New Hope For Acorda Therapeutics In 2019

Photo Credit: Biomed Realty

Recommendation

I recommend long Acorda Therapeutics (ACOR) for 1-3 months aiming at a price target zone ranging from $20.23-$27.24 (currently trading at $15.95). The negative impact of generics erosion on Ampyra's sales has been overstated in my opinion, for which the company has used pricing strategy to buffer the damage. There's a large demand for Parkinson's Disease OFF period treatment worldwide, with about 350k patient population that is targeted by Inbrija. The company is poised to spin off Inbrija and focuses on its marketing and sales in the year ahead. The company is trading significantly below the peers with 1.26x P/S ratio vs. 4x of the peer average.

Catalysts in the next quarter include the FY18 earnings release in February, the Inbrija launch and the EU approval of it, as well as the potential success in the reformulation of CVT-427 for migraine.

Investment Theses

Assuming you know the background and the history of the company, the flagship product Ampyra is facing generics erosion after losing patents against other pharma companies like Mylan (MYL) who launched the generic version of dalfampridine in September 2018. The public thinks that the generics erosion kicks in immediately and would expect the sales of Ampyra decline precipitously. While there's a significant decline in the TRx count, 4Q18 sales might not be as gloomy as the consensus thinks.

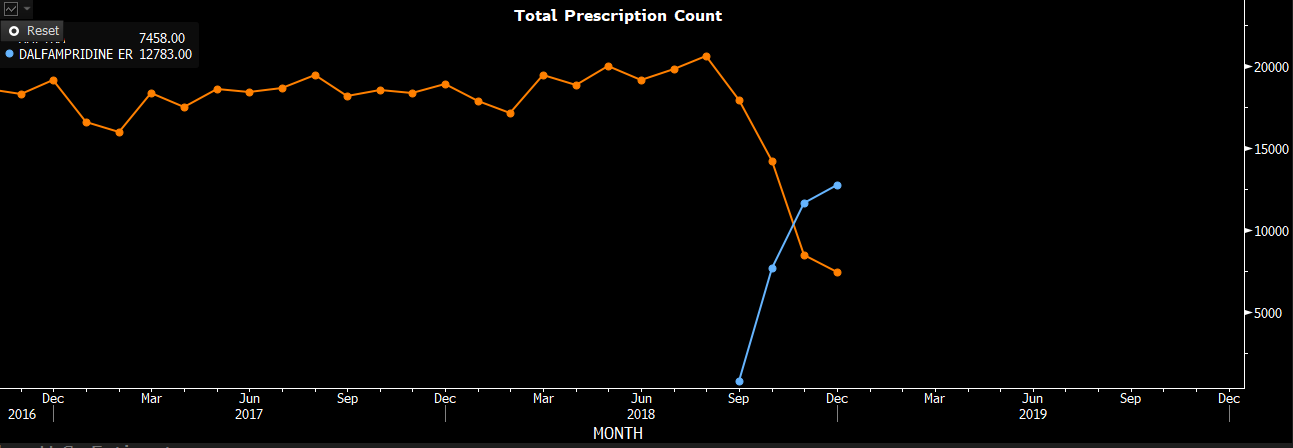

Mylan launched the generic version of Ampyra in September 2018, shortly after that, the total prescriptions count for Ampyra cascaded (see chart).

Bloomberg Intelligence (Orange for Ampyra TRx count; blue for generics)

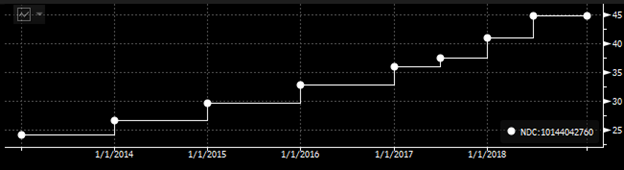

However, 3Q18 earnings was a huge surprise as the company reported $142.81mn sales vs. $90mm consensus. It makes sense if we dive into the pricing of Ampyra in the second half of the year. The company has been raising the Wholesale Acquisition Cost semiannually since 2017 when the firm faced lawsuits that invalidated four of Ampyra's patents.

Bloomberg Intelligence (WAC for Ampyra. You can see that before 2017, the company raised the price on an annual basis.)

