Key EventsThis Week: The Quiet Before Payrolls

In this week's relative data vacuum, as earnings season grinds to a close and US payrolls not due until next Friday, all eyes will be on the flash February European CPI releases (France Tues, Germany Weds, Italy, and EA Thurs) and labor market data released throughout the week. The CPI numbers follow Friday's upward revisions for the January report in the Euro Area, where core inflation was revised up a tenth to a new record of +5.3%. We also have the global PMIs and US ISMs with manufacturing on the first day of the month (Wednesday) and services (Friday).

ECB speakers will have plenty of opportunity to reflect on the data with at least 8 appearances already scheduled for next week. For a more backward-looking assessment, markets will also have the ECB's account of the February meeting due Thursday to read through. DB's European economists upgraded their ECB call last week and now see two +50bps hikes in March/May followed by a final +25bps hike in June, which would imply a terminal of 3.75%, up from 3.25% previously. Fed speakers are also prevalent as you'll see in the day-by-day week ahead breakdown below courtesy of DB's Jim Reid. There are six FOMC voters and there is a lot for them to chew over at the moment, especially after Friday's PCE data.

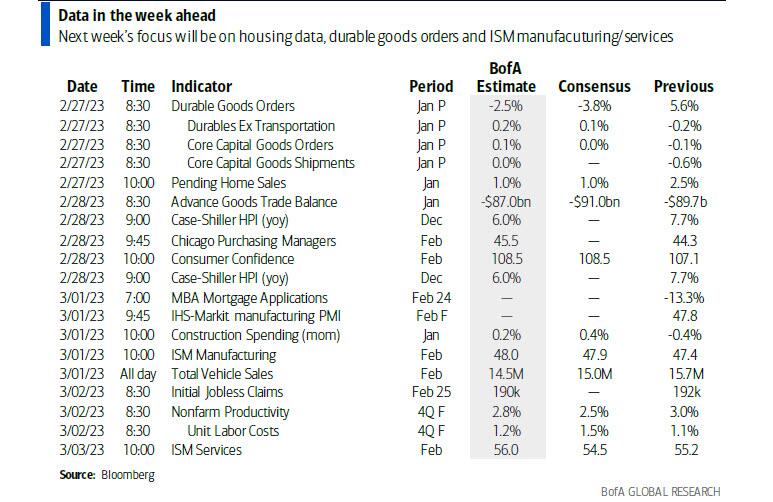

Outside of the ISMs, US data will revolve around consumer and manufacturing activity. That will include the Conference Board's consumer confidence index tomorrow, Chicago PMI (also tomorrow), and a host of regional central bank indices. Other notable indicators due include durable goods orders today and the advance goods trade balance tomorrow.

Earnings season comes to a close, but there are still several prominent companies reporting earnings including OXY, ZOOM, Rivian, Costco, Best Buy, Nio, Target, AMC, Lowe's, Splunk, Macy's and a handful other names.

(Click on image to enlarge)

Courtesy of DB, here is a day-by-day calendar of events

Monday, February 27

- Data: US February Dallas Fed manufacturing activity, January durable goods orders, pending home sales, Japan January retail sales, industrial production, Italy February manufacturing confidence, economic sentiment and consumer confidence index, Eurozone February services, industrial and economic confidence, January M3, Canada Q4 current account balance

- Central banks: Fed's Jefferson speaks, ECB's Lane and de Cos speak, BoE's Broadbent speaks

- Earnings: Occidental Petroleum, Workday, Zoom

Tuesday, February 28

- Data: US February Conference Board consumer confidence, MNI Chicago PMI, Richmond Fed manufacturing index, Dallas Fed services activity, January wholesale, retail inventories, advance goods trade balance, Q4 house price purchase index, December FHFA house price index, UK February Lloyds business barometer, Japan January housing starts, Italy December industrial sales, France February CPI, January PPI, consumer spending, Canada Q4 GDP

- Central banks: Fed's Goolsbee speaks, ECB's Vujcic speaks, BoE's Pill and Mann speak

- Earnings: Target, Bayer, AutoZone, First Solar, Moncler, Norwegian Cruise Line, AMC Entertainment, Ocado

