The AI Plays Wall Street Doesn’t Want You To Know About

Looks like I underestimated this one!

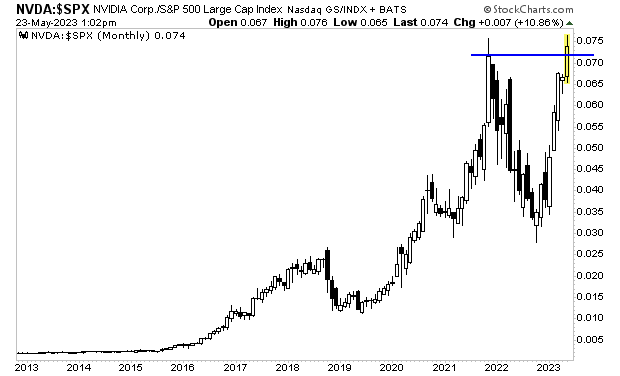

Yesterday I noted that the Artificial Intelligence (AI) bubble was still going strong, but that large players like Nvidia (NVDA) were probably “tapped out.”

At that time, I noted that the ratio between NVDA and the broader market has just hit a new all-time high. Now, regardless of how much AI really changes the world, do you think NVDA should be outperforming the S&P 500 even more than it did during the economic shutdowns when the Fed was pumping trillions of dollars into the financial system?

Seeing this I thought NVDA’s stock was probably close to a top of sorts. I mentioned that I wouldn’t be surprised for this chart to close out the month of May down from current levels, which means NVDA underperforms the broader market in the coming weeks.

(Click on image to enlarge)

NVDA reported results after the bell on Wednesday, and it completely SMASHED expectations to the upside. The stock EXPLODED higher by 27% in the after hours.

Yes, a $750+ billion company is up 27% in a single day,

This is the thing about bubbles, they can last longer and go much further than anyone believes. NVDA stock which was already up over 100% this year is now exploding even higher. How high will it go? To a market cap of $1 trillion? $2 trillion?

I have no idea.

This is why George Soros always argued you should “buy a bubble” as soon as you recognize it. Bubbles, like all manias, can exceed even your wildest expectations.

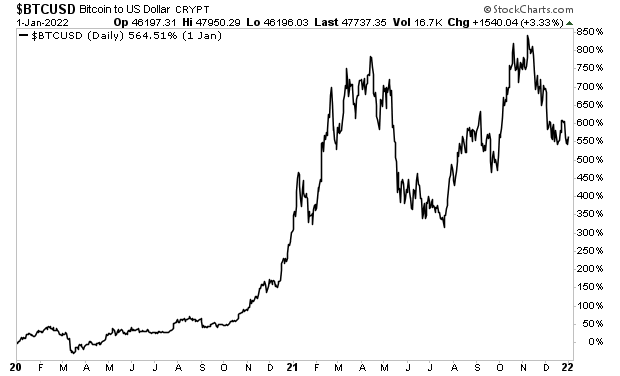

The crypto currency bubble of 2020-2022 lasted between 6 and 12 months depending on how you measure it. It saw Bitcoin (BTC) rise 600%…

(Click on image to enlarge)

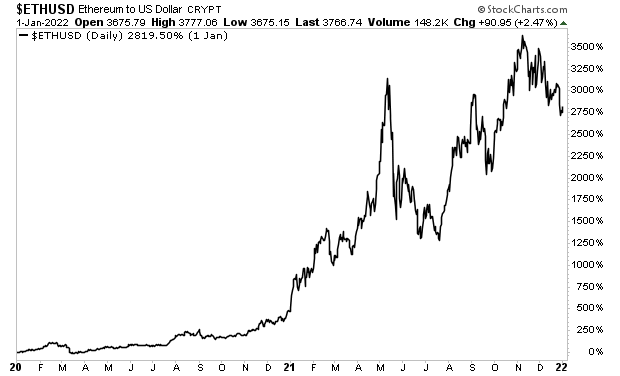

… while smaller crypto currencies like Ethereum rose 3000%!

(Click on image to enlarge)

If the AI bubble began in late 2022/ early 2023, we are probably about halfway through this situation (see NVDA’s results yesterday).

Does this bubble defy reason and logic? Yes. But traders and speculators aren’t looking for reason… they are looking for profits!

And right now, AI is where the biggest profits lie.

Societe General has noted that AI-associated stocks account for ALL of the gains in the broader stock market this year. Put another way, without the influence of AI as an investment theme, the S&P 500 would be DOWN this year.

So if you feel like you’ve “missed the boat” in AI, do not be alarmed. These things take much longer and go much farther than anyone ever believes!

On that note, we are putting together an Executive Summary outlining the real impact of AI as well as which companies are best positioned to profit from this major trend when the froth is taken out of the market.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed next week, you can join the wait-list here.

More By This Author:

There’s Something “Unusual” About This Market Rally… I Think I Know What It IsHow To Profit From The AI Revolution

Signs Of A Recession Are Growing