Never Waste A Good Crisis – A Profit-price Spiral In Germany

With the largest strikes in Germany in more than three decades this week, fears of a wage-price spiral have gained momentum once again. However, last year’s data show clear signs of a profit-price spiral already spreading in the economy.

Over the last two years, many of us will have had our suspicions that price hikes aren't just the result of higher energy and commodity prices, but that some producers, suppliers and service providers have upped their costs, whether to make up for losses during the Covid-19 lockdowns or to increase financial buffers for worse times to come.

In the minutes of the European Central Bank's (ECB's) February meeting, the issue of potential price markups not related to higher costs was raised for the first time. The minutes revealed that “profit growth remained very strong, which suggested that the pass-through of higher costs to higher selling prices remained robust... It was therefore widely stressed that developments in profits and markup warranted constant monitoring and further analysis on an equal footing with developments in wages”.

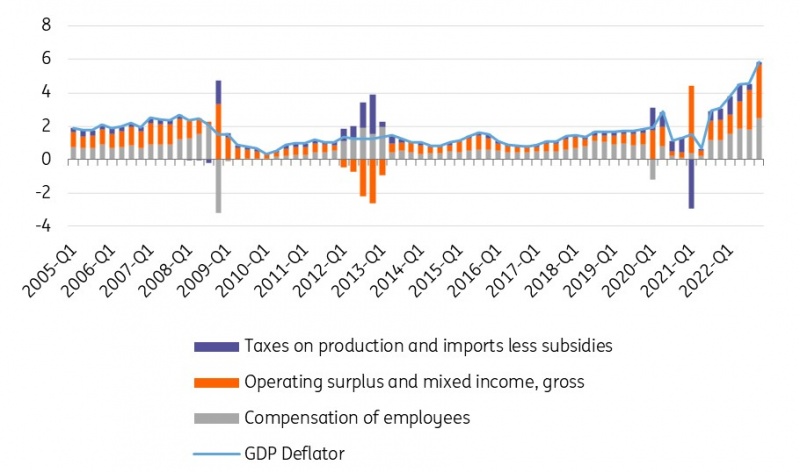

According to a Reuters report in early March, the ECB had discussed analyses showing that profit margins in the eurozone had been rising rather than falling. As a consequence, profits rather than labor costs and taxes accounted for the largest chunk of domestic price pressures in the eurozone since 2021.

GDP deflator (%YoY) and percentage point contributions of labor costs and profits (eurozone)

Source: Eurostat; ING Economic & Financial Analysis

Measuring a profit-price spiral in Germany

It's a similar picture in Germany. If companies had simply only passed on higher producer prices, profits would hardly have risen. In practice, however, from the second half of 2021 onward, a significant share of the increase in prices can be explained by higher corporate profits. There is no official corporate profit data, so this is based on gross value added minus the compensation of employees as a proxy, since gross value added results from the compensation of employees and corporate profits and is already indirectly corrected for prices of input goods. At the same time, however, gross value added also includes machinery and investment depreciations, which are hard to quantify.