Using some back-of-the-envelope calculation, I estimate that the retail price for Ampyra for 1H18 was about $2196.58 per unit, and in the second half of the year, it was increased to $2609.85. The TRx counts for November and December are 8.48k and 7.46k, respectively. Here, I guess the TRx count for January is about 3k, which is a 50%+ decline. Even though, I get $49.43mm for the 4Q18 Ampyra sales alone, which is higher than the Wall Street consensus of $47.25mm for Total Revenue. The only way I can get something close to the Street estimate is to assume a 1k TRx count for January and maybe 20 days of February, which is not very likely as the generic producers are not keen to market the dalfampridine to gain those prescriptions from Ampyra. Further, the company rolled out a 60-day trial program that allows patients to try Ampyra for free, which is a creative way for the company to negotiate with payers as patients have enough time to respond to the efficacy of the treatment, and the management has received a subset of patients who responded positively, meaning they would pay for the drug. The trial strategy serves as a cushion to slow down the generics erosion.

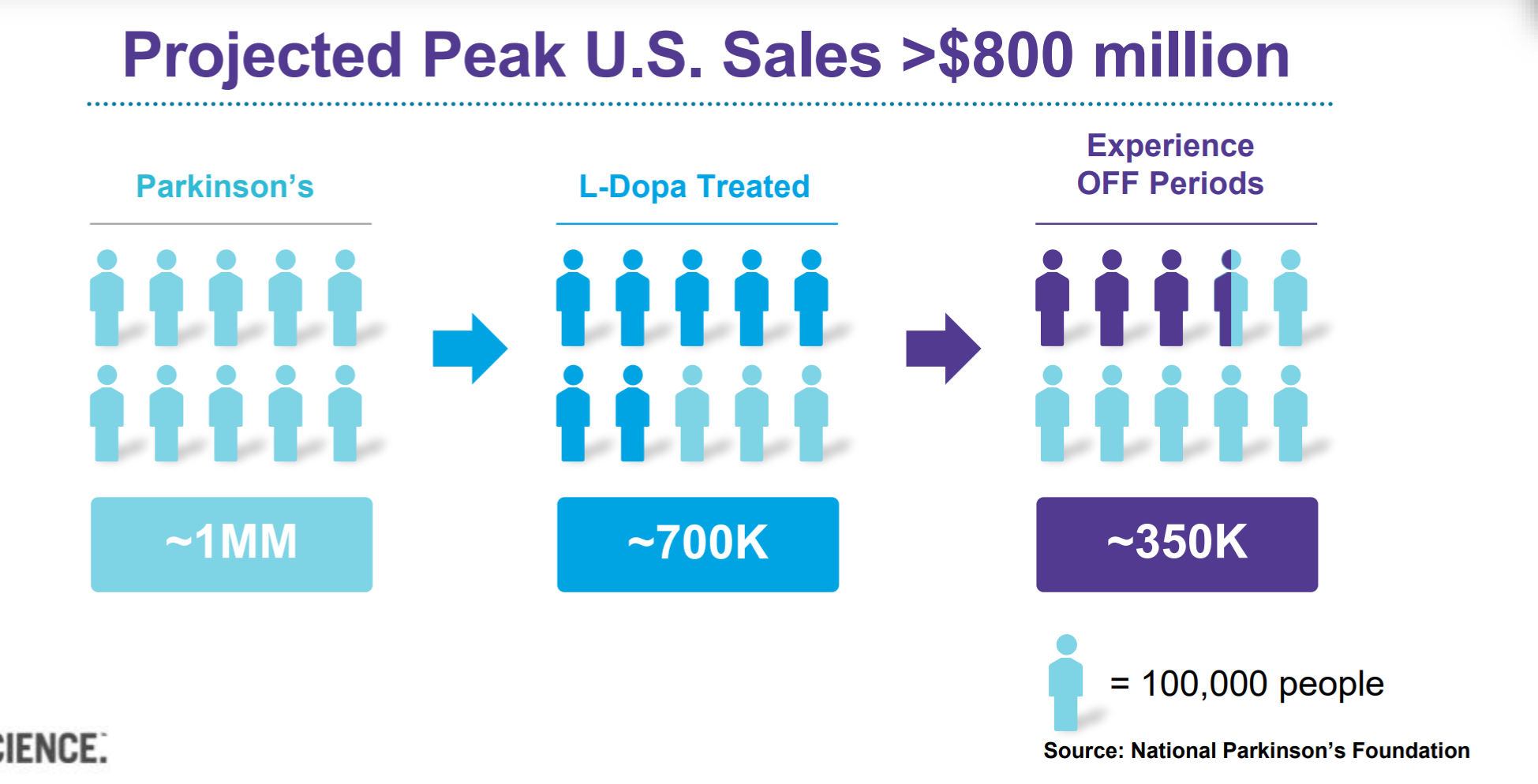

Secondly, Inbrija launch is what everyone's anticipating, and it could be the table-turner that save the Ampyra loss. Clearly, the management recognizes the importance of Inbrija, so it has revised its OpEx guidance for 2019 with $200-210mm for SG&A, and $70-80mm for R&D. With more than $400mm cash in hand, the company is ready to dedicate 2019 to Inbrija's debut. I talked to the investor relations and was informed that the company is not planning for any human clinical trials at this time. So, we can assign a higher probability of success to Inbrija's launch and sales. If you are familiar with the company, I'm sure you know that Inbrija faces significant demand from PD patients who take carbidopa/levodopa. There are about 1mm PD patients in the US, and about 35% of them take carbidopa/levodopa and experience OFF period. That's a total addressable market of 350k here.

