Weekly Stock Report

Hope everyone who is a dad had a Happy Father's Day!

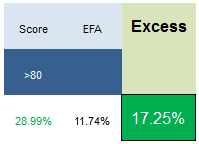

Top scoring weekly returns: Buy and Hold 1 Year

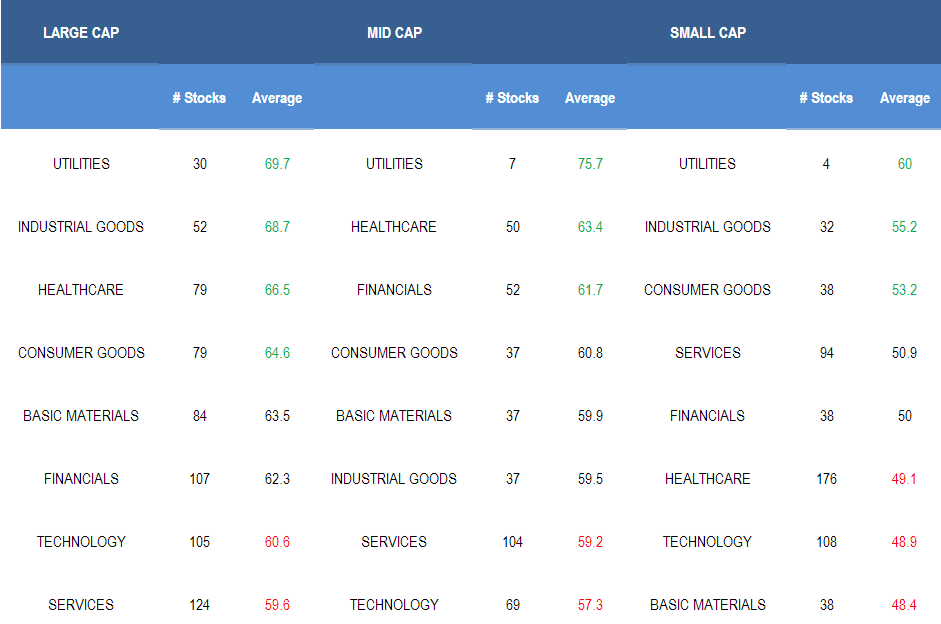

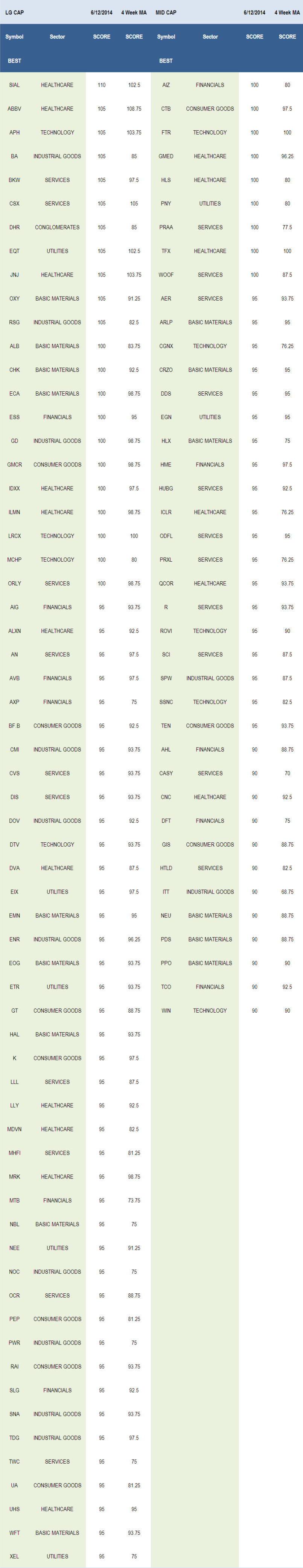

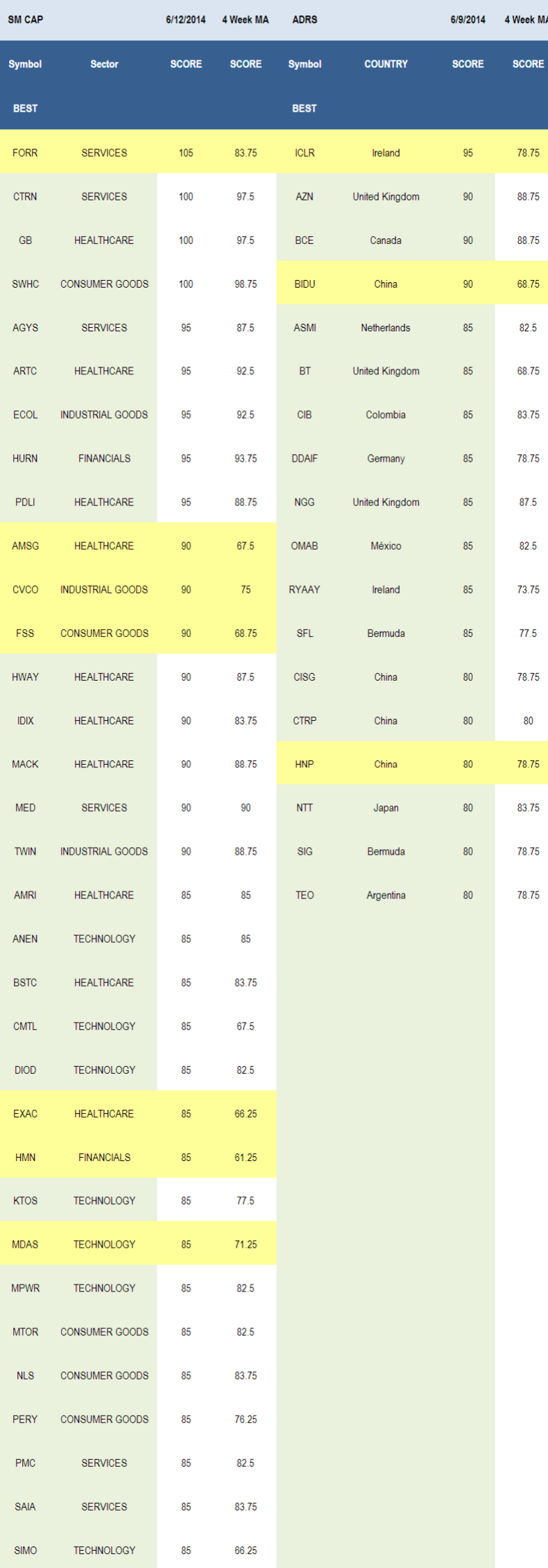

Utilities are the top scoring sector across our universe, followed by industrial goods.

Healthcare and consumer goods score in line. Managers should be overweight large and mid cap healthcare and under weight small cap healthcare.

Financials, basic materials, services, and technology stocks score below average. Mid cap financials score better relative to their peers than small cap. Large and mid cap basic materials score better than small cap.

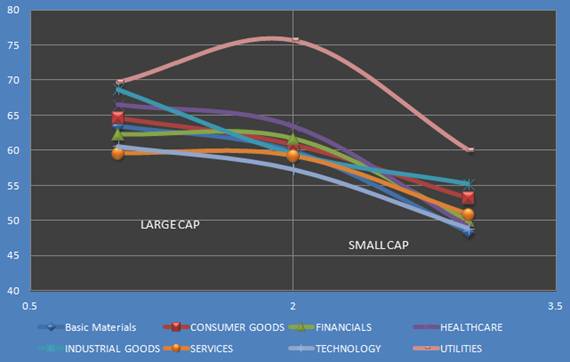

The following chart visualizes sector score by market cap.