Wednesday, March 1

- Data: US February ISM index, wards total vehicle sales, January construction spending, China February PMIs, UK January net consumer credit, mortgage approvals, M4, Japan Q4 company sales, profits, capital spending, February monetary base, Italy February manufacturing PMI, new car registrations, budget balance, Germany February unemployment claims rate, CPI, Canada February manufacturing PMI

- Central banks: BoJ's Nakagawa speaks, ECB's Villeroy, Nagel and Visco speak, BoE's Bailey speaks

- Earnings: Petrobras, SQM, Salesforce, Lowe's, Snowflake, NIO, Okta

Thursday, March 2

- Data: US initial jobless claims, Japan February Tokyo CPI, consumer confidence, January job-to-applicant ratio, jobless rate, Italy and Eurozone February CPI and January unemployment rate, France January budget balance

- Central banks: ECB's account of February policy meeting, Fed's Waller speaks, BoJ's Takata speaks, BoE's Pill speaks

- Earnings: Broadcom, Costco, VMware, Merck, AB InBev, Universal Music Group, Marvell Technology, Dell Technologies, Zscaler, Macy's, Nordstrom, C3.ai

Friday, March 3

- Data: US February ISM services, China February Caixin services PMIs, UK February official reserves changes, Italy February services PMI, Germany January trade balance, France January manufacturing production and industrial production, Eurozone January PPI, Canada Q4 labor productivity, January building permits

- Central banks: Fed's Bostic, Logan and Bowman speak, ECB's Vasle, Holzmann and Muller speak, BoE's Hauser speaks

- Earnings: Deutsche Lufthansa

* * *

Finally, looking at the US, Goldman notes that the key economic data release this week is the durable goods report on the Monday and the ISM manufacturing report on Wednesday. There are several speaking engagements from Fed officials this week, including remarks by Governor Jefferson on Monday, by Chicago Fed President Goolsbee on Tuesday, and by Governor Waller on Thursday.

Monday, February 27

- 08:30 AM Durable goods orders, January preliminary (GS -5.5%, consensus -4.0%, last +5.6%); Durable goods orders ex-transportation, January preliminary (GS +0.3%, consensus +0.2%, last -0.2%); Core capital goods orders, January preliminary (GS +0.3%, consensus -0.1%, last -0.1%); Core capital goods shipments, January preliminary (GS +0.5%, consensus +0.0%, last -0.6%): We estimate that durable goods orders pulled back 5.5% in the preliminary January report, reflecting a normalization in commercial aircraft orders following the spike in December. However, we forecast a rebound in both core capital goods orders (+0.3%) and shipments (+0.5%), reflecting firmer foreign demand related to China’s reopening and the January pickup in US industrial production data.

- 10:00 AM Pending home sales, January (GS +5.0%, consensus +1.0%, last +2.5%): We estimate pending home sales increased 5.0% in January, following a 2.5% increase in December.

- 10:30 AM Dallas Fed manufacturing index, February (consensus -9.3, last -8.4)

- 10:30 AM Fed Governor Jefferson speaks: Fed Governor Phillip Jefferson will discuss inflation and the Fed’s dual mandate at a virtual event hosted by Harvard University. Text and audience Q&A are expected. On February 24th, Governor Jefferson noted that the current inflationary episode represents “a complex mixture of temporary and more long-lasting elements that defy simple, parsimonious explanation,” and argued that “the ongoing imbalance between the supply and demand for labor, combined with the large share of labor costs in the services sector, suggests that high inflation may come down only slowly.”

Tuesday, February 28

- 08:30 AM Advance goods trade balance, January (GS -$91.0bn, consensus -$91.0bn, last -$89.7bn): We estimate that the goods trade deficit widened by $1.3bn to $91.0bn in January compared to the final December report.

- 08:30 AM Wholesale inventories, January preliminary (consensus +0.1%, last +0.1%)

- 09:00 AM FHFA house price index, December (consensus -0.2%, last -0.1%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, December (GS -0.4%, consensus -0.4%, last -0.5%): We estimate that the S&P/Case-Shiller 20-city home price index declined 0.4% in December, following a 0.5% decline in November.

- 09:45 AM Chicago PMI, February (GS 47.0, consensus 45.3, last 44.3): We estimate that the Chicago PMI was rebounded 2.7pt to 47.0 in February, reflecting the reopening of the Chinese economy and firmer industrial data globally.

- 10:00 AM Conference Board consumer confidence, February (GS 109.0, consensus 108.4, last 107.1): We estimate that the Conference Board consumer confidence index increased to 109.0 in February.