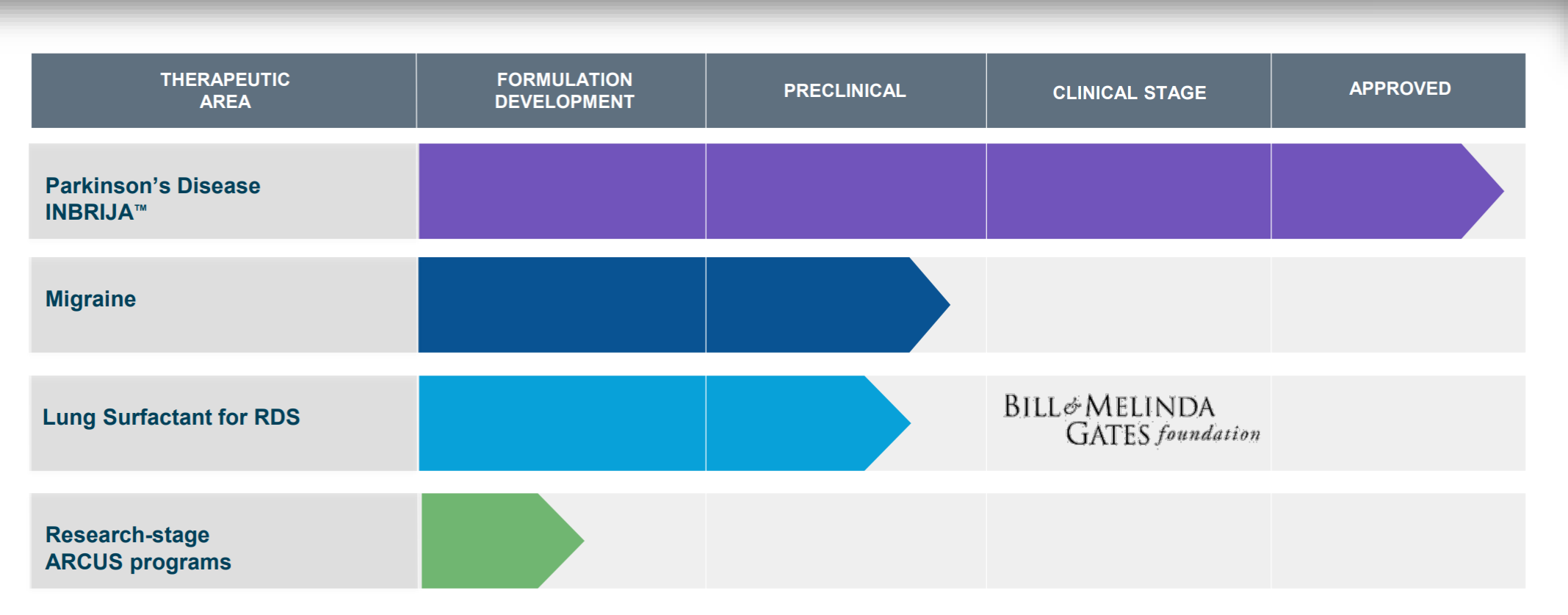

JP Morgan Healthcare Presentation by Acorda

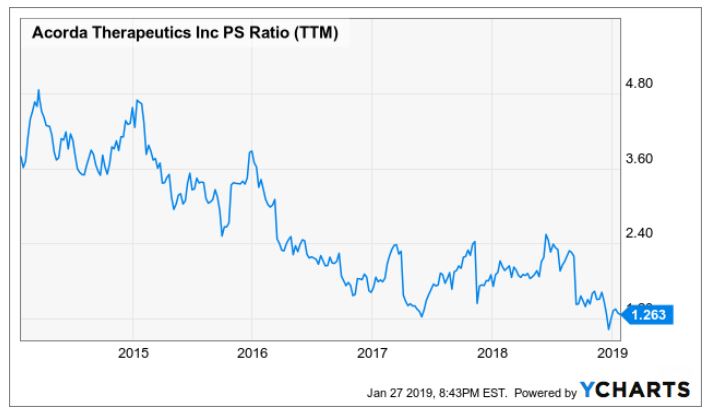

My last thesis lies on the low P/S ratio that the company is trading at. Currently, the company is trading at 1.9x (the YCharts shows 1.26 but I hand-calculated a P/S of 1.9x; the difference here is not material for our purpose) while the peers like Alkermes (ALKS), Biogen (BIIB) and AbbVie (ABBV) are trading at an average of 4.73x.

YCharts

Comparing to the company itself, the 7-year median P/S is 3.143 (see chart). So we can conclude that the company is undervalued based on the P/S ratio. By the way, I chose the P/S ratio as our key metric because it is relevant for biotech companies that rely on revenues from the commercialized drugs. A P/E ratio might not be a good metric here because usually small biotechs have negative earnings, there's no way to get a PE.

YCharts (I will use these two numbers for my sensitivity tables in the valuation session later)

ACOR is even more undervalued when comparing with the industry average of 7.02x.

As you can see, before the Ampyra lawsuits, the company was trading between 2-5x PS, so we should expect the stock price trading within that range again after Inbrija's launch.