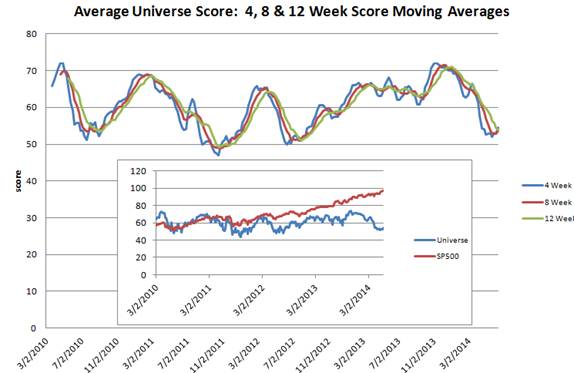

This next chart provides insight into historical smoothed scores since 2010. A move in the blue line above the red and green line is consistent with a better environment for embracing risk (beta).

Utilities

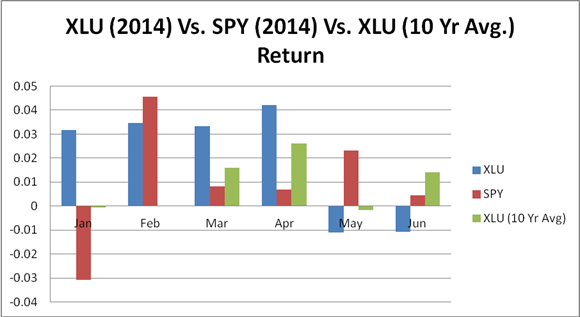

Utilities have pretty much followed their historical seasonal path this year, but in order for it to keep that up in June the basket will need to head higher over the next two weeks.

