Key Events This Busy Week: Retail Sales, Housing, Earnings And Torrent Of Fed Speakers Including Powell

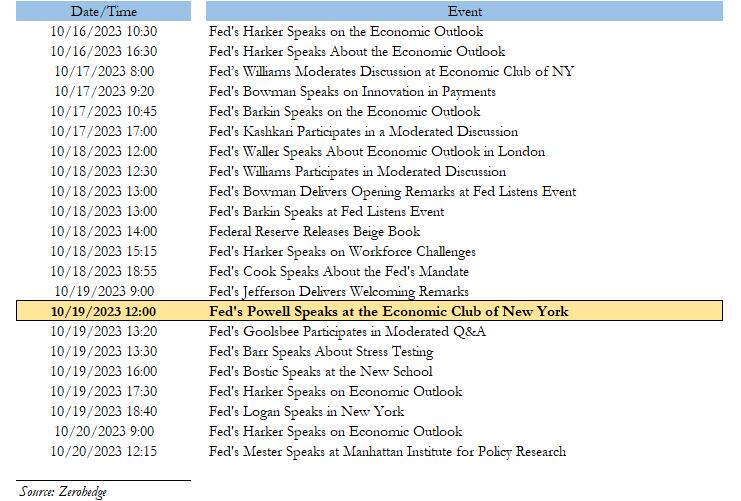

With earnings season now having started in earnest, and with traders closely following every development in the Middle East, it looks like it will be a busy week but without an obvious focal point. There is a barrage of Fed speak before their media black-out at the weekend but Powell’s speech at the Economic Club of New York on Thursday will be the highlight. DB's Jim Reid details who is speaking in the end of the day-by-day calendar below, but DB’s Brett Ryan’s week ahead gives a bit more detail of their various biases (available to pro subs here).

(Click on image to enlarge)

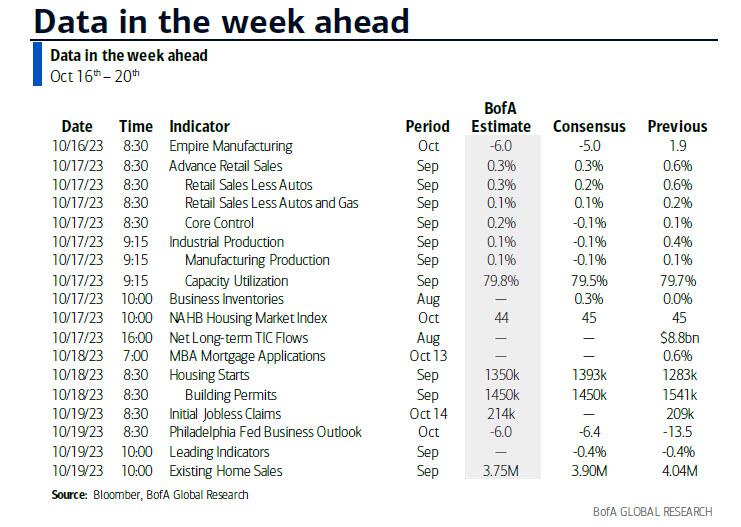

The key data point will likely be US retail sales (tomorrow) which we expect to decline (-0.1%) after two strong months, but we also have a lot of US housing data with the NAHB (tomorrow), starts/permits (Wednesday) and existing home sales (Thursday). US weekly jobless claims (Thursday) corresponds to payrolls survey week so will be used to fine tune estimates.

(Click on image to enlarge)

Staying with the US, earnings season will start to get into gear with the highlights being Bank of America, Goldman Sachs and Johnson and Johnson (tomorrow), Morgan Stanley, Tesla, Netflix, ASML, and Procter & Gamble (Wednesday), TSMC (Thursday) and American Express (Friday). Tesla and Netflix probably have the most ability to move macro markets given their size.

(Click on image to enlarge)

China sees its monthly activity dump on Wednesday where signs of a turnaround will be scrutinized. This is the same day as UK inflation comes out (preview here). The UK labour market data tomorrow is interesting as unemployment is now 0.8pp above the lows at 4.3% and has increased more than anywhere else in the DM world. UK retail sales is out on Friday.

In Europe, we have the ZEW survey in Germany (tomorrow) and the PPI report on Friday, with retail sales for France also due that day. With regards to German PPI it's expected to hit -14.2% YoY from -12.6% the previous month so crazy numbers historically after peaking at an even more crazy +45.8% YoY just over a year ago.

In Japan the national CPI on Friday will be the last before the October 31st BoJ meeting where YCC is likely in our opinion to be abandoned. So an important print.

