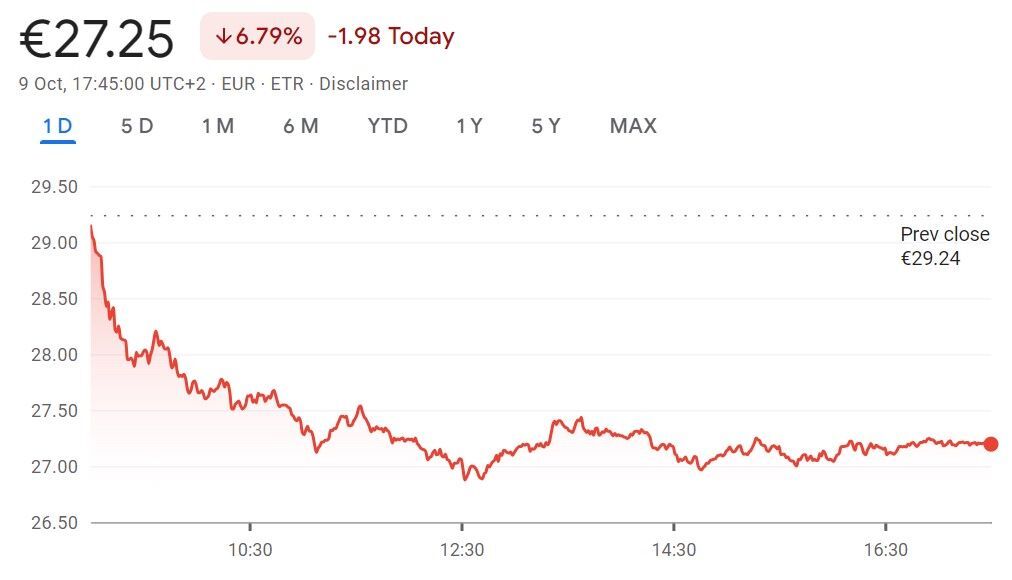

Bayer Shares Fall 7% As US Court Reconsiders Monsanto PCB Exposure Case

Image Source: Unsplash

- The lawsuit relates to PCB exposure at a school, with a $185 million award previously overturned.

- A $10.9 billion settlement resolved more than half of the 125,000 Roundup claims.

- Bayer’s stock has fallen 13% year-to-date, with more than 30% lost last year.

German life sciences giant Bayer (BAYZF) saw its shares drop by over 7% on Wednesday following a US court’s decision to review a case against Monsanto, a subsidiary acquired by Bayer in 2018.

The litigation involves claims that exposure to polychlorinated biphenyls (PCBs), used in Monsanto products, harmed students and staff at a Washington state school.

The case is one of several legal battles Bayer faces concerning Monsanto’s legacy products. The ongoing litigation has created financial pressure for Bayer, with its stock already down 13% this year.

The case revolves around claims that exposure to Monsanto’s PCBs at Sky Valley Education Center in Washington state caused harm to several individuals.

Previously, a $185 million award was overturned in May, following an appeals court ruling that identified errors in the trial proceedings, including concerns over the scientific validity of the plaintiff’s testimony.

PCB exposure claims

Bayer’s involvement in the PCB exposure case has added to the ongoing challenges the company faces due to its 2018 acquisition of Monsanto.

PCBs were industrial materials manufactured by Monsanto until the company voluntarily ceased production in 1977.

The legal repercussions of Monsanto’s products, including PCBs and the controversial weed killer Roundup, have continued to haunt Bayer, contributing to significant financial losses.

In May, an appeals court overturned a substantial $185 million award initially granted to the plaintiffs, citing errors in the trial.

Despite this, the plaintiffs have pushed for further review, leading to the Washington Supreme Court’s decision to re-examine the case.

Bayer has responded by reiterating its stance that the claims are unfounded, arguing that the appellate court’s decision had already highlighted key errors in the plaintiffs’ arguments, particularly regarding the scientific basis for the PCB exposure claims.

Monsanto litigation

Bayer’s acquisition of Monsanto has led to a slew of lawsuits in the US, primarily focused on the alleged health risks associated with its products.

The most high-profile of these has been litigation concerning the widely used herbicide Roundup, which has been linked to cancer in several cases.

Although Bayer reached a $10.9 billion settlement in 2020, covering approximately 125,000 claims related to Roundup, the company remains entangled in ongoing legal challenges.

While Bayer secured a legal victory in September when the 3rd US Circuit Court of Appeals ruled in its favor, finding no basis for a claim that Monsanto had violated state law by failing to include a cancer warning on Roundup products, the financial and reputational fallout from Monsanto-related litigation persists.

Bayer’s stock has faced consistent pressure, falling by more than 30% in the previous year, with the ongoing lawsuits being a key factor in its performance struggles.

Source: Google Finance

The Washington Supreme Court’s decision to review the PCB exposure case represents another hurdle for Bayer as it navigates the legal quagmire associated with Monsanto’s legacy products.

While Bayer remains confident in its legal position, the financial burden of these cases continues to weigh heavily on the company’s stock, raising concerns about its long-term recovery prospects.

More By This Author:

It’s All About Jobs Now

Roblox Faces Hindenburg Short Attack: Why This Could Be A Buying Opportunity

Three Strong Reasons To Buy NXP Stock After UBS Upgrade

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more