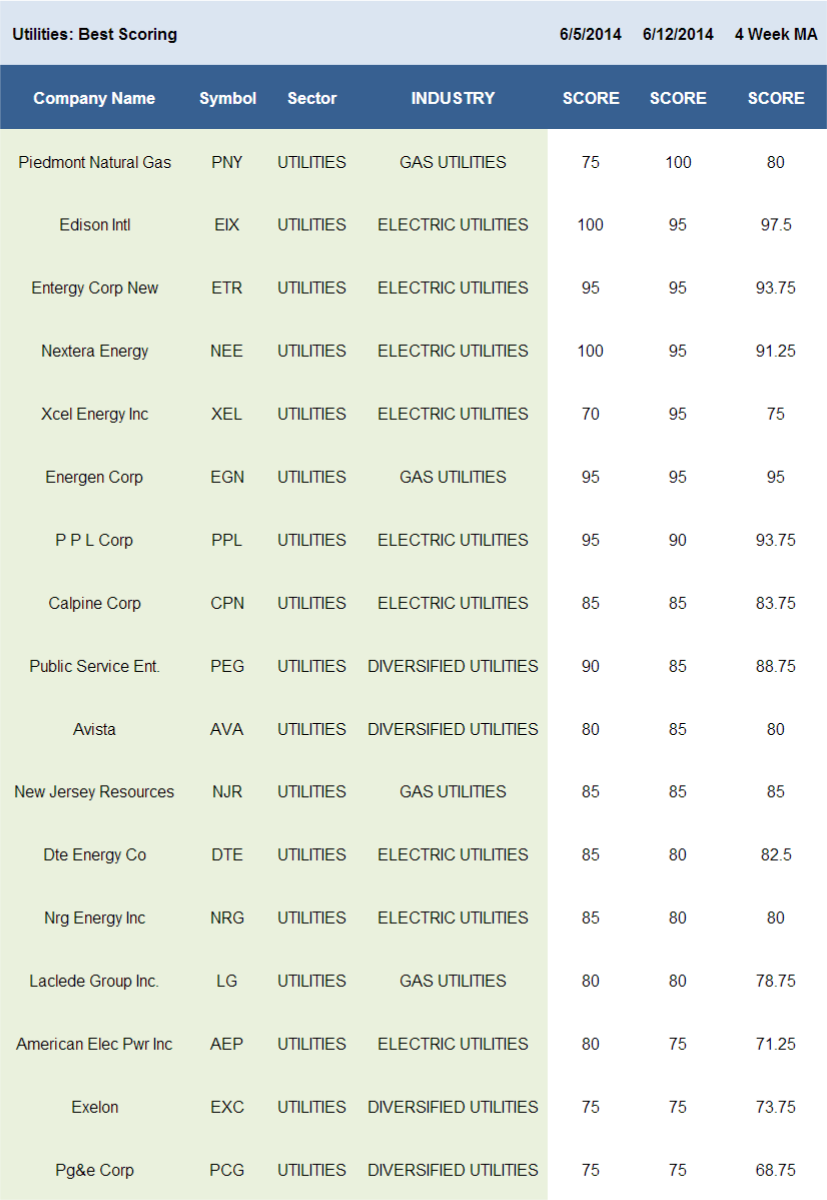

Utilities remain our best scoring sector, supported by dovish coal regulation, potential rate increases tied to natural gas price spikes this past winter, and summer cooling demand season fast approaching. Historically, dividend paying defensive baskets are better bets through summer doldrums and utilities yields remain competitive. Despite rallying 13.5% this year, the XLU continues to yield 3.44%.

