USD/JPY Outlook: Yen Braces For Gains After Lackluster Jobs

As we stepped into the new week, the USD/JPY outlook took a bearish turn, with the yen standing its ground in expectation of another descent in the US dollar’s value. This anticipation gained momentum following a lackluster US jobs report.

The dollar index experienced a significant drop of over 1% last week, its most substantial decrease since mid-July, hitting a six-week low. Several factors, including weak US jobs data, softer global manufacturing numbers, and a drop in longer-term Treasury yields, contributed to the dollar’s decline. Consequently, it prompted a yen rally that saw it recover from levels weaker than 150 per dollar.

Meanwhile, Treasury yields slumped in response to soft US jobs and manufacturing data. Additionally, the US government reduced its refinancing estimate for the quarter.

Futures markets now imply a 90% probability that the Fed has completed its rate hikes. Moreover, there is an 86% chance that the first policy easing will occur as early as June. The shift in the dollar’s direction and the yen’s rebound from last week’s lows suggested that Japanese authorities likely do not need to intervene in the currency market.

Notably, the yen reached 151.74 per dollar last week, approaching the lows in October of the previous year. These lows triggered several rounds of dollar-selling intervention by the Bank of Japan.

USD/JPY key events today

There are no significant events scheduled for today from the US or Japan. As such, investors will likely keep digesting the US NFP report.

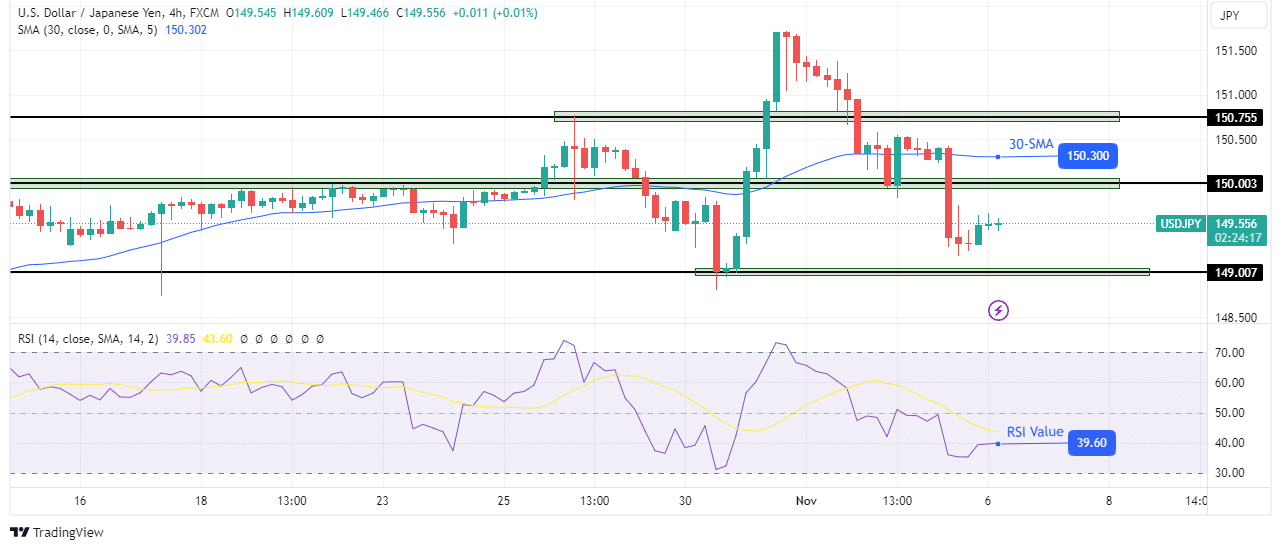

USD/JPY technical outlook: Yen retreats below key resistance at 150.00

USD/JPY 4-hour chart

On the technical side, the yen has dropped back below the 150.00 key resistance level. Initially, the price shot up from the 149.00 support level to break above 150.00. However, bulls could only keep the price above this level briefly as bears resurfaced with as much strength to push the price lower.

Moreover, the price broke below the 30-SMA as the RSI fell below 50 to support a bearish bias. Consequently, bears are currently in control and are targeting the 149.00 support level. A break below 149.00 will likely confirm a bearish trend.

More By This Author:

Gold Price At Resistance Under $2,000 Ahead Of The US NFPEUR/USD Outlook: Optimism Swells As US Rates Approach Peak

Gold Price Playing In Rising Wedge, Focus On FOMC

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more