New US Home Sales Bounce, But It Won’t Last

New home sales jumped nearly 11% in April, but we see this as a short term blip higher for a series that is in a very clear downward trend. Surging mortgage borrowing costs and a general lack of affordability mean transaction numbers will fall sharply in coming months and with supply on the rise, home price growth will slow sharply and likely fall in some areas.

A surprise jump in new home sales

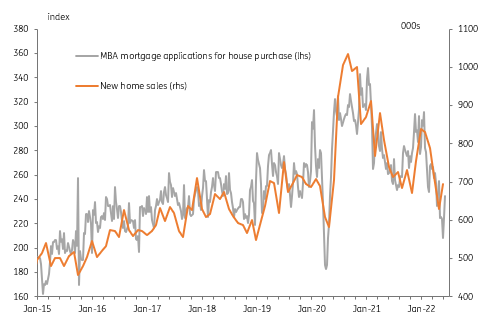

What US housing market crash? New home sales jumped 10.7% month-on-month in May going from an upwardly revised annualised 629k to 696k, much better than the 590k consensus forecast. Admittedly, mortgage applications for home purchases had risen in the past two weeks as can be seen in the chart below, but it is difficult to believe that this will mark the start of a new upward trajectory.

US new home sales and mortgage applications for home purchases

Source: Macrobond, ING

But demand will weaken through the rest of the year

With affordability looking so stretched given house prices have risen nearly 40% nationally since the start of the pandemic, and mortgage rates getting close to 6%, the pool of potential buyers is rapidly shrinking. To highlight this, the Mortgage Bankers Association reported Wednesday that the average loan size for a new purchase was $422k in the week of June 17. At the start of the year when the typical 30Y fixed-rate mortgage was 3.5%, the monthly mortgage payment would have been around $1895. Today, with mortgage rates at 6%, that payment would be $2530.

Higher borrowing costs are not the only issue for housing demand. Consumer confidence is being hit hard by concerns over high inflation and the plunge in equity markets. Consequently, we see today’s bounce in new home sales as a temporary blip higher in what is a very volatile series that is firmly in a downward trend.

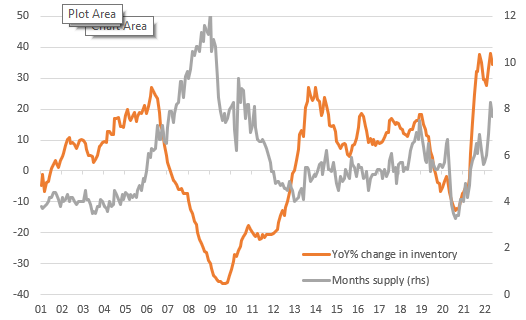

New home inventory for sale is on the rise

Source: Macrobond, ING

House price growth to slow with supply on the rise

At the same time, inventory for sale is on an upward trend. There are now 444,000 newly built homes up for sale, the highest since May 2008 and with building permits and housing starts still growing, this number looks set to rise. To us, this means we are seeing the housing market rapidly move away from a period of huge excess demand as massive fiscal and monetary stimulus combined with the option of working from home boosted activity amid a dearth of supply.

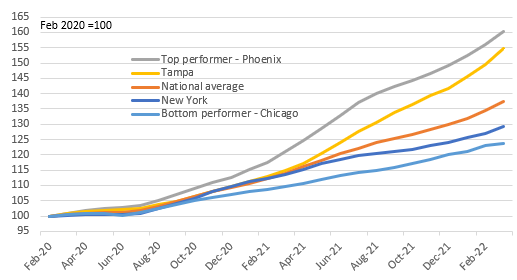

US house price levels across the country indexed to February 2020 = 100

Source: Macrobond, ING

Instead, we are now facing a market where there is a lot more property being made available for sale while demand is on a downward trend. This means that the rapid price appreciation seen across the country should soon start to slow with some hotspots facing the clear risk of a correction lower.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more