- 10:00 AM Richmond Fed manufacturing index, February (last -11)

- 02:30 PM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will deliver a speech at the Ivy Tech Community College. Text is expected. This will be President Goolsbee first speech since he became President of the Chicago Fed earlier this year. In an interview last November, President Goolsbee noted that “the rate at which [inflation] comes down might not be as rapid as everyone wants” and stressed that “if we started to get month after month of inflation numbers that were worse than expected, there is no terminal rate. [The FOMC would] keep raising rates until [it stops] inflation.”

Wednesday, March 1

- 09:45 AM S&P Global US manufacturing PMI, February final (consensus 47.8, last 47.8)

- 10:00 AM ISM manufacturing index, February (GS 48.4, consensus 48.0, last 47.4): We estimate that the ISM manufacturing index rebounded 1.0pt to 48.4 in February, reflecting the reopening of the Chinese economy and firmer industrial data globally. Our GS manufacturing tracker rebounded by 0.8pt to 48.3.

Thursday, March 2

- 08:30 AM Nonfarm productivity, Q4 final (GS +2.6%, consensus +2.5%, last +3.0%): Unit labor costs, Q4 final (GS +3.2%, consensus +1.6%, last +1.1%): We expect a 0.4pp downward revision to nonfarm productivity growth to +2.6% (qoq saar) in the final Q4 reading. We also expect growth in unit labor costs—compensation per hour divided by output per hour—to be revised up by 2.1pp to +3.2%.

- 08:30 AM Initial jobless claims, week ended February 25 (GS 190k, consensus 197k, last 192k); Continuing jobless claims, week ended February 18 (consensus 1,672k, last 1,654k): We estimate that initial jobless claims edged 2k lower to 190k in the week ended February 25.

- 02:00 PM Fed Governor Waller speaks: Fed Governor Chris Waller will deliver a speech on the economic outlook at an event hosted by the Mid-Size Bank Coalition of America. Text and moderated Q&A are expected. On February 8th, Governor Waller stressed that although the FOMC had “made progress reducing inflation, I want to be clear today that the job is not done.” Governor Waller emphasized that bringing down inflation “might be a long fight, with interest rates higher for longer than some are currently expecting.”

Friday, March 3

- 09:45 AM S&P Global US services PMI, February final (last 50.5)

- 10:00 AM ISM services index, February (GS 55.0, consensus 54.5, last 55.2): We estimate that the ISM services index edged down 0.2pt to 55.0 in February, reflecting solid consumer spending trends and resilience in our survey tracker (+1.4pt to 53.0).

- 11:00 AM Dallas Fed President Logan (FOMC voter) speaks: Dallas Fed President Lorie Logan will deliver opening remarks at an event hosted by the University of Chicago’s Booth School of Business. Text is expected. On January 18th, President Logan argued that the FOMC “shouldn’t lock in on a peak interest rate or precise path. Instead, I believe it’s appropriate to gradually raise rates, carefully assess financial conditions and the outlook, and remain flexible to adjust as needed, so we can robustly manage the risks we face.” President Logan noted that “it seems likely that returning inflation to 2 percent will require wage growth to slow substantially,” and that “that may take time.”

- 12:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will give welcoming remarks via recorded video at a conference on racial inequality. On February 6th, President Bostic noted that his judgment of the appropriate path for monetary policy “will depend on how the economy evolves relative to my expectations.” When discussing January’s strong jobs report, Bostic said he is “inclined to look through this a bit.” However, if the economy continues to be stronger than expected, Bostic said he would “expect that that would translate into us raising interest rates more than I have projected right now.”

- 03:00 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will chair a panel on central bank facilities at an event hosted by the University of Chicago’s Booth School of Business. Text and moderated Q&A are expected. On February 17th, Governor Bowman argued that the FOMC “will have to continue to raise the federal funds rate until we start to see a lot more progress” on inflation.

Source: Deutsche Bank ,BofA, Goldman

More By This Author:

US Durable Goods Orders Plunged Most Since COVID Lockdowns In JanuaryBonds, Stocks, & Bitcoin Battered By (G)Rate Expectations Repricing

Former Treasury Secretary Admits Doubts On Soft Economic Landing - Looks To Global Institutions For Solutions

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more