* * *

Courtesy of DB, here is a day-by-day preview of the week ahead

Monday, October 16

- Data: US October Empire manufacturing index, Japan August capacity utilization, Italy August general government debt, Eurozone August trade balance, Canada August manufacturing sales

- Central banks: Fed's Harker speaks, ECB's Villeroy speaks, BoE's Pill and Woods speak, BoC business outlook, China 1-yr MLF rate

Tuesday, October 17

- Data: US October New York Fed services business activity, NAHB housing market index, September retail sales, industrial production, capacity utilization, August total net TIC flows, business inventories, UK September jobless claims change, August average weekly earnings, unemployment rate, Japan August Tertiary industry index, Germany October Zew survey, Canada September CPI, housing starts, August international securities transactions

- Central banks: Fed's Williams, Bowman and Barkin speak, ECB's Guindos, Holzmann, Centeno and Knot speak, BoE's Dhingra speaks

- Earnings: Johnson & Johnson, Bank of America, Lockheed Martin, Goldman Sachs, Prologis, Albertsons, United Airlines Holdings

Wednesday, October 18

- Data: US September housing starts, building permits, China Q3 GDP, September industrial production, retail sales, property investment, UK September CPI, RPI, PPI, August house price index, Italy August trade balance, Eurozone August construction output

- Central banks: Fed's Beige Book, Waller, Williams, Bowman, Cook and Harker speak

- Earnings: Tesla, Procter & Gamble, ASML, Netflix, Abbott Laboratories, SAP, Morgan Stanley, Lam Research, Volvo, Deutsche Boerse, Alcoa

Thursday, October 19

- Data: US October Philadelphia Fed business outlook, September leading index, existing home sales, initial jobless claims, China September new home prices, Japan September trade balance, Italy August current account balance, France October manufacturing and business confidence, ECB August current account, Canada September raw materials and industrial product price index

- Central banks: Fed's Powell, Jefferson, Goolsbee, Barr, Bostic and Harker speak

- Earnings: TSMC, Philip Morris, Blackstone, Union Pacific, AT&T, Intuitive Surgical, CSX, Freeport-McMoRan, Truist Financial, Nokia, American Airlines

Friday, October 20

- Data: China 1-yr and 5-yr loan prime rates, UK October GfK consumer confidence, September retail sales, public finances, Japan September national CPI, Germany September PPI, France September retail sales, EU27 September new car registrations, Canada August retail sales

- Central banks: Fed's Logan, Mester and Harker speak

- Earnings: American Express, Schlumberger

* * *

Finally, looking at just the US, here is Goldman's preview noting that the key economic data releases this week are the retail sales report on Tuesday, and the jobless claims and Philadelphia Fed manufacturing index reports on Thursday. The Beige Book for the November FOMC meeting period will be released on Wednesday. There are many speaking engagements by Fed officials this week including Chair Powell, Vice Chair Jefferson, Vice Chair for Supervision Barr, Governors Bowman, Waller, and Cook, and Presidents Harker, Williams, Barkin, Goolsbee, Bostic, Logan, and Mester.

Monday, October 16

- 10:30 AM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will speak on the economic outlook at the Mortgage Bankers Association's Annual Convention and Expo in Philadelphia. Speech text is expected. On October 13, Harker said “absent a stark turn in what I see in the data and hear from contacts, both in one-on-one conversations and in forums like this, I believe that we are at the point where we can hold rates where they are.”

- 04:30 PM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will speak on the economic outlook at a virtual event hosted by the National Association of Corporate Directors. Speech text and a Q&A are expected.

Tuesday, October 17

- 08:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will moderate a discussion with Intel CEO Pat Gelsinger at the Economic Club of New York.

- 08:30 AM Retail sales, September (GS +0.6%, consensus +0.3%, last +0.6%); Retail sales ex-auto, September (GS +0.4%, consensus +0.2%, last +0.6%); Retail sales ex-auto & gas, September (GS +0.3%, consensus +0.1%, last +0.2%);Core retail sales, September (GS +0.1%, consensus -0.1%, last +0.1%): We estimate core retail sales edged up 0.1% in September (ex-autos, gasoline, and building materials; mom sa). Our forecast reflects a late-month pickup in spending following sequential weakness in the first half of the month. We also estimate a 0.6% rise in headline retail sales, reflecting increases in auto, gasoline, and restaurant sales.

- 09:15 AM Industrial production, September (GS +0.2%, consensus flat, last +0.4%); Manufacturing production, September (GS +0.2%, consensus -0.1%, last +0.1%); Capacity utilization, September (GS 79.7%, consensus 79.6%, last 79.7%): We estimate industrial production increased 0.2%, as strong motor vehicle and oil and gas production outweigh weak mining production. We estimate capacity utilization was unchanged at 79.7%.

- 09:20 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will speak about responsible innovation in money and payments at the Harvard Law School Program on International Financial Systems Roundtable on Central Bank Digital Currency. Speech text and audience Q&A are expected. On October 11, Governor Bowman said “inflation remains well above the FOMC’s 2 percent target. Domestic spending has continues at a strong pace, and the labor market remains tight. This suggests that the policy rate may need to rise further and stay restrictive for some time to return inflation to the FOMC’s goal.”

- 10:45 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will speak on the economic outlook to the Real Estate Roundtable in Washington. An audience Q&A is expected.