From this point on, I'm going to discuss something important to the company in the long run but are not relevant within our investment window. Acorda has a simple pipeline now consisting of three products: BTT1023, CVT-427 and rHIgM22. BTT1023 (timolumab) is an orphan drug that has potential that targets Multiple Inflammatory and Fibrotic Diseases. Currently, BTT1023 is under Phase 2 development but the company is seeking a partnership for further R&D. CVT-427 has huge demand because it utilizes ARCUS inhalation technology to mitigate migraine symptoms in 10 minutes, compared to tradition oral medications that take an hour to take effect. Unfortunately, during the Phase 1 trial, some patients experienced bronchoconstriction so the company is investigating a way to reformulate the drug to solve the issue.

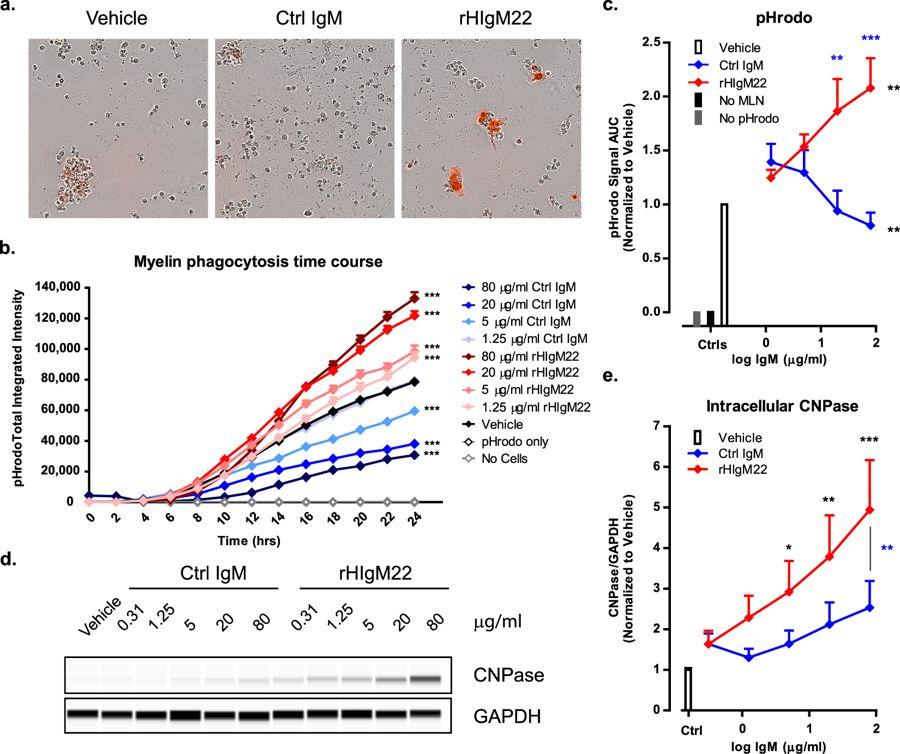

Another potential blockbuster is rHIgM22, which is a unique drug as it might be the only one that stimulates the oligodendrocytes (cells that repair myelin cells). A study has shown some efficacy in the drug, so a successful development in this drug can address the unmet demand for MS treatments.

