TTP: An Energy-Related Fund Benefiting From Activist Involvement

![]()

Image Source: Stock photo by Vecteezy

Given the current economic outlook, overloading in energy and fixed income is the right move at this moment in time. One fund I like is Tortoise Pipeline and Energy Fund (TTP), writes Tim Melvin, editor of Underground Income.

As economic, market-related, and geopolitical data become available, my conviction about the allocation we have developed becomes even stronger. The exciting part of this is that the allocation decision has been made by tracking the buying activity of the leading closed-end fund activists. For the most part, the big investors in closed-end funds have been focusing on fixed-income and energy-related funds because of growing discounts to net asset value.

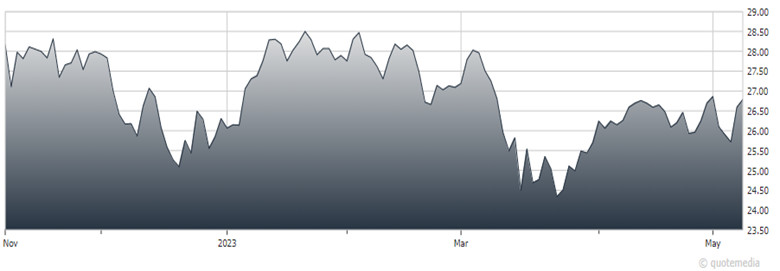

That brings me to TTP. Saba Capital recently filed a 13D announcing that it owns over 8.5% of the fund and intends to take an activist approach to narrow the discount of the net asset value. That discount was recently over 18%.

Tortoise Pipeline & Energy Fund Inc.

The activist has taken the first step by pushing to de-stagger the board, making it easier to gain control of the board in a proxy fight. Saba has already won several of these struggles at MLP closed-end funds, leading to positive changes in shares we owned in the portfolio. I expect this one to have the same ending.

Tortoise conducted a tender offer for shares last November at a price well above market. Although it had little impact on the discount, it did give shareholders a chance to sell some shares close to NAV.

While we wait for the activist’s campaign to play out, we will have increased our exposure to cash-producing energy infrastructure assets. This fund invests in the pipelines that move crude oil, natural gas, and petroleum liquids around the country from production to end users. It also invests in some other energy infrastructure projects, including LNG facilities.

At its recent price, the yield was 9.14%. Thanks to the magic of closed-end fund accounting, all the MLP payouts are converted to ordinary dividends reported on a K1. My recommended action would be to considering buying TTP.

About the Author

Tim Melvin is a 30-year plus veteran of financial markets. He is also the editor of The 20% Letter. Mr. Melvin uses rigorous quantitative analysis based on the principles used in deep value and private equity styles of investing to help investors compound their wealth by utilizing strategies designed to maximize profits and minimize risk. He uses in-depth research efforts to uncover special situation opportunities that can profit regardless of market direction.

Mr. Melvin has also developed models for building alternative income portfolios that can help individual investors. He believes that individuals have powerful advantages over institutions but are not taught how to use them. Mr. Melvin wants to be the one who helps individual investors stop taking entirely too much risk for too little return.

More By This Author:

Worried About This Market? Try Seeking Solace (And Yield) In These 4 SectorsCMS Energy: An Attractive Michigan Utility With A Long Dividend History

Four Flexible Funds For A Cautious Market

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.