Wednesday, October 18

- 08:30 AM Housing starts, September (GS +11.0%, consensus +7.6%, last -11.3%); Building permits, September (consensus -5.9%, last +6.8%)

- 12:00 PM Fed Governor Waller speaks: Fed Governor Christopher Waller will speak about the economic outlook at the European Economics and Financial Centre's Distinguished Speaker Seminar. Speech text and both audience and moderator Q&A are expected.

- 12:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will participate in a moderated discussion at Queens College. A moderated Q&A is expected.

- 01:00 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will deliver welcoming remarks at a Fed Listens event at the Richmond Fed. Speech text is expected.

- 01:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will deliver opening remarks and speak at a Fed Listens event hosted by the Richmond Fed. Speech text is expected.

- 02:00 PM Beige Book, November FOMC meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the September FOMC meeting period noted that overall economic activity was modest during July and August. Consumer spending on tourism was stronger than expected, and some districts’ reports suggested that consumers may have exhausted excess savings. Manufacturing contacts in 7 districts noted improved supply chains and ability to meet existing orders. Nearly all districts reported that the inventory of homes for sale remained constrained. In this month’s Beige Book, we look for anecdotes related to growth, sentiment, and the evolution of labor market tightness and inflationary pressures.

- 03:15 PM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will speak about workforce challenges at an event titled "People, Possibilities, Practice: Designing a Better Future for Workers" at the Philadelphia Fed. Speech text is expected.

- 06:55 PM Fed Governor Cook speaks: Fed Governor Lisa Cook will speak about the evolution of the Fed's mandate at the Louis E. Martin Awards Ceremony at the 2023 Future of Black Communities Summit. Speech text is expected.

Thursday, October 19

- 08:30 AM Initial jobless claims, week ended October 14 (GS 205k, consensus 214k, last 209k); Continuing jobless claims, week ended October 7 (GS 1,725k, consensus 1,700k, last 1,702k)

- 08:30 AM Philadelphia Fed manufacturing index, October (GS -3.5, consensus -7.0, last -13.5); We estimate that the Philadelphia Fed manufacturing index picked up by 10pt to -3.5 in October, reflecting the rebound in East Asian industrial activity and upward convergence toward other manufacturing surveys.

- 09:00 AM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will deliver welcoming remarks at the Fed's 18th Central Bank Conference on the Microstructure of Financial Markets. Speech text is expected. On October 9, Vice Chair Jefferson said “my view is that the FOMC is in a position to proceed carefully in assessing the extent of any additional policy firming that may be necessary.”

- 10:00 AM Existing home sales, September (GS -5.5%, consensus -4.0%, last -0.7%)

- 12:00 PM Fed Chair Powell speaks: Fed Chair Jerome Powell will speak at the Economic Club of New York. Speech text and moderated Q&A are expected. On September 20, Chair Powell said “the fact that [the Committee] decided to maintain the policy rate at [the September FOMC] meeting doesn’t mean that we’ve decided that we have or have not at this time reached that stance of monetary policy that we’re seeking.”

- 01:20 PM Chicago Fed President Goolsbee speaks: Chicago Fed President Austan Goolsbee will participate in a moderated Q&A at the Wisconsin Manufacturers & Commerce Business Day. A moderated Q&A is expected. On October 5, President Goolsbee said “on the real side I feel like nothing has happened so far that is convincing evidence that we are off the golden path. I still feel like this is our goal and it’s still possible.”

- 01:30 PM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will speak about stress testing at the 2023 Federal Reserve Stress Testing Research Conference at the Boston Fed. The event will be livestreamed. Speech text and moderated Q&A are expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak on the role of policy in addressing inequality at the New School University Center. Speech text and audience Q&A are expected. On October 11, President Bostic said “today, I don’t think we need to do anything more in terms of interest rates.”

- 05:30 PM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will speak on the economic outlook at the Chartered Financial Analyst Society Philadelphia 80th Anniversary Celebration. Speech text and audience Q&A are expected.

- 06:30 PM Dallas Fed President Logan (FOMC voter) speaks: Dallas Fed President Lorie Logan will speak at a Money Marketeers of New York University event. Audience and moderated Q&A are expected. On October 9, President Logan said “if term premiums rise, they could do some of the work of cooling the economy for us, leaving less need for additional monetary policy tightening to achieve the FOMC’s objectives.”

Friday, October 20

- 09:00 AM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will speak on the economic outlook at the Risk Management Association Philadelphia Chapter Meeting. Speech text and audience Q&A are expected.

- 12:15 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will speak on the outlook for the economy and monetary policy at the Manhattan Institute for Policy Research. Speech text and audience Q&A are expected. On October 3, President Mester said “if the economy looks the way it did at the next meeting, similar to the way it looked at our recent meeting, I would do the further rate increase… I probably favor going again, but again, we’re going to have to wait and see how the economy evolves.”

Source: DB, Goldman, BofA

More By This Author:

Oil Slides On Biden-Maduro Deal For "Freer" Venezuela Elections, Easing Export SanctionsFutures, Yields Rise Amid Hopes For Diplomatic Solution To Israeli War

Second Largest US Lab-Grown Diamond Producer Goes Bust

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more