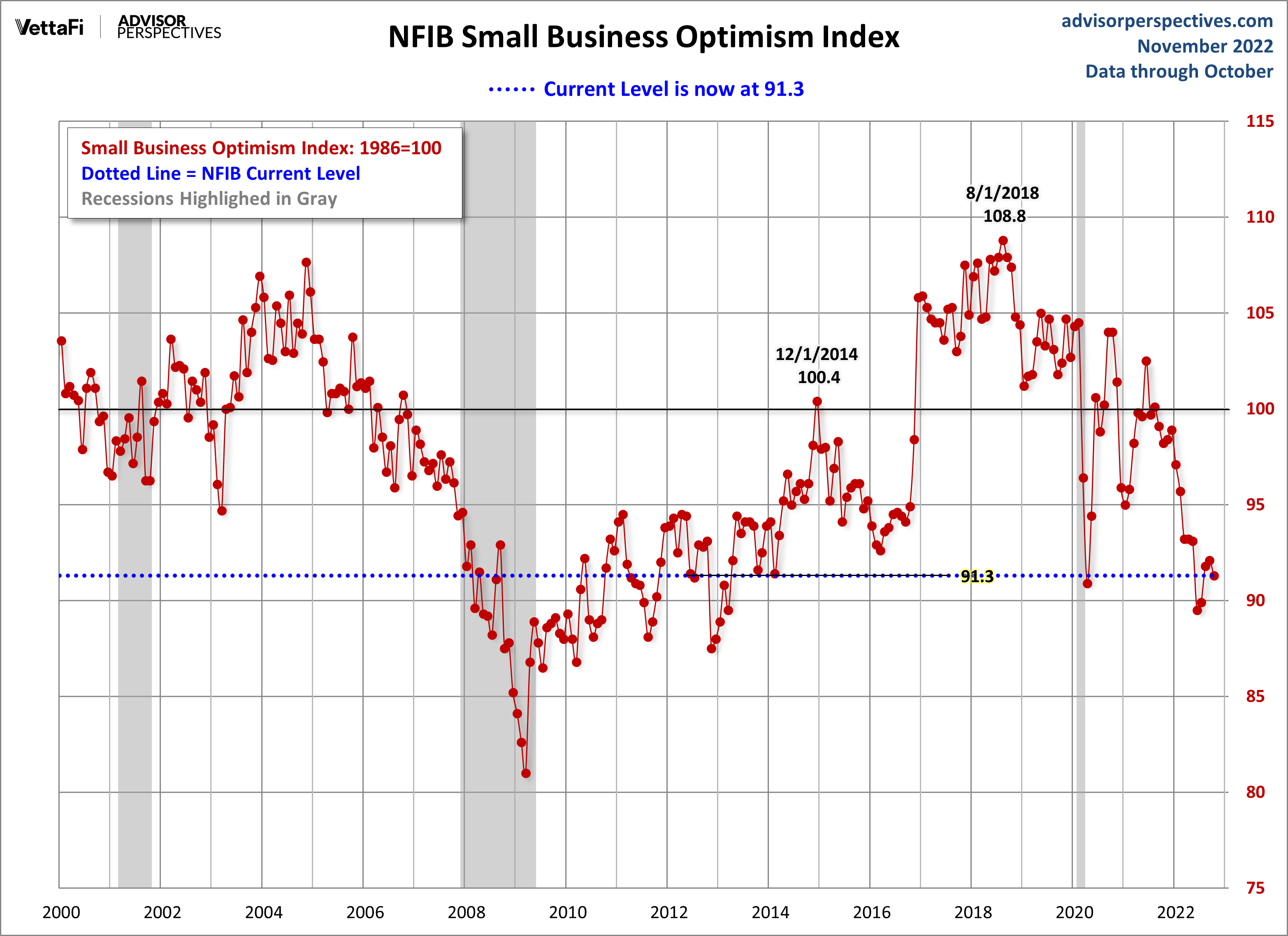

Here is a closer look at the indicator since the turn of the century.

The average monthly change in this indicator is 1.4 points. To smooth out the noise of volatility, here is a 3-month moving average of the Optimism Index along with the monthly values, shown as dots.

