Student Debt Is Challenging The Reason For Getting That Long Sought After College Degree

What has changed for many of the college educated is finding themselves in debt longer than their parents were after college, being penalized for having student debt when going to buy homes, cars, etc., and in the end having less wealth and a lower salary when compared to those without a college education.

One reader’s comment. “I’ve been meaning to write back, but a large number of days on the road takes precedence. I disagree about the relevance of my experience working endless shit jobs while living in crappy apartments and eating pb&j to pay back my loans. That said, I do respect your opinion, and I hope you continue to share your thoughts about how entirely fucked up our priorities are as a Nation when it comes to education.

As my father who is in his late sixties recently said to me “sorry your generation got screwed”, something I’m quite cognizant of as I lose twenty grand selling a home to pursue a career. In the meantime, time to bust some ass and take care of what is in our power to affect. Patrick “Ripping Off College Students Economic Future”

The argument for a college education has always been the earning potential the 4-year degree holder has as opposed to those without a 4-year college degree. As more and more students have trouble buying into the Middle Class with the degree they have earned because of the overwhelming debt, the value of a college education has come into question considering the debt load carried by college graduates. What has changed in the last decade is tuition increases outstripping the cost of healthcare, the decline in state support for colleges, and the increased use of credit cards, home equity, and retirement account borrowing to fund college education. What remains after the piece of paper is passed out at graduation day is debt remaining with the student into his thirties and sometimes well into their forties.

What we are seeing today has no precedence (precedent) in the history of education. The Cassandra’s of the world such as Dr. Elizabeth Warren warned of the “Coming Collapse of the Middle Class” with households not being able to get by or just barely scrapping by with a two earner income scenario. One illness or lost job could conceivably leave the family destitute unable to pay a student loan and also unable to discharge the student debt in bankruptcy. Student Loan Justice Org Alan Collinge speaks of his own as well as others battle with student loan debt. It is near to impossible to escape the long arm of student loan debt, which still makes a suitable profit even in default.

College debt has risen at twice the rate of mortgage and credit card debt since 2007. During that same period, the nation has gone through a dramatic economic shock leaving many without jobs or low paying jobs. Besides experiencing unemployment the population has also experienced housing value decreases, and loss of value in retirement funds. This loss of financial viability impacts students as the burden transfers from the host family to the student upon graduation The student lacks the ability to pay off the debt quickly, over time, or even discharge it through bankruptcy due to the lack of well paying jobs. Many turn to the fatal mistake of walking away from student loan debt.

“Labor market indicators give us some clues. Much has been made of the college wage premium, that is, the difference between incomes of college graduates versus non-college graduates. According to analyses of Census Bureau surveys, a bachelor’s degree recipient can expect to earn an average of $1 million more in lifetime income than a wage earner without a degree.

But behind that headline number is a more troubling trend. The growing gap between college graduates and others isn’t really due to rising starting wages for the average college graduate – it’s that the wages of those without a degree are falling rapidly. In fact, when accounting for inflation, young college graduates have found that starting wages are falling. “CFPB: Rohit Chopra Addresses Major Financial Issues tot the Federal Reserve Bank of St. Louis”

To repeat what Rohit Chopra testified to at the St. Louis Fed; the premium gained from a college education so many in Congress and economists have espoused as the biggest reason to get a college education has changed. The level of income gained has decreased in a similar manner as what has occurred with those lacking a college degree. While the $million dollar gap still exists between college grads and high school grads; the starting wages for college graduates has decreased when considering inflation and falling wages. Between 2000 and 2011, real wages for high school graduates dropped ~11% while it dropped ~5.4% for college graduates. So is there a Smillion gap in lifetime earnings if you get that college education? There still is; but, it is not worth as much as it was in previous decades. So what does this mean for future graduates?