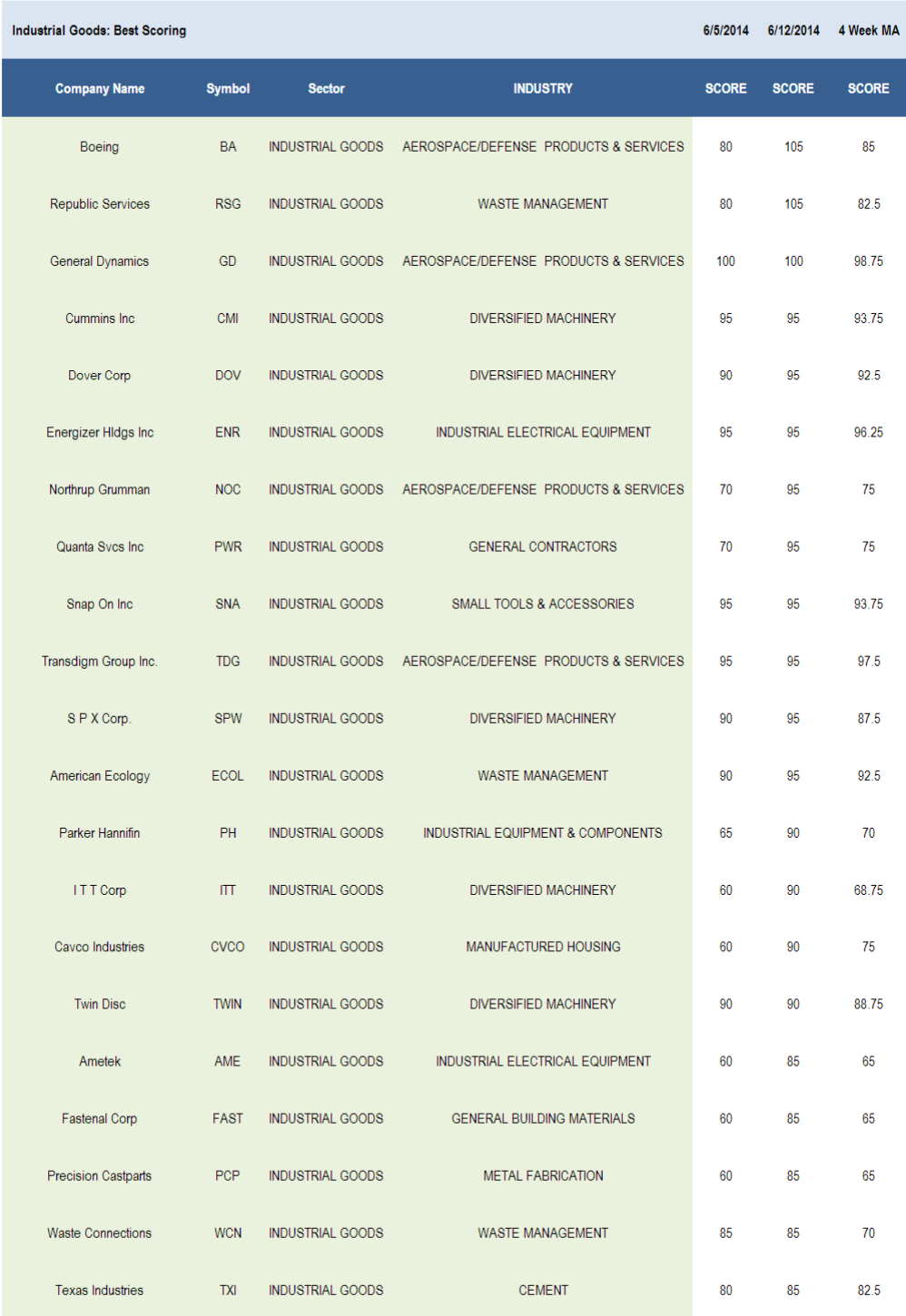

Industrial Goods

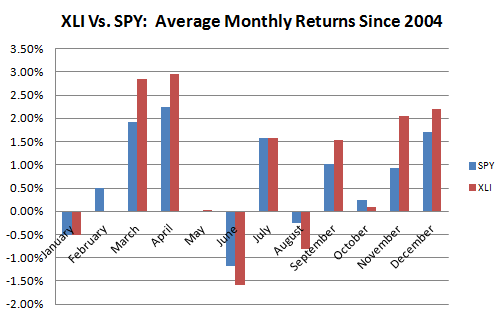

Industrials score moved back above average this week ahead of a shift to generally positive seasonality beginning in July. Over the last ten years, buying weakness in June in the group has been rewarded in July and in the final six months of the year, the XLI has posted negative average returns in just August. That suggests that if industrials fall into month end, managers may want to increase weights.

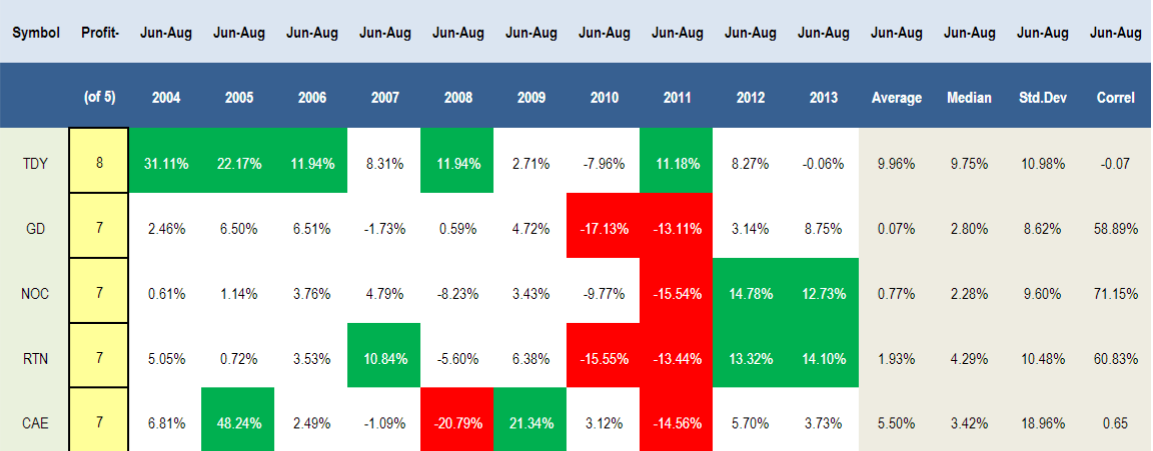

A significant number of the top scoring industrial goods stocks are aerospace/defense companies. Next month's Farnborough Airshow offers potential order catalysts that may support suppliers. That said, the basket tends to perform better heading into the Airshow than exiting it. That said, there are some exceptions. Over the past decade, the following stocks have posted solid seasonality in the 3-month period ending August.

None.