Business Optimism and Consumer Confidence

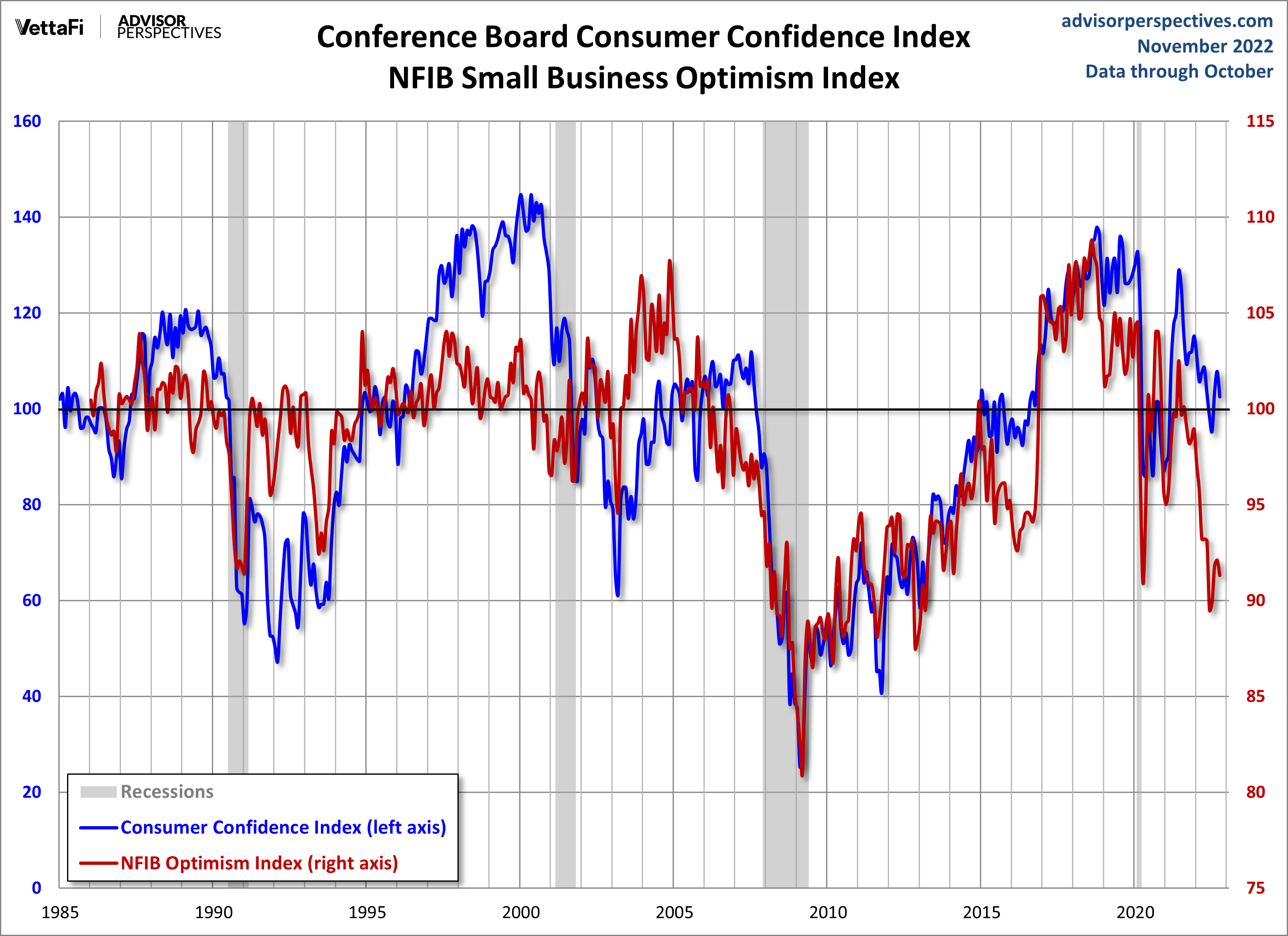

The next chart is an overlay of the Business Optimism Index and the Conference Board Consumer Confidence Index. The consumer measure is the more volatile of the two, so it is plotted on a separate axis to give a better comparison of the two series from the common baseline of 100.

These two measures of mood have been highly correlated since the early days of the Great Recession. The two diverged after their previous interim peaks, but have recently resumed their correlation. A decline in Small Business Sentiment was a long leading indicator for the previous two recessions (but clearly not for the Covid-19 recession).

More By This Author:

October Employment: Services Vs. Goods Producing JobsThe Big Four Economic Indicators: October Employment - Monday, Nov. 7

S&P 500 Snapshot: Brief Reprieve, But Back To The Bear