Human IgM antibody rHIgM22 promotes phagocytic clearance of myelin debris by microglia

rHIgM22 is currently in Phase I, so the future is still uncertain and distant.

JP Morgan Healthcare Presentation by Acorda

There are other ARCUS based products under development, but due to their early stages and the management's focus, I'd rather not discuss them as they have no impact on our short-term investment.

Catalysts

The nearest event that would impact the stock price would be the FY18 earnings release in February. It would be a good time for investors to realize that the generics erosion is not that atrocious on Ampyra’s sales. The better sales in Ampyra would surprise the public as the consensus expects $47.25mm sales.

Inbrija launch would certainly push the stock price up as this is the event the public has been anticipating. If the launch comes before the earnings, we would expect an even better FY18. The company has submitted MAA to EU agencies, approval of Inbrija in EU would also contribute royalties revenue to Acorda. But we do not have a detailed date on EU approval yet.

Acorda’s CVT-427 zolmitriptan for migraine is under reformulation. There is a significant demand for drugs that can mitigate migraine quickly. The bronchoconstriction side effect in the previous trial is the reason for the reformulation. The company is investigating the API and the excipients and is considering other API that can be formulated for ARCUS inhalable tech. This is an uncertain catalyst but it can contribute significant move to the stock price.

Valuation

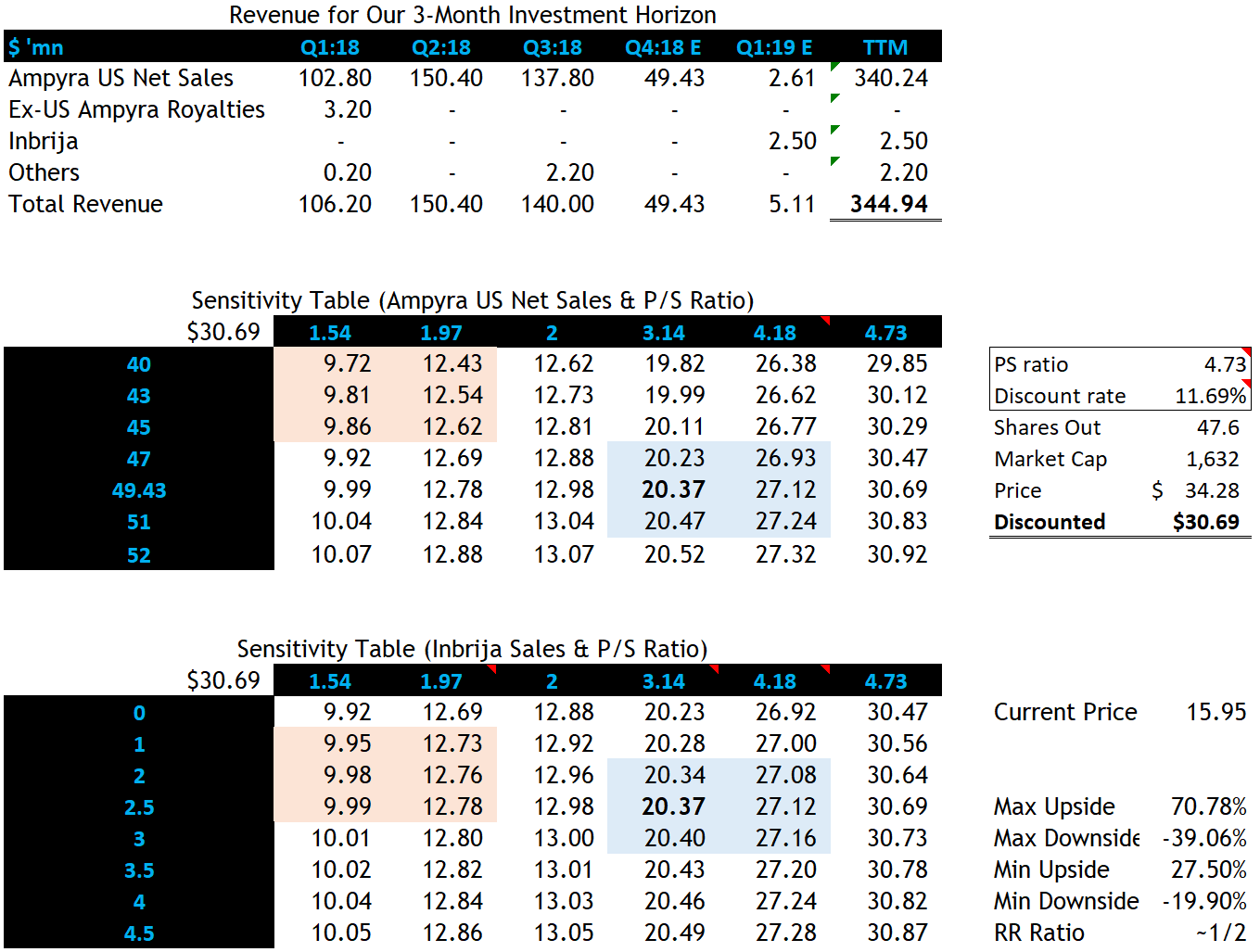

Since our investment horizon is limited to 1-3 months. I used a TTM P/S model to get a sense where we should target. A discount rate of 11.69% is used as it is the industry average for biotech companies and I don’t see any point of testing different discount rates because it wouldn’t vary in such a short time.

Company data; sell-side reports; my modelling in Excel

I used 3.14x as a base-case P/S ratio as this number is the 7-yr median for ACOR. The company is currently undervalued based on this number as it is trading around 1.26x. However, following the Inbrija launch, if successful, we can expect the stock trade at around 4.18x PS, which is the 1-yr forward ratio. The best case would be that the investors justify the company at 4.73x, which is the peer group average (Alkermes, AbbVie and Biogen).

