Bitcoin Spot ETF Coming After SEC Abandons Appeal

Today was the deadline by which the SEC must either appeal the D.C. Circuit Court of Appeals decision to the U.S. Supreme Court, request the Appeals Court revisit its ruling, or follow the court’s August order and review Grayscale’s bid to change its Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF.

Bloomberg has just reported, according to a person familiar with the matter, that the SEC isn't planing to ask for an appeal.

As a reminder, in August, the D.C. Circuit Court of Appeals ruled that the SEC’s denial of Grayscale Investment’s application to convert the Grayscale Bitcoin Trust (GBTC) into an ETF was invalid and must be reviewed, calling it an "arbitrary and capricious" rejection.

The court said that federal agencies are required to “treat like cases alike.”

The SEC's decision not to appeal was somewhat expected as Bloomberg ETF analyst Eric Balchunas tweeted yesterday...

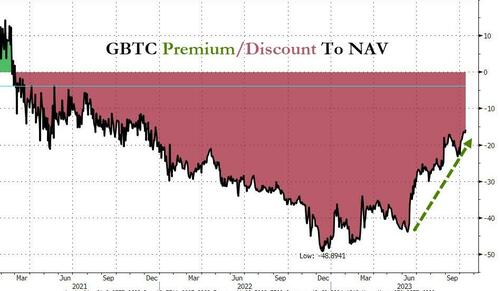

And as is evident in the collapse in the market's discount for GBTC...

So what happpens next?

Bloomberg's James Seyffart tweeted the following:

1. Done deal I guess if this is accurate. No en banc application

2. No. I do not think they will appeal to the Supreme Court either.

3. Dialogue between Grayscale and SEC should begin next week. Hoping for more info on next steps sometime next week or week after?

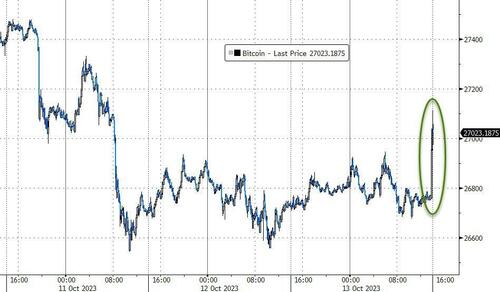

Bitcoin bounced a little on the headline...

However, as CoinTelegraph reports, there's still a chance regulators could delay and continue their 'war onm crypto':

A September note from law firm Ropes & Gray warned the GBTC application could be sent back for review to the SEC, giving the regulator another chance to reject it on a different basis.

“In this scenario, the new denial could itself then be subject to another appeal by GBTC to the D.C. Circuit,” wrote the firm.

Another delay scenario, according to Ropes & Gray, would be if the New York Stock Exchange has to make a new filing to list GBTC - then it is possible the SEC could take up to eight months to reach a decision on the ETF.

But, the likelihood of an approved spot Bitcoin ETF this year is 75%, according to Bloomberg analysts who updated the odds after Grayscale’s August court win (and is likely dramatically higher now as they previously noted the odds jump to a 95% likelihood of approval by the end of 2024).

More By This Author:

China's Birth Rate Plummets 10% To Lowest On RecordPfizer Crashes After Slashing Profit Guidance By More Than Half On Collapsing Demand For Covid Meds

Big Bank Loan Volumes Continue To Decline As Deposit Outflows Return

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more