~One in five households have student debt with the largest percentage, a record 44%, carried by Households under 35 years of age. Indeed the ratio of student debt to income has increased from 3.6% in 1989 to 21.9% in 2010 (PEW) for this same age group. In the chart, “Share of Outstanding Student Loan Debt Owed by Characteristics of the Household” the least wealthy bottom fourth or those whose net worth is less than $8,562 owed 58% of the outstanding student debt. “Households Owing Student Loan Debt at Record Levels”

The impact on the economy is only just starting to be felt as young college educated household are unable to spend on consumer goods and also that much desired goal “housing. Last year, Chairman Bernanke remarked: ‘lending to potential first-time homebuyers has dropped precipitously, even in parts of the country where unemployment rates and housing conditions are better than the national average. Indeed, the propensity of younger households – headed by adults aged 29 to 34 – to take out their first mortgage has been much lower recently than it was 10 years ago, a period well before the most recent run-up in home prices.’ Two weeks ago, Bernanke noted; student debt may be impacting the ability of many young people to buy their first home.”

With the decreased earnings of college graduates, the emergence of student loan debt in the 30 – 40 year old households (increasing from 1.1% student loan debt to household income in 1989 to 8.7% in 2010-PEW) who finished college 5 to 15 years earlier has become commonplace. Mind you, we are not talking about households with or chasing advanced degrees. These are households with two Bachelor’s degrees and debt totaling ~$52,000. The impact of a longer student loan debt cycle is seen by comparing those with student debt to those households without student debt; as Chopra remarked, 30 year olds with no history of student debt are more likely to have mortgage debt than those with student debt. A college education was supposed to increase the earning power of graduates as opposed to those without, surpassing the debt liability of the education and allowing graduates the ability to buy more in the economy. Not only has this changed, the impact on the housing market, as a “recent survey by the National Association of Realtors found 49 percent of respondents describe student debt as a ‘huge’ obstacle to affording a home.” Those with student loan debt have to put off for a longer period the purchase of a home.

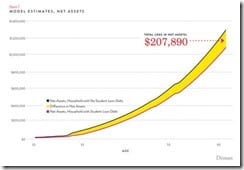

Demos illustrated the impact of household student debt as compared to household with no student debt on household income in its study; “At What Cost; How Student Debt Reduces Lifetime Wealth.” The losses incurred from student debt outweigh the income increases. Again over time, the income of those without student debt surpass those with student debt.

And as Demos demonstrates also, those households with student loan debt suffer a similar fate in comparison to those with no student debt. The length of time taken to pay off student debt impacts the accumulation of asset compared to those households having no student debt. The impact only begins with students as it also ripples through a consumption led economy. “Average household debt fell from $105,000 in 2007 to $101,000 in 2010 (Pew Research Center, 2012). “Household Debt Levels” have declined because of a reduction in debt for residential real estate. In addition, debt tied to credit cards has also declined. Outstanding student loan debt has risen since 2007, and hence student debt as measured by the SCF has risen from 3% of total household debt in 2007 to 5% in 2010.”

The threat to a college student’s future is not Social Security or Medicare expenditures as Stanley Druckenmiller promotes in his Generation Equity College Campus Tours. The real threat to a college student obtaining that ticket to the middle class can be seen in uncontrolled and increasing college costs, decreasing state aid to colleges resulting in rising tuition and subsequent student debt , fewer well paying jobs, and decreased earnings after college. As shown by Demos in both graphs, those without student loan debt appear to come out financially better over the years. While average household debt decreased from 2007 to 2010, student loan debt has increased “If current borrowing patterns continue, student debt levels will reach $2 trillion in 2025 (PEW)” and more student loan defaults.

-----

References:

- Prepared Remarks by Rohit Chopra Before the Federal Reserve Bank of St. Louis;

http://www.consumerfinance.gov/newsroom/student-loan-ombudsman-rohit-chopra-before-the-federal-reserve-bank-of-st-louis/

- The Coming Collapse of The Middle Class; Dr. Elizabeth Warren;

http://www.soyouthinkyoucaninvest.com/2009/04/elizabeth-warren-coming-collapse-of.html

- At What Cost; How Student Debt Reduces Lifetime Wealth; Demos, Robert Hilton Smith;

http://www.demos.org/what-cost-how-student-debt-reduces-lifetime-wealth

- Student Loan Justice Organization; Alan Collinge;

http://studentloanjustice.org/

- Households owing student loan debts at record levels

http://www.pewresearch.org/fact-tank/2013/07/01/248455/

None.