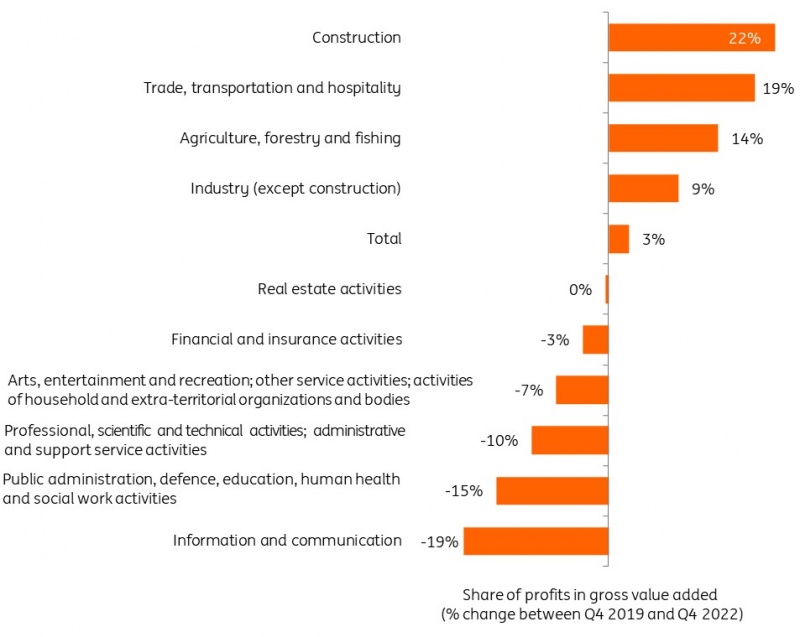

Applying the aforementioned methodology shows that the share of profits in total gross value added has increased significantly in some sectors over the last three years. A hint that German companies could fuel inflation further. In the construction sector, for example, the share of profits in gross value added increased by 22% between the fourth quarter of 2019 and the fourth quarter of 2022. In the trade, transport and hospitality sector the figure was 19%, while it rose by 14% in the agriculture sector.

Increase share of profits in gross value added

Source: Destatis; ING Economic & Financial Analysis

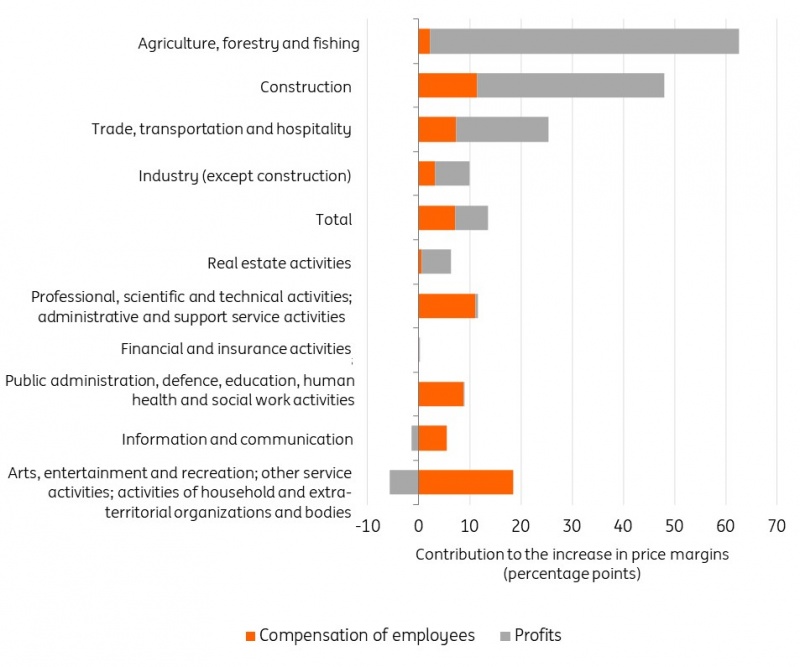

Price margins have also increased significantly over the last three years. In particular, companies in the agricultural, construction, retail, transport and hospitality sectors have seen significant increases in price margins. While price margins overall increased by 14% between the fourth quarter of 2019 and the fourth quarter of 2022, they increased by 63% in agriculture, 48% in the construction sector, and by 25% in the trade, transportation, and hospitality sector. By contrast, price margins in financial and insurance activities increased by only 0.2% and in information and communications by 4%.

Contribution of compensation of employees and profits to the increase in price margins

Source: Destatis; ING Economic & Financial Analysis

In many sectors, profits – not the compensation of employees – were the driver behind higher price margins. While the 14% increase in price margins in the overall economy between the fourth quarter of 2019 and the fourth quarter of 2022 can be explained in almost equal parts by an increase in compensation of employees and profits, the rise in price margins in the agricultural sector, the construction sector, and in the trade, transportation, and hospitality sector can be mainly explained by an increase in profits, and is thus not due to higher energy and commodity prices.

How to tackle 'greedflation'?

Later today, data will probably show that headline inflation in Germany is falling on the back of lower energy prices. Inflation in Germany and the eurozone, however, is no longer the result of a pure supply-side shock. On the contrary, over the last year, inflation has increasingly become a demand-side issue. It is not only higher energy and commodity prices which are being passed through to consumers, it is also widening profit margins in some sectors which are contributing to inflationary pressures.

Whether it is "greedflation" in the purest meaning of the word or there are other reasons, we cannot know entirely. What is clear, however, is that with both a profit-price and wage-price spiral currently turning heavily, core inflation will remain stubbornly high and the ECB will continue hiking interest rates, at least until the summer before entering a high-for-longer period.

More By This Author:

FX Daily: Unorthodox Correlations

Australia: Softer Inflation Hints At Pause In Rates

Why Spain’s Housing Market Is Set To Cool This Year

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more