War Of Words Erupts Between Buffett & Robinhood

Robinhood has been slammed over the past three years for misrepresenting its business model which it has claimed is "to democratize finance for all." Instead it caters to the gambling instincts of millennial and GenZ traders, while quietly selling their orderflow (a practice it was forced to disclose not too long ago) to the highest bidders. Bidders, such as billionaire Ken Griffin's Citadel, who then traded ahead of this mountain of bulk trading data to virtually risk-free profits: over the weekend. Warren Buffett also slammed the "free" brokerage, which nearly imploded during the February short squeeze mania, accusing the company of “taking advantage of the gambling instincts of society."

Speaking at Berkshire's virtual shareholder meeting on Saturday, Buffett said that Robinhood has become "a very significant part of the casino group that has joined into the stock market in the last year or year and a half."

The billionaire continued, saying that "it creates its own reality for a while, and nobody tells you when the clock is going to strike 12 and it all turns to pumpkins and mice," he said. He added there is "nothing illegal to it, there's nothing immoral, but I don't think you build a society around people doing it" and said he looks forward to reading the S-1 filing of Robinhood, which has filed confidentially for an initial public offering.

Buffett's faithful 97-year-old sidekick Charlie Munger disagreed, and unloaded on Robinhood saying it is "deeply wrong" and "god awful that something like that brought investments from civilized men and decent citizens."

But in a surprising twist, instead of taking the insults from the geriatric duo silently and stoically - as so many other corporations tend to do - on Monday morning Robinhood hit back against the billionaire duo, saying criticisms of the no-fee trading app by Warren Buffett and Charlie Munger were insults against younger investors, blasting the billionaires as out-of-touch elites who are "acting like they are the only oracles of investing."

Robinhood, which has a habit of taking from the poor and giving to Ken Griffin (so he can buy yet another nine-digit mansion somewhere in the world) but which nobody seems to mind as long as everything keeps rising, issued a statement saying that "if the last year has taught us anything, it is that people are tired of the Warren Buffetts and Charlie Mungers of the world acting like they are the only oracles of investing."

The litany of faux outrage continued :

"It is clear that the elites benefited from a stock market that kept many families sidelined from participating while they amassed huge wealth from decades of investing — driving a deep wedge between the haves and have-nots."

"At Robinhood, people now don’t need thousands of dollars to begin investing. We pioneered commission-free trading, and fractional shares make it possible for people with less money to invest in a piece of a stock. Take Berkshire Hathaway Class A stock. One share trades for north of $400,000. But with Robinhood, fans of the company can invest what they can afford and don’t need to amass what is a prohibitive sum for most Americans. Plenty of Robinhood customers do just that by buying a fraction of Berkshire Hathaway stocks, as well as many other stocks that Messrs. Buffett and Munger have invested in. In fact, we see that a majority of Robinhood’s customers are buying and holding."

"Retail investing in America is thriving today because everyday investors are seizing the opportunity to build their own nest egg. It may never be nearly as big as the billions upon billions that the elites in this country have amassed. But it sure is something to celebrate."

While we applaud Robinhood's Herculean effort at misdirection, the only thing the company is "celebrating" is that the SEC and DOJ still find selling client orders as a legal activity, when in reality it is merely profiting from enabling frontrunning. But because this activity (which Citadel's former GC once railed against before Citadel realized it would make much more money from encouraging it) has become the cornerstone of modern equity markets, since everyone is literally doing it, there is no way it can be banned, at least not until there is a major market crash.

And speaking of selling client orders, Robinhood picked the worst possible timing to publish its latest Rule 606 filing, which reveals just how much money it made from selling Millennials' orderflow. The filing showed that when it comes to taking pennies from the poor to give to the rich, it truly has no equal because in the first quarter, Robinhood's revenue from “payment for order flow” - a system where market makers like Citadel pay brokers like Robinhood for not only routing orders to them but giving them an exclusive look at total retail order flow, hit a record $331 million in the first quarter, up more than 3x from $91 million a year ago.

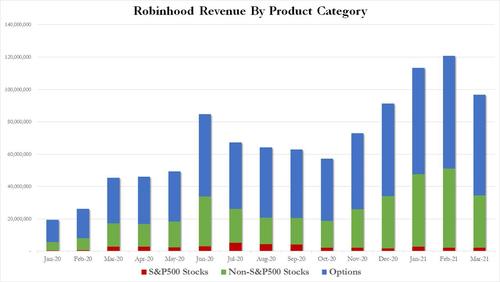

As shown in the chart below, revenue from payments for order flow peaked in February at about $121 million, before dropping 20% to $96.7 million in March. Much of the decline was due to reduced trading of non-S&P 500 stocks and options, the filing shows. As a reminder, non-S&P stock and option trading remain the only somewhat valuable aspects of market dataflow currently, as traditional S& P500 stock trading has been commoditized to death by other brokers and exchanges.

In 2020, Robinhood made a total of $687 million from selling orderflow, primarily to Citadel; it has almost hit the halfway point just one quarter into 2021.

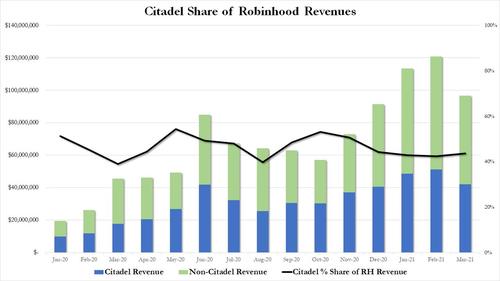

And speaking of Citadel, it is quite clear that Robinhood continues to effectively act a subsidiary of the world's largest retail order exchange: in Q1, Citadel accounted for a whopping 43% of all Robinhood revenues.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more