NEM: Earnings Sell Off Is A Buying Opportunity

(Click on image to enlarge)

On Tuesday I previewed Newmont’s (NEM) 3Q earnings report saying that any selloff would be a buying opportunity. Well that selloff has arrived in a big way with NEM down more than 13%, dragging the Van Eck Gold Miners ETF (GDX) down nearly 3.5% with it! While it might look scary to me it’s a gift because I’ve been waiting patiently for a spot to add to my gold positions but couldn’t find one in what has been a lockout rally – until today.

Why is NEM selling off so badly? While I’m not a mining stock expert, I suspect it has to do with the increasing costs NEM reported to mine gold. While the average gold price NEM received in the 3rd quarter continued to rise – as expected – to $2518/oz, their costs increased as well. Their All In Sustaining Cost (AISC) increased to $1611/oz from $1562 in 2Q24 and $1426 in 3Q23. That resulted in a 2% drop in their Adjusted EBITDA Margin from the previous quarter to 42.7%. Obviously, NEM’s profitability is a function of the price of gold – but also the cost of mining it. In other words, increasing costs neutralized the increase in the gold price in the 3rd quarter.

(Click on image to enlarge)

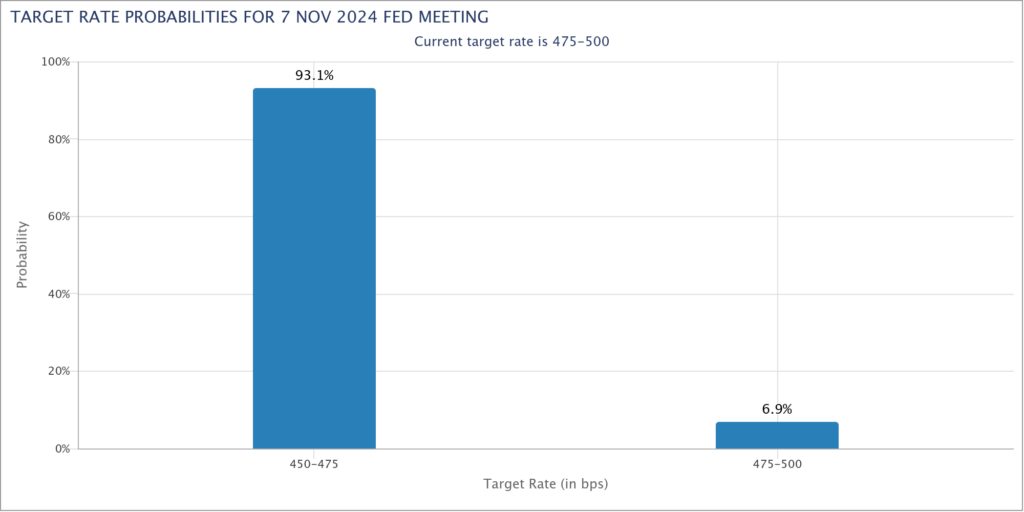

Why aren’t I concerned? I’m not concerned because – one – I expect gold prices to continue going higher. The Fed is very likely to cut rates another 25 basis points in two weeks – supporting the price of gold. Additionally, NEM forecast an AISC of $1475/oz in the 4th quarter. In other words, costs were elevated this quarter but that may have been due to some one off items. The fundamentals still look extremely bullish for the gold miners and therefore today’s selloff looks like an easy buying opportunity to me.

More By This Author:

NEM: Previewing The Largest Gold Miner’s 3Q Earnings Report

The Case For Defense Stocks Ahead Of 3Q Earnings

Sweetgreen: Fast Casual Health Food Chain Is A Long Term Winner