Torchlight Energy Inks Drilling And Development Agreement With University Lands

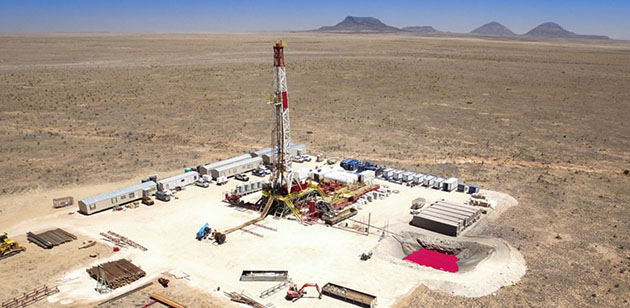

Torchlight Energy Resources Inc. (TRCH) announced that the company, along with operating partner Founders Oil and Gas, has signed a Drilling and Development Unit (DDU) agreement with University Lands for its Orogrande Basin project in Texas. University Lands manages the surface and mineral interests of 2.1 million acres of land across nineteen counties in West Texas for the benefit of the Permanent University Fund.

According to Torchlight, "The DDU agreement allows for all 192 existing leases covering the 133,000 net acres leased from University Lands to be combined into one lease for development purposes."

The company has stated that "the agreement represents one of the largest DDU Agreements ever granted by the University Lands organization in the State of Texas, according to University Lands personnel."

"The significance of this agreement to Torchlight is tremendous," stated John Brda, CEO of Torchlight Energy. "We have devoted significant time and effort to this DDU Agreement over the past year. Based on the sheer size of this play, its development by an independent under multiple leases would be nearly impossible. The DDU creation makes the Orogrande Basin Project manageable at reasonable cost and maximizes the attractiveness of the play to potential suitors in any future sale discussions."

Dallas Salazar, CEO of Atlas Consulting, wrote on April 3 that this was a "great day for Torchlight, with the announcement of its Drilling and Development Agreement with University Lands on its Orogrande Basin project. The agreement grants it the exclusive right through April 2028 to drill and develop the project. This exclusivity matters—that's why we have a patent office and filing system; effectively, Torchlight did both with the D&DA today. Being primarily a science project at this point, having exclusivity in the Orogrande project will matter if the data are productive. Torchlight positions its Orogrande project for easy M&A structuring with the exclusivity lockup, the duration of which is superb. Additionally, the de minimis drilling obligations [by contract—to hold the acreage] simplify M&A structuring. I look at Torchlight as two investment theses: [1] the Orogrande project for M&A and [2] the Hazel project for long-term value."

In March, Torchlight announced it had begun the flowback and cleanup stage of testing on the Flying B Ranch #2 well in the Hazel project in the Midland Basin. According to the company, "Next steps toward bringing the well into production will be to flow back frac fluid from the upper stage and drill out the bridge plug that was set above the Wolfcamp B formation. Subsequently, the well will be flowed back and tested. Once completion fluids are removed, an oil cut and production will be measured to provide Initial Production (IP) figure and viability for horizontal field development. This testing will begin immediately and the well monitored over the coming weeks. Additional testing may be done on the upper zones to validate further pay zones at a later date."

In February, Salazar established a baseline value for Torchlight Energy equity. In an analysis he published on Seeking Alpha, Salazar wrote, "Based on comparable transaction analysis [for acreage comparable to Torchlight's Hazel Project acreage—via analysis of logs and cores showing pay potential], based on third-party valuation of the geographical positioning of Torchlight's Hazel Project assets [by geologists and by Land Men], based on projected EURs [estimated ultimate recoveries] and IRRs [rates of return specific to production], based on analysis of Hazel Project specific drilling obligations [i.e., securitization risk assigned to the acreage], and assigning zero value to Torchlight's Orogrande Project acreage—Torchlight equity should be assigned $2.50-$3.00 in immediate-term value. . .This equity pricing analysis effectively assigns ~$150 million in equity value to Torchlight's Hazel Project at its current iteration."

Torchlight is currently trading around $1.40.