I predict the revenue for Ampyra in 4Q18 to be 49.43, which was derived from my research on Ampyra’s price and likely TRx counts. Similarly for 1Q19. Inbrija sales of 2.5m is derived from the sell-side estimate since they have more resources to get an educated guess. Two sensitivity tables testing the Ampyra/Inbrija sales with P/S ratios tell me the downside ranging 9.72-12.62 and the upside 20.23-27.24.

Risks

- Ampyra sales disappoints. If that happens, the result would be a miss-the consensus FY18 earnings. The stock price would tank as per the model suggests. If there’s only $40mm sales form Ampyra, we can expect the stock to go as low as $12/sh.

- A disappointing Inbrija sales would do a similar thing to the stock. The model suggests a possibility of $9/sh if the Inbrija sales does not reach $1mm.

- Patent loss. The company had lost four patents on Ampyra which contributed to generics erosion. If ARCUS and/or Inbrija undergo similar quagmire, the stock can go below $8/sh.

- Inbrija faces little peer competition as it is an innovative drug that has protected technology. One competitor, Sunovion, has a preregistered candidate APL-130277 that uses a sublingual double-layer film to treat OFF episode symptoms. Sunovion is behind as it just received PDUFA in this January. Nevertheless, the success of Inbrija’s market capture lies on PwP who take carbidopa/levodopa. So far, L-dopa is the golden standard of treating PD but there is unmet demand in efficacy and safety. Some companies are working on novel treatments that can replace L-dopa. Success in those products would curb Inbrija’s sales or demand. Oxford BioMedica is developing AXO-LENTI-PD, a gene therapy that can extend the efficacy to over years (so there’s no short-term OFF episode). Within our investment horizon, there’s little competition other than government regulation and payer’s policies on reimbursement.

Conclusion

The bottom line is that the company has made some failed investment, particularly in acquiring Biotie at a premium, which gave ACOR a basket of failed drugs. But we are seeing some hopes in 2019 after all the pains the company had travailed through.

Long ACOR aiming $20.23-$27.24 in one to three months. The public overestimates the generics erosion on Ampyra, which counters it with hiking in price. The sales might beat the consensus which would push the price upward. Inbrija is another catalyst that can correct the low P/S ratio. By stress testing the company, we still have a good risk/reward ratio of ~1:2, implying that the downside being $9.72/sh and the upside being $27.24/sh.

Disclosure:

I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Has your opinion on this stock changed over the last few months